Post by : Saif Nasser

Consumer prices in the United States continued to rise in September, showing that inflation is still strong even as the economy faces challenges from trade tariffs and a government shutdown. Experts say higher prices for goods affected by tariffs kept inflation firm, but it is not likely to stop the Federal Reserve from cutting interest rates again next week.

According to a report from the Labor Department, the Consumer Price Index (CPI) — which measures the average change in prices that people pay for goods and services — probably rose by 0.4% in September. This would match the increase seen in August. Over the past year, prices are estimated to have risen 3.1%, the largest increase in more than a year.

The CPI report, which was delayed due to the ongoing government shutdown, is being released to help the Social Security Administration calculate its 2026 cost-of-living adjustment for millions of retired Americans. This means the report is important not only for policymakers but also for families who depend on government benefits.

Economists say inflation rose mainly because of the “tariff pass-through” effect — when companies pass on the cost of import taxes (tariffs) to consumers. U.S. tariffs on many imported goods, especially from China, have made products like clothing, electronics, and some foods more expensive.

Sarah House, a senior economist at Wells Fargo, said that while housing and rent prices are starting to cool down, goods inflation remains high due to tariffs. “The shutdown may have delayed data, but it hasn’t changed the stubborn state of inflation,” she said. “We expect prices for goods to stay high because of continued tariff effects.”

Gasoline prices were another major reason behind the rise in inflation. Food prices also went up but at a slower rate than in August. However, the cost of beef and coffee stayed high, partly due to droughts in recent years and higher import taxes.

Economists expect the core CPI, which excludes food and energy, to have risen 0.3% in September. This would mean prices for everyday goods and services — like clothes, furniture, and health care — continue to rise at a steady pace. Over the last 12 months, core inflation is estimated to be around 3.1%.

Businesses are also feeling the pressure from tariffs. Many companies have chosen to absorb part of the tariff costs instead of passing all of them to consumers. But this has affected their profits and hiring plans. “Operating margins are lower, so they’ve taken a piece of it there, but they also stopped hiring,” said Brian Bethune, an economics professor at Boston College.

Retailers like Walmart have also said their costs are rising because they now have to restock products at new, higher prices. Analysts at BNP Paribas estimate that companies will pass about 60% of the total tariff costs to customers over the next six months.

Still, not all prices are rising at the same pace. Some services, like hotel stays and air travel, saw smaller price increases in September after sharp jumps in August. Rent prices, which had risen unusually high in some cities last month, are also expected to grow more slowly.

The Federal Reserve, which controls U.S. interest rates, closely tracks inflation when deciding whether to raise or cut rates. The Fed’s target for inflation is 2%, but inflation has been above that level for many months. Despite the strong price growth, economists expect the Fed to lower its benchmark interest rate again next week by 0.25%, bringing it down to a range between 3.75% and 4.00%.

The central bank hopes that cutting interest rates will support borrowing and spending, helping the economy grow while keeping inflation under control.

Meanwhile, the ongoing government shutdown has caused major problems for collecting and processing economic data. Normally, the Bureau of Labor Statistics collects price data throughout the month, much of it in person. But because of the shutdown, more than half of the October data has not been collected yet. This has raised questions about whether the October CPI report will be reliable or even released on time.

Economist Ronnie Walker from Goldman Sachs said the shutdown could make it hard for the government to publish accurate inflation data. “If the shutdown lasts through the end of the month, the data may not meet the usual standards,” he explained.

During the last major government shutdown in 2013, about 75% of the CPI data was still collected, but it took months to recover. This time, experts worry the impact may be worse since the Bureau of Labor Statistics has fewer resources and staff.

If the shutdown continues, officials may have to find new ways to estimate October’s inflation numbers, such as collecting prices later or using estimates based on previous months. However, these methods could make the data less precise.

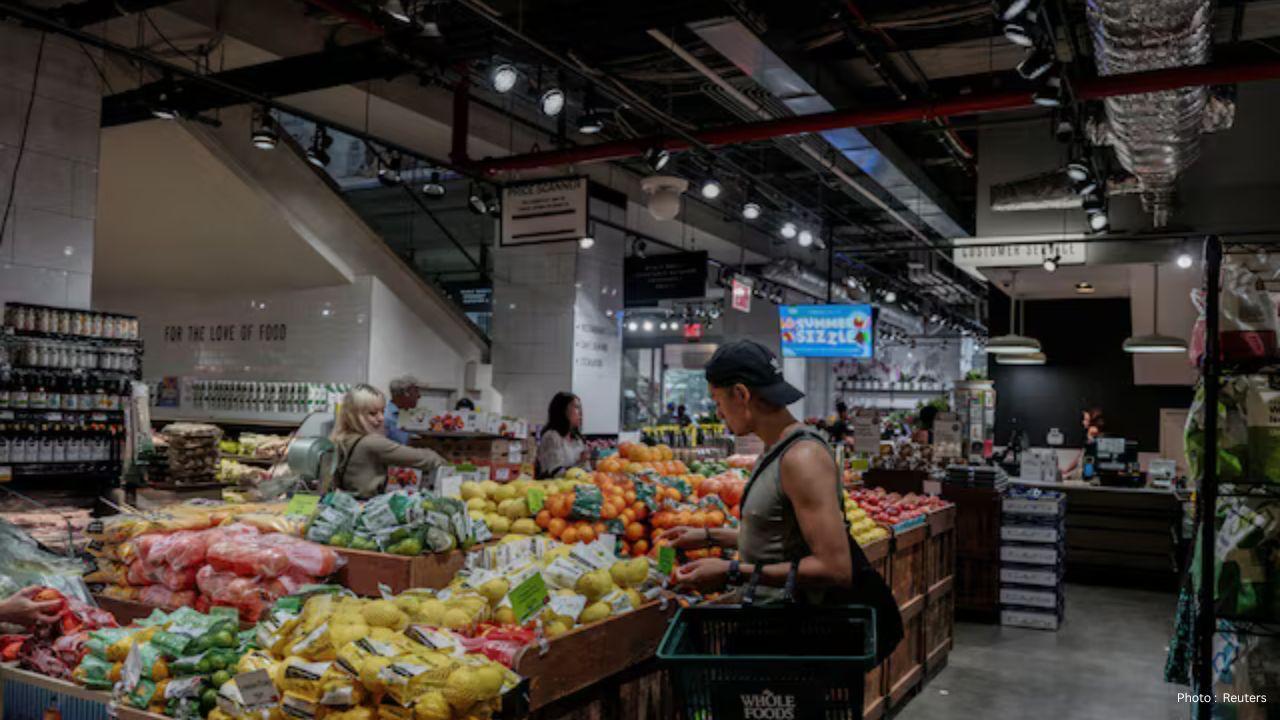

For now, the September inflation report confirms what many Americans already feel — that prices remain high for essentials like food, fuel, and household goods. While some progress has been made in slowing inflation, the effects of tariffs and supply chain pressures continue to make life more expensive for U.S. consumers.

With interest rate cuts expected soon, economists hope the Federal Reserve can balance the need for lower inflation with keeping the economy stable. But until tariff-related costs ease and the government resumes full operations, price pressures are likely to remain a major concern for both households and businesses across the country.

Mattel Revives Masters of the Universe Action Figures Ahead of Film Launch

Mattel is reintroducing Masters of the Universe figures in line with its upcoming film, tapping into

China Executes 11 Members of Criminal Clan Linked to Myanmar Scam

China has executed 11 criminals associated with the Ming family, known for major scams and human tra

US Issues Alarm to Iran as Military Forces Deploy in Gulf Region

With a significant military presence in the Gulf, Trump urges Iran to negotiate a nuclear deal or fa

Copper Prices Reach Unprecedented Highs Amid Geopolitical Turmoil

Copper prices soar to all-time highs as geopolitical tensions and a weakening dollar boost investor

New Zealand Secures First Win Against India, Triumph by 50 Runs

New Zealand won the 4th T20I against India by 50 runs in Vizag. Despite Dube's impressive 65, India