Post by : Monika

Global oil markets showed signs of recovery on October 13, 2025, following sharp losses earlier in the week. Investors reacted positively to signals that tensions between the United States and China might ease, despite ongoing uncertainty surrounding tariffs, export controls, and global supply.

Brent crude futures rose by 92 cents, or 1.47%, to $63.65 per barrel, while U.S. West Texas Intermediate (WTI) crude gained 89 cents, or 1.51%, reaching $59.79 per barrel. This rebound came after Friday’s significant declines, when Brent lost 3.82% and WTI fell 4.24%, marking the lowest levels since early May.

The Cause of Oil Market Volatility

The recent price fluctuations were driven mainly by concerns over trade conflicts between the U.S. and China. The U.S. administration, led by President Donald Trump, threatened to impose new tariffs on Chinese goods while also tightening export controls on high-tech products. In response, China expanded restrictions on rare earth exports, which are critical for technology and defense industries.

These announcements caused global markets, including commodities like crude oil, to react sharply. Oil prices fell as investors feared reduced demand from China, the world’s largest oil importer, and potential disruptions in global trade.

Market Recovery and Investor Optimism

Despite these concerns, oil prices rebounded due to a mix of profit-taking, speculation, and optimism that tensions could ease. Analysts noted that some traders believe the tariffs are being used as negotiation tools rather than permanent measures.

Financial experts highlighted that statements from President Trump and Vice President JD Vance suggested willingness to engage in negotiations with China, which gave investors hope. If trade talks proceed positively, demand for oil could remain stable or even increase, supporting higher prices.

China’s Crude Oil Imports and Refinery Activity

China’s domestic oil market also influenced global pricing. In September 2025, China’s crude oil imports grew by 3.9% year-on-year, reaching 11.5 million barrels per day. This growth was driven by record refinery utilization rates, as Chinese refineries maximized production to meet domestic demand.

However, seaborne crude imports fell by 4.5% compared with August, marking the lowest level since January. Analysts attribute this to stricter import quotas for independent refineries, less favorable trade conditions, and the effect of global geopolitical tensions.

Geopolitical Developments and Oil Markets

Oil markets are highly sensitive to geopolitical events, and recent developments provided some relief. President Trump announced the end of the Gaza war following a brokered ceasefire, including the release of hostages and prisoners.

This reduction in geopolitical risk shifted market focus back to supply and demand fundamentals, highlighting the influence of trade policy and global consumption on crude prices. Investors remain alert to any further developments in the Middle East, as disruptions there could quickly push oil prices higher.

Regional Market Reactions

Asia: Asian markets, particularly in Japan, China, and South Korea, reacted strongly to global oil price fluctuations. Falling crude prices earlier caused declines in energy stocks and other sectors sensitive to industrial demand. The subsequent rebound helped stabilize regional markets slightly, but uncertainty remained high.

United States: U.S. markets saw mixed responses. Energy companies’ stocks rose with recovering oil prices, while technology and manufacturing sectors remain sensitive to the ongoing U.S.-China trade disputes. Bond yields fell slightly as investors considered potential interest rate adjustments in response to global economic pressure.

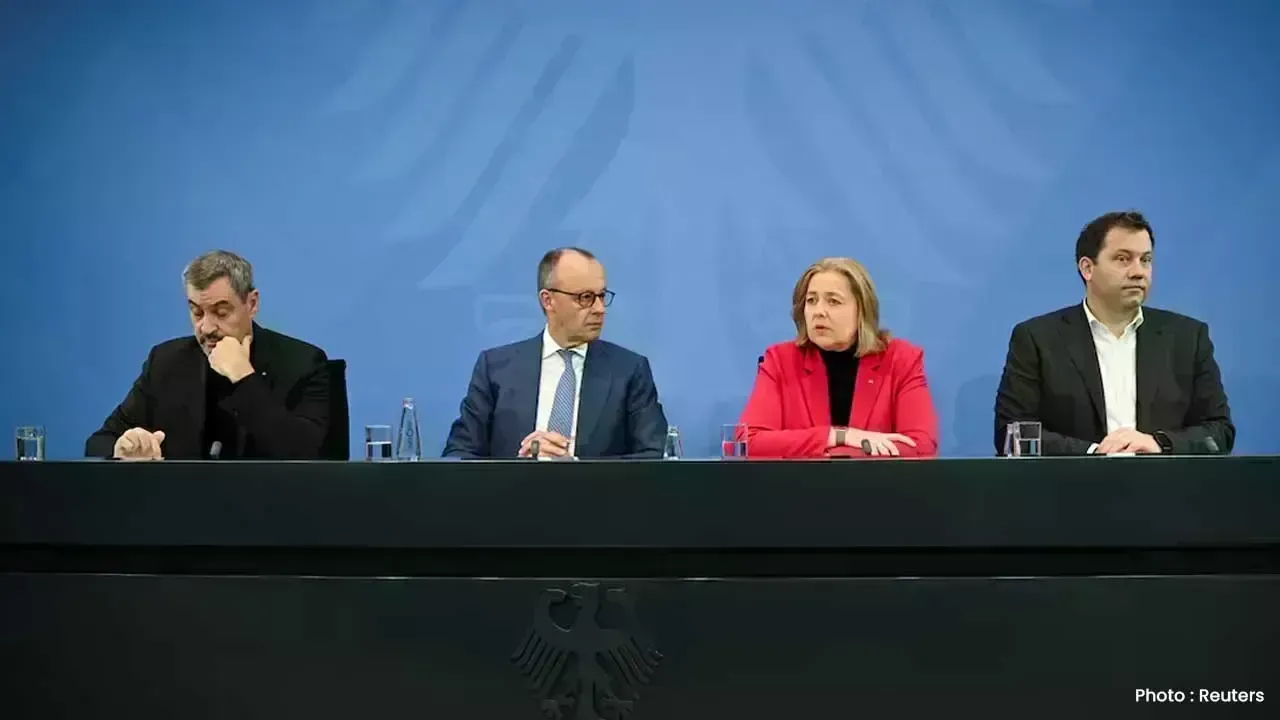

Europe: European markets were influenced by both energy price shifts and political uncertainty. Investors monitored developments in France and Germany, as political instability could affect energy policy and market confidence.

Impact on Specific Sectors

Global Economic Implications

Rising and falling oil prices have broader consequences. Higher prices can increase costs for manufacturers, transportation, and consumers. Conversely, lower prices may relieve some cost pressures but could signal reduced global demand, which worries investors.

Economists note that the current oil price rebound, though positive, is fragile. Any renewed escalation in U.S.-China trade tensions or geopolitical conflicts could reverse gains quickly, creating further volatility in global markets.

Analyst Perspectives

Financial analysts have shared cautious optimism:

Potential Scenarios for Oil Prices

Investor Sentiment and Market Psychology

Investor behavior shows a mix of caution and strategic optimism. Many are turning to safe-haven assets like gold while cautiously increasing exposure to energy stocks. Hedge funds and institutional investors are using risk management strategies to mitigate potential losses from sudden price swings.

Looking Ahead

The partial rebound in oil prices on October 13, 2025, reflects cautious optimism among investors, driven by signs of potential easing in U.S.-China trade tensions and a reduction in geopolitical risk in the Middle East.

While Brent crude and WTI recovered from sharp declines, volatility remains high. Energy markets continue to respond to trade negotiations, political developments, and refinery production levels. Investors are advised to monitor these factors closely and adopt strategies to manage risk.

This period highlights the interconnected nature of global markets, where trade policy, geopolitics, and industrial activity all converge to influence commodity prices, investor confidence, and economic growth worldwide.

OpenAI Highlights Growing Cybersecurity Threats from Emerging AI Technologies

OpenAI has raised alarms about the increasing cyber risks from its upcoming AI models, emphasizing s

Manchester City Triumphs 2-1 Against Real Madrid, Alonso Faces Increased Scrutiny

Manchester City secured a 2-1 victory over Real Madrid, raising concerns for coach Xabi Alonso amid

Cristiano Ronaldo Leads Al Nassr to 4-2 Victory Over Al Wahda in Friendly Face-Off

Ronaldo's goal helped Al Nassr secure a 4-2 friendly win over Al Wahda, boosting anticipation for th

Landon Donovan Challenges Australia Coach on World Cup Prospects

Landon Donovan counters Australia coach Tony Popovic’s optimism for the World Cup, expecting an earl

Mercedes-Benz Forms Landmark Partnership with WTA

Mercedes-Benz and the WTA unveil a significant partnership effective January 2026, with major invest

Abhishek Addresses Divorce Rumours Concerning His Family

Abhishek Bachchan confirms that daughter Aaradhya remains oblivious to divorce speculations, focusin