Post by : Naveen Mittal

As climate change tightens its grip, India is facing a new kind of challenge—climate volatility that hits faster, harder, and more frequently than ever before. From deadly heatwaves sweeping across northern states to flash floods devastating hill regions, the cost of disasters is rising both in human and economic terms.

In response, the Indian government is preparing to launch something groundbreaking: a nationwide climate-linked insurance scheme designed to deliver swift, data-driven relief to communities hit by extreme weather. If successful, this initiative could make India a global pioneer in parametric climate insurance—a model that uses real-time weather data to trigger automatic payouts when disasters strike.

Traditional insurance systems depend on claims, verification, and paperwork—a process that often delays help when it’s needed most. But climate change doesn’t wait.

Parametric insurance flips the model. Instead of waiting for on-ground assessments, it uses predefined weather parameters—like rainfall, temperature, or wind speed—to automatically release funds once thresholds are crossed.

For example:

If rainfall in a region exceeds 500 mm within a week, payouts to affected farmers or families are triggered instantly.

If a heatwave lasts longer than seven days above 45°C, compensation is released without field surveys.

This approach not only speeds up disaster relief but also reduces corruption, bureaucracy, and loss of dignity for victims forced to prove their suffering to claim aid.

India ranks among the top five countries most vulnerable to climate disasters. Over the past five years, extreme weather events have caused losses exceeding $50 billion, affecting more than 80 million people.

In 2024 alone, India faced:

Heatwaves across 23 states with record-breaking temperatures.

Flash floods in Himachal Pradesh and Uttarakhand that destroyed infrastructure and farmlands.

Cyclones in the Bay of Bengal and Arabian Sea that hit coastal economies.

These aren’t isolated tragedies—they’re becoming predictable emergencies. With the climate crisis accelerating, a financial safety net for the poor and vulnerable is no longer optional—it’s essential.

According to initial proposals being discussed by NITI Aayog, the Ministry of Finance, and the Ministry of Earth Sciences, the climate insurance framework will:

Link to IMD and satellite data to monitor rainfall, temperature, and wind patterns in real time.

Define “trigger thresholds” for different disasters based on regional vulnerability—floods, droughts, cyclones, or heatwaves.

Use mobile platforms to register beneficiaries and disburse payments digitally.

Partner with public and private insurers, leveraging microinsurance and fintech platforms for scalability.

Integrate with existing welfare programs, including PMFBY (Pradhan Mantri Fasal Bima Yojana) and NDMA relief mechanisms.

The system would ensure speedy, transparent, and equitable distribution of relief funds—within hours instead of weeks.

Parametric insurance isn’t new, but India’s scale makes it unprecedented. Similar models have already shown promise elsewhere:

In Kenya, drought insurance tied to satellite-based rainfall data has protected pastoralists from famine.

In the Caribbean, a regional climate insurance pool has helped small island nations recover quickly from hurricanes.

In Bangladesh, microinsurance for flood-affected farmers has reduced economic distress by 40%.

India’s challenge is not whether it can build such a system—but whether it can do it at scale, covering hundreds of millions of people across diverse climatic zones.

Experts warn that insurance is only one piece of the puzzle. True resilience requires a broader ecosystem: early warning systems, better urban planning, nature-based solutions, and community awareness.

To complement the insurance scheme, India is also investing in:

AI-based flood forecasting to improve disaster preparedness.

Green infrastructure—such as mangrove restoration and permeable urban surfaces—to reduce flood impact.

Renewable energy transitions, reducing long-term vulnerability to climate shocks.

The idea is simple: don’t just pay for damage—prevent it.

For millions of small farmers, fishermen, and daily wage earners, the difference between survival and ruin often lies in how quickly help arrives.

A climate-linked insurance scheme can mean:

Farmers receiving compensation before their next planting cycle, not after.

Flood victims rebuilding immediately, avoiding debt traps.

Vulnerable families gaining financial dignity in the face of disaster.

In essence, it converts compassion into infrastructure—a system that automatically responds to suffering, instead of reacting after the fact.

No transformative policy comes without obstacles. For India, these include:

Accurate weather data: Many rural areas still lack high-resolution sensors and consistent measurements.

Pricing complexity: Balancing affordable premiums with sustainable risk coverage.

Policy integration: Ensuring coordination between states, ministries, and private insurers.

Awareness and trust: Convincing rural communities that digital, data-driven payouts will actually work.

However, digital public infrastructure—like Aadhaar, UPI, and Jan Dhan—gives India a unique advantage. With these systems in place, climate insurance can scale faster here than almost anywhere else in the world.

As climate extremes intensify across Asia, Africa, and Latin America, India’s model could inspire a new era of “climate safety nets”—financial systems built for a warming planet.

It’s not just about risk-sharing; it’s about climate justice—ensuring that those who contribute least to global warming aren’t left to bear its worst costs alone.

Disclaimer:

This article is for informational and educational purposes only. Climate and policy frameworks are evolving; readers should refer to official government releases and verified data for the latest information on India’s climate-linked insurance scheme.

OpenAI Highlights Growing Cybersecurity Threats from Emerging AI Technologies

OpenAI has raised alarms about the increasing cyber risks from its upcoming AI models, emphasizing s

Manchester City Triumphs 2-1 Against Real Madrid, Alonso Faces Increased Scrutiny

Manchester City secured a 2-1 victory over Real Madrid, raising concerns for coach Xabi Alonso amid

Cristiano Ronaldo Leads Al Nassr to 4-2 Victory Over Al Wahda in Friendly Face-Off

Ronaldo's goal helped Al Nassr secure a 4-2 friendly win over Al Wahda, boosting anticipation for th

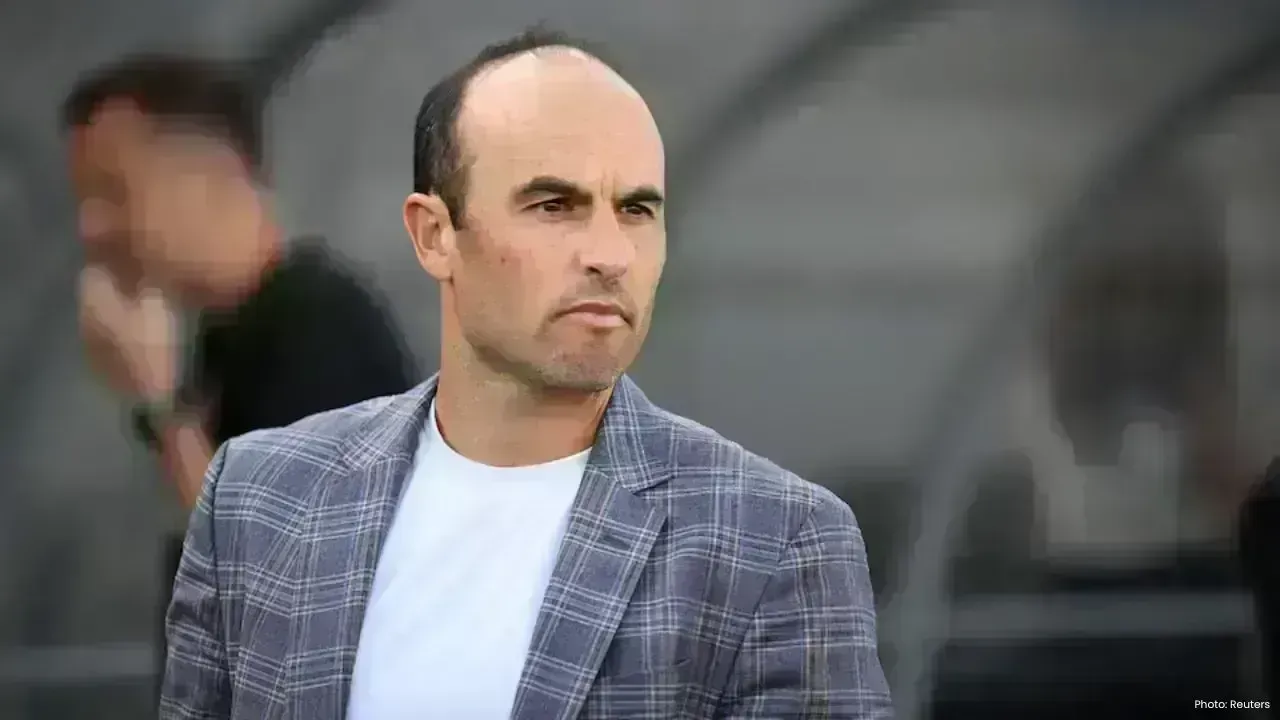

Landon Donovan Challenges Australia Coach on World Cup Prospects

Landon Donovan counters Australia coach Tony Popovic’s optimism for the World Cup, expecting an earl

Mercedes-Benz Forms Landmark Partnership with WTA

Mercedes-Benz and the WTA unveil a significant partnership effective January 2026, with major invest

Abhishek Addresses Divorce Rumours Concerning His Family

Abhishek Bachchan confirms that daughter Aaradhya remains oblivious to divorce speculations, focusin