Post by : Sami Jeet

It’s a common belief that increasing earnings will eliminate financial worries. The logic appears straightforward: more money translates to fewer problems and greater contentment. However, reality presents a stark contrast. Even top earners often face anxiety, debt, and unending financial demands, whereas many individuals with moderate incomes enjoy a sense of calm and security.

Financial serenity isn’t governed merely by one’s income; rather, it stems from how effectively one's finances enhance life rather than dominate it. This article explores why a high income cannot promise financial peace, identifies the roots of financial stress, and highlights what genuinely fosters lasting stability and tranquility.

Financial serenity is frequently confused with abundance or the ability to spend freely. In truth, its essence is far more profound and straightforward.

Knowing your bills are settled without any anxiety

Feeling prepared for emergencies

Sleeping soundly free from financial stress

Making choices without the dread of running dry

Having a clear vision for future aspirations

Emotional and psychological peace precedes numerical comfort—income supports serenity, but it does not generate it independently.

As earnings rise, so do expectations.

With greater income comes:

Larger homes

More luxurious vehicles

Enhanced services

Elevated social demands

Expenses tend to rise in tandem with income, leaving little extra despite the increases.

High earners often bear:

Costlier EMIs

Long-term liabilities

Professional pressures

Family expectations

An increased income introduces greater responsibilities, not necessarily enhanced freedom.

Lifestyle inflation serves as a formidable adversary to financial tranquility.

Each pay rise often leads to a lifestyle upgrade. What was once considered a luxury soon turns into a necessity. Over time:

Fixed costs burgeon

Savings dwindle

Financial tensions mount

Higher earnings can paradoxically lead to a feeling of decreased financial well-being.

Two individuals with identical incomes can lead entirely different financial lives.

One manages expenses effectively and builds a safety net

The other overspends and finds themselves living paycheck to paycheck

Financial peace hinges more on effective expense management than on the size of income.

High earnings without a solid framework can lead to instability.

No emergency savings

Lack of budgeting

Absence of long-term strategy

Poor understanding of cash flow

Without a framework, money feels unpredictable—even in sizeable amounts.

Debt significantly impacts mental well-being, often more than income levels.

Monthly commitments limit flexibility

Interest payments siphon off future earnings

Financial choices feel constrained

Even those with high incomes can feel trapped if debt dictates their cash flow.

The human psyche is drawn to certainty.

Confidence

Less anxiety

Improved decision-making

Emotional stability

Individuals with moderate incomes but predictable expenses frequently experience a calmer state than high earners with erratic finances.

Unplanned expenses can trigger significant financial anxiety.

Minor issues can escalate into crises

Choices become reactive

Debts accumulate

Financial peace comes from preparedness, not perfection.

Money is frequently utilized as a means to manage emotions.

Impulse spending due to stress

Comparative status spending

Purchases as rewards

Social influence

A higher income can exacerbate emotional spending, increasing long-term stress.

While comfort can be fleeting, clarity provides lasting benefits.

Awareness of spending habits

Understanding one's priorities

Setting clear objectives

Monitoring progress

Clarity can diminish fear more effectively than mere luxury.

While income holds power, its effectiveness is contingent upon direction.

Funds tend to flow out as quickly as they come in.

Even a modest income can foster stability, assurance, and freedom.

Financial peace derives from control rather than mere abundance.

People anchored in strong financial values experience reduced stress.

Clear definition of "enough"

Avoiding comparisons

Prioritizing long-term security

Aligning expenditures with purpose

Values steer financial decisions more effectively than income levels.

Many high-income individuals sacrifice peace for pressure.

Extended working hours

Always being on call

Risk of burnout

Neglecting health

Financial peace encompasses autonomy over time, not just earning capacity.

Financial serenity is cultivated through systems, habits, and mindset.

Managed expenses

Emergency funds

Low unnecessary debt levels

Defined objectives

Regular assessments

While income contributes to these elements, it does not replace their necessity.

Greater control outweighs additional earnings.

Prioritize security over luxury.

Fewer obligations translate to reduced stress.

Inner peace is what truly counts.

Financial peace positively influences:

Mental well-being

Relationships

Decision-making confidence

Overall life satisfaction

Consistent financial strains can impact health more than one might realize.

Serenity is personalized.

Minimal expenditures

Strong savings

Simplicity in living

For others, it signifies:

Stable businesses

Long-term growth

Measured risk

No singular income threshold guarantees peace.

A high income can enhance life but cannot substitute for clarity, structure, and discipline. Financial peace is not solely about hitting a specific figure; rather, it’s about eliminating fear from monetary decisions.

Individuals who master financial management often enjoy tranquility long before achieving their income potential. Conversely, those who pursue income without a thoughtful structure frequently feel pressure regardless of their earnings.

Genuine financial serenity is constructed, not merely acquired.

This article aims to provide educational information and does not constitute financial or professional advice. Financial circumstances differ based on earnings, expenditures, lifestyle, and personal objectives. Always consult a qualified financial advisor prior to making significant financial decisions.

Release of 130 Students From St Mary’s Catholic School Marks Hopeful Turn in Nigeria

Nigerian authorities announce the release of 130 students from St Mary’s, ensuring no pupil remains

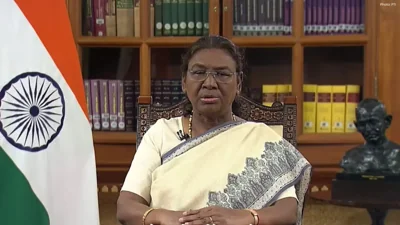

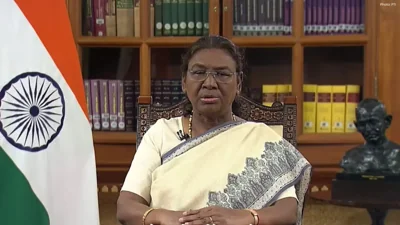

President Murmu Endorses SHANTI Bill to Propel Nuclear Energy Expansion

President Droupadi Murmu endorses the SHANTI Bill, facilitating private sector involvement in nuclea

New Zealand Claims Test Series with Decisive Victory Over West Indies

New Zealand triumphed over West Indies by 323 runs in the final Test, securing a 2-0 series win with

Centre Affirms Protection for Aravalli Hills Amidst Mining Concerns

Government asserts over 90% of Aravalli hills remain protected, dismissing mining concerns as misinf

Traffic Control Measures Announced for A.R. Rahman Concert at IGI Stadium

Delhi Traffic Police introduces measures near IGI Stadium for A.R. Rahman's concert on Saturday even

Kim Woo-bin and Shin Min-a Tie the Knot After a Decade Together

Actors Kim Woo-bin and Shin Min-a celebrated their marriage in an intimate ceremony in Seoul, markin