Post by : Monika

Visa, one of the largest payment companies in the world, has announced a new program to test the use of stablecoins for international payments. Stablecoins are a type of digital money that is linked to traditional currencies like the U.S. dollar.

They are designed to maintain a stable value, unlike other cryptocurrencies that can change in price quickly. By using stablecoins, Visa hopes to make global transactions faster, cheaper, and easier for businesses.

International payments are essential for global trade. Companies regularly need to send and receive money across countries. Traditionally, this process is slow and often costly. Businesses must hold cash in multiple currencies to ensure they can pay suppliers or employees in different countries. Currency exchange fees and bank intermediaries add to the costs, and payments can take days to reach their destinations.

Visa’s pilot program is designed to change this system. The company is working with several partners to explore how stablecoins can be used to fund international payments. Instead of holding cash in several currencies, businesses could use digital tokens that are accepted worldwide. These tokens can be pre-funded in digital wallets, and payments can be made instantly, reducing delays and freeing up working capital for businesses.

What Are Stablecoins and How Do They Work

Stablecoins are digital assets that are backed by a stable currency or asset. For example, one stablecoin might always be worth one U.S. dollar. This makes them more predictable and reliable than other cryptocurrencies like Bitcoin or Ethereum, which can see large changes in value within a short period.

The predictability of stablecoins makes them suitable for everyday business transactions. Companies can use them to pay for goods, services, or salaries without worrying about sudden changes in value. They can also be stored safely in digital wallets and used in multiple countries without the need to convert currencies repeatedly.

In Visa’s pilot program, stablecoins will act as a bridge for international payments. Instead of converting money into the recipient’s currency through multiple banks, companies can send stablecoins that are instantly convertible into the local currency. This process saves time, reduces costs, and simplifies accounting.

Benefits of Using Stablecoins

The introduction of stablecoins for global payments offers several advantages.

Faster Transactions: Traditional international payments can take several days to process because they pass through multiple banks and intermediaries. Stablecoins, being digital, can move instantly between wallets, allowing payments to reach recipients in minutes.

This speed is especially useful for businesses that rely on timely payments for importing goods, paying employees, or managing cash flow.

Lower Costs: Banks and payment processors charge fees for currency exchange and cross-border transfers. By using stablecoins, companies can reduce these fees because the transaction occurs digitally without many intermediaries. This could save businesses significant amounts of money over time, especially those that deal with large volumes of international payments.

Simplified Accounting: When companies make payments in multiple currencies, it can be complicated to track and reconcile transactions. Stablecoins provide a single digital asset that can be converted into any currency, reducing the complexity of accounting and bookkeeping.

Freeing Up Capital: Businesses often keep large reserves of cash in foreign currencies to meet payment obligations. By using stablecoins, companies can minimize the need to maintain multiple accounts, freeing up cash that can be invested elsewhere or used to support operations.

Visa’s Pilot Program

Visa has started testing stablecoins in collaboration with several financial and business partners. The program explores using digital tokens to pre-fund accounts and complete transactions efficiently. Instead of sending traditional currency through multiple banks, stablecoins can move directly from one digital wallet to another, cutting out delays and reducing the number of steps in the payment process.

The pilot program is designed to gather data on how stablecoins work in real-world business environments. It will help Visa understand the benefits and challenges of adopting this technology on a larger scale. Lessons from the program will be used to refine systems, improve security, and ensure that stablecoins can integrate smoothly into existing payment networks.

Regulatory Support

One of the reasons Visa feels confident about testing stablecoins is the support of clear regulations. Recently, governments have started creating rules to oversee stablecoins and digital payment systems. For example, legislation in some countries clarifies how stablecoins can be issued, used, and monitored. This regulatory clarity makes it easier for companies like Visa to explore digital currencies while ensuring compliance with financial laws.

Having clear regulations also increases confidence among businesses and financial institutions. When companies know that stablecoins are legally recognized and safely regulated, they are more willing to experiment with digital tokens for international payments. This could encourage wider adoption of stablecoins in global trade.

Challenges to Consider

While stablecoins offer many advantages, they also come with challenges.

The Future of Stablecoins in Payments

If the pilot program succeeds, stablecoins could become a key part of the global financial system. Businesses could use them for day-to-day international transactions, reducing reliance on traditional banking systems. Cross-border payments could become faster, cheaper, and more efficient, benefiting both small and large companies.

Stablecoins also have the potential to support new types of financial services. For example, digital tokens could be used for instant supplier payments, automated payroll systems for international employees, or rapid settlement of trade invoices. The flexibility and speed of stablecoins could open up new business opportunities and make global commerce smoother.

Visa is taking a cautious but forward-looking approach. By integrating stablecoins into existing payment networks, the company ensures that traditional financial infrastructure remains stable while exploring innovative solutions. This balance helps maintain trust and security in global transactions.

Visa’s initiative to test stablecoins for cross-border payments is a significant step toward modernizing international transactions. By using digital tokens, businesses can speed up payments, lower costs, simplify accounting, and reduce the need to hold multiple currencies.

The pilot program is also an important experiment in integrating new technology safely and effectively. Visa’s focus on regulatory compliance, security, and practical implementation ensures that stablecoins can be a reliable tool for businesses worldwide.

As global trade continues to grow and businesses demand faster and more efficient payment solutions, stablecoins could play an increasingly important role in the financial system. Visa’s exploration of this technology shows how digital currencies can be used alongside traditional financial systems to create a more modern, efficient, and secure global economy.

If successful, stablecoins may soon become a standard option for companies conducting international payments, changing the way money moves across borders and making global commerce faster, easier, and more cost-effective.

OpenAI Highlights Growing Cybersecurity Threats from Emerging AI Technologies

OpenAI has raised alarms about the increasing cyber risks from its upcoming AI models, emphasizing s

Manchester City Triumphs 2-1 Against Real Madrid, Alonso Faces Increased Scrutiny

Manchester City secured a 2-1 victory over Real Madrid, raising concerns for coach Xabi Alonso amid

Cristiano Ronaldo Leads Al Nassr to 4-2 Victory Over Al Wahda in Friendly Face-Off

Ronaldo's goal helped Al Nassr secure a 4-2 friendly win over Al Wahda, boosting anticipation for th

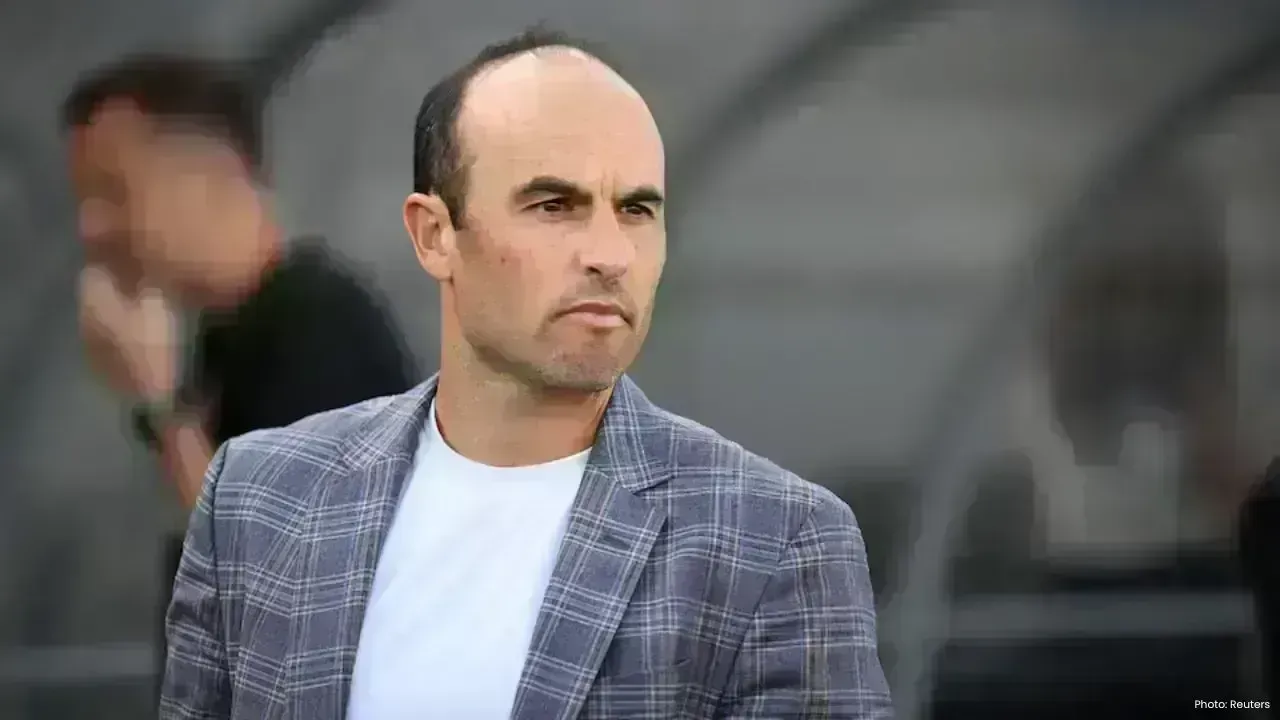

Landon Donovan Challenges Australia Coach on World Cup Prospects

Landon Donovan counters Australia coach Tony Popovic’s optimism for the World Cup, expecting an earl

Mercedes-Benz Forms Landmark Partnership with WTA

Mercedes-Benz and the WTA unveil a significant partnership effective January 2026, with major invest

Abhishek Addresses Divorce Rumours Concerning His Family

Abhishek Bachchan confirms that daughter Aaradhya remains oblivious to divorce speculations, focusin