Post by : Sami Jeet

Medium-risk investors find themselves in a pragmatic investment space, seeking returns that surpass fixed deposits without enduring extreme volatility or high risks of capital loss. This demographic typically comprises salaried professionals, families in growth phases, mid-career entrepreneurs, and long-term planners focused on wealth accumulation with mitigated risk.

As we navigate through 2026, factors such as market uncertainty and inflation necessitate a selection of well-structured, balanced investment options, steering clear from chasing fleeting trends or overly cautious strategies. This guide elucidates the top investment options well-suited for medium-risk investors, detailing their mechanics, suitability, and strategic application.

Medium risk signifies not just average returns or uncontrolled uncertainty, but rather:

A willingness to withstand temporary fluctuations

An expectation of moderate to substantial long-term gains

A focus on capital preservation coupled with growth

Aiming to sidestep extreme highs and deep lows

In this realm, medium-risk investing accentuates equilibrium over extremes.

Fundamentally low-risk options often fail to outpace inflation, while high-risk investments require emotional fortitude and precise timing. The perks of medium-risk investments include:

Mitigating volatility

Possessing potential to ward off inflation

Alleviating stress during market downturns

Aligning seamlessly with long-term objectives

Ideal for educational planning, home purchases, and retirement savings.

Hybrid mutual funds merge equity and debt, standing as a prime choice for medium-risk investors.

These funds allocate a portion of investments to equities for growth and the remainder to debt instruments for stability.

Exhibit lower volatility compared to pure equity funds

Deliver superior returns relative to pure debt funds

Rebalancing handled automatically by fund managers

Ideal for goals spanning 3–7 years

Balanced advantage funds and aggressive hybrid funds shine in this category.

Index funds provide equity exposure minus the risks associated with active management.

Broad market diversification benefits

Lower expense ratios compared to actively managed funds

Minimized bias from fund management

Potential for long-term asset growth

They mimic market indices and align best with investors demonstrating patience and discipline.

Large-cap funds target established, financially sound companies.

Experience less volatility than mid- and small-cap counterparts

Consistent earnings and robust financials

Long-term gains with lesser downside risk

These funds cater to those wanting equity exposure without extreme price swings.

Debt mutual funds often face misconceptions.

Returns can be influenced by interest rate fluctuations and credit ratings.

Short to medium-duration funds

Corporate bond funds with strong credit ratings

Banking and PSU debt funds

These provide enhanced returns over fixed deposits while maintaining manageable risk.

Fixed deposits still serve a purpose for medium-risk investors.

Avoid long-term commitment of all assets

Implement a maturity ladder strategy

Integrate with growth-oriented assets

FDs contribute liquidity and stability, not growth.

While gold may not maximize returns, it acts as a stability-enhancing asset.

A hedge against inflation

Providing security in market downturns

Low correlation with stock markets

Digital gold, gold ETFs, and sovereign gold bonds present effective options.

Approached with caution, real estate can align well with medium-risk investors.

Investing in rental properties

Targeting budget-friendly property segments

Utilizing REITs for diversity

Steer clear of speculative investments and excessive leverage.

The NPS combines equities, corporate bonds, and government securities.

Controlled asset distribution

Opportunity for long-term compounding

Structured retirement planning

It's a perfect fit for investors eyeing long-term horizons.

A Systematic Investment Plan (SIP) serves as a risk control mechanism.

Mitigating timing-related risks

Smoothing out market volatility

Promoting disciplined investment habits

SIPs are particularly effective across equity, hybrid, and index funds.

Success in medium-risk investing hinges on thoughtful asset distribution.

40–50% in equity-focused investments

25–35% in debt instruments

10–15% in gold or alternatives

The remaining should stay in liquid assets

Adjust this structure based on age, financial stability, and objectives.

Chasing high returns during bullish periods

Panic selling in correction phases

Overcommitting to a single asset class

Neglecting necessary rebalancing

Consistency is key, outweighing fleeting performance spikes.

Quarterly evaluations are generally adequate.

Changes in asset allocation

Identifying underperforming assets

Amendments in goal timelines

Avoid hasty buying and selling.

Risk diminishes as time frames extend.

Short-term goals necessitate enhanced stability

Long-term aspirations permit higher equities exposure

Match investments with timelines, not emotions.

This investment approach minimizes burnout, anxiety, and remorse. It empowers investors to remain committed even during downturns, eventually reaping rewards from recoveries. Consequently, it typically outshines impulsive high-risk methodologies.

The optimal investment strategy for medium-risk individuals isn't confined to one product, but rather a harmonious blend. Growth, stability, liquidity, and protection must coalesce. Markets can fluctuate, yet a disciplined medium-risk strategy upholds financial objectives.

Intelligent investing is less about thrills—it’s fundamentally about consistency and clarity.

This article serves purely as informational content and should not be interpreted as financial advice. Investment outcomes may differ based on market conditions, individual risk profiles, and financial aspirations. Consultation with a certified financial advisor is highly recommended prior to making investment choices or altering one’s portfolio.

Tragic Fall Claims Life of Teen at Abandoned Filming Site

A 19-year-old woman tragically fell to her death from an abandoned building in Atlanta, previously f

Dhurandhar Surpasses 800 Crore Mark at the Box Office

Ranveer Singh's Dhurandhar rakes in ₹800 crore globally, with the hit song Shararat captivating audi

Kriti Sanon Discusses Her Complex Role in Tere Ishk Mein

Kriti Sanon initially found her role in Tere Ishk Mein negative but grew to understand and appreciat

Release of 130 Students From St Mary’s Catholic School Marks Hopeful Turn in Nigeria

Nigerian authorities announce the release of 130 students from St Mary’s, ensuring no pupil remains

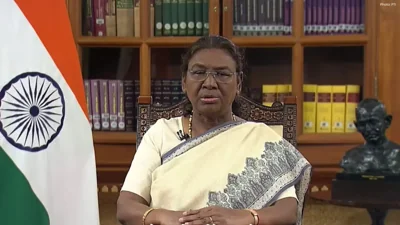

President Murmu Endorses SHANTI Bill to Propel Nuclear Energy Expansion

President Droupadi Murmu endorses the SHANTI Bill, facilitating private sector involvement in nuclea

New Zealand Claims Test Series with Decisive Victory Over West Indies

New Zealand triumphed over West Indies by 323 runs in the final Test, securing a 2-0 series win with