Post by : Jyoti Singh

Photo: Facebook Sabzi Mandi at your door

New Delhi, August 14, 2025 – India’s wholesale inflation fell deeper into negative territory in July, recording a rate of 0.58% compared to 0.13% in June, according to data released by the government on Thursday.

The latest figure marks the continuation of a rare and extended period of falling wholesale prices, a trend that India has not witnessed in more than ten years. The drop in July was mainly due to lower prices of food items, mineral oils, crude petroleum and natural gas, and basic metals the Ministry of Commerce and Industry said in its statement.

Economists had already expected a further dip in wholesale inflation. A Reuters poll conducted earlier this month projected that the Wholesale Price Index (WPI)-based inflation would shrink to around -0.30% in July. However, the actual decline was even steeper, suggesting that price pressures in the economy are easing faster than anticipated.

Why Prices Fell

The fall in wholesale inflation was driven by several factors:

1. Food Prices:

Despite erratic monsoon rains in some regions, India’s agricultural output, especially from the strong spring harvest, has been robust. This has kept food supplies steady and helped bring down prices for many essential items.

2. Energy and Oil:

Prices of mineral oils and crude petroleum dropped compared to last year. This not only lowered wholesale inflation but also reduced input costs for various industries.

3. Metals:

The manufacturing cost of basic metals declined, reflecting weaker demand in certain sectors and a fall in global commodity prices.

A Record Disinflation Streak

India is now experiencing its longest stretch of disinflation in more than a decade. Disinflation means prices are still rising in some sectors but at a slower pace overall – or, in this case, actually falling for certain goods in the wholesale market.

While retail prices (measured by the Consumer Price Index or CPI) and wholesale prices (measured by the WPI) often move in the same direction, they can behave differently due to variations in the items they track. The WPI focuses more on goods sold in bulk between businesses, while CPI measures what consumers pay for goods and services in the retail market.

Retail Inflation Also Down Sharply

The good news for ordinary citizens is that retail inflation has also dropped sharply. India’s retail inflation rate fell to 1.55% in July — the lowest in over eight years. This was largely because of a sharp decline in food prices, particularly vegetables and cereals, which have been more affordable in recent weeks.

This is the first time in more than six years that retail inflation has slipped below the Reserve Bank of India’s (RBI) tolerance band of 2–6%. The current 1.55% level is the lowest year-on-year figure since June 2017.

For households, this means everyday expenses for food and some basic needs have reduced, providing some relief after years of high prices during and after the pandemic.

RBI’s View and Inflation Outlook

The Reserve Bank of India’s Monetary Policy Committee (MPC), which sets the country’s interest rates, recently discussed its expectations for inflation over the coming months.

According to the RBI, while inflation is currently under control, there are risks ahead:

Food Price Volatility: The central bank is cautious about vegetable prices, which can rise suddenly due to supply disruptions caused by bad weather, pests, or transportation issues.

Global Trade Issues: Even though some geopolitical tensions have eased, new tariffs and changes in international trade continue to affect the cost of imports and exports.

The RBI expects that inflation might rise again in the last quarter of the 2025–26 financial year but it will still likely remain at relatively safe levels.

Projections for the Future

The RBI has adjusted its inflation forecast for the full year 2025–26, lowering it from 3.70% (forecast in June) to 3.10%. However, it also expects that in the first quarter of the 2026–27 financial year inflation may touch 4.9% which is above its target level of 4%.

Here are the RBI’s quarter-by-quarter estimates for the rest of FY26:

Q2 (July–Sept): 2.1%

Q3 (Oct–Dec): 3.1%

Q4 (Jan–Mar): 4.4%

The RBI noted that core inflation — which excludes food and fuel prices — has stayed steady at around 4%. This indicates that while some price pressures remain, they are not increasing sharply.

Why This Matters for the Economy

Inflation levels play a major role in shaping economic policy. When prices rise too quickly, central banks like the RBI often increase interest rates to slow spending and borrowing. But when inflation falls, especially into negative territory, it can have mixed effects:

Positive Effects:

Lower prices can make goods and services more affordable for consumers.

Businesses that rely on imported raw materials benefit from cheaper inputs.

Negative Effects:

Too much price decline can signal weak demand in the economy.

If businesses expect prices to keep falling, they may delay investments, which can slow growth.

In India’s case, economists say the current fall in inflation is more due to strong agricultural production and lower global commodity prices than a slowdown in consumer demand. This means it is less of a warning sign and more of a positive development — at least for now.

Impact on Households and Businesses

For households, falling inflation means a lighter burden on daily budgets. Families are likely to feel the difference in food bills and fuel expenses first.

For businesses, especially those in manufacturing and food processing, the decline in wholesale prices means they can reduce costs and potentially increase profit margins or pass savings on to consumers.

Export-oriented businesses may also benefit because lower domestic input costs can make Indian goods more competitive abroad. However, exporters who rely heavily on global commodity prices may see mixed results, as falling prices in world markets can also mean reduced revenues.

Global Context

India is not alone in experiencing a cooling of inflation. Several major economies have reported a slowdown in price growth in recent months, thanks to easing global energy prices, better supply chain conditions, and improved agricultural output.

However, in some countries, inflation remains stubbornly high due to domestic challenges and currency fluctuations. In contrast, India’s stable currency, strong harvest, and relatively steady global oil prices have allowed it to keep inflation well below the levels seen in many other developing nations.

What Could Change the Trend

Experts warn that several factors could reverse the downward inflation trend in India:

1. Poor Monsoon in Key Areas: If rainfall is lower than expected in important farming regions, food production could drop, leading to higher prices.

2. Global Oil Price Shocks: If global tensions flare up, crude oil prices could rise sharply, impacting transport and manufacturing costs.

3. Export Demand Changes: A sudden spike in demand for Indian agricultural products abroad could push domestic prices up.

4. Supply Chain Disruptions: Natural disasters, strikes, or political tensions could slow down the movement of goods, causing shortages and price increases.

India’s wholesale inflation slipping to -0.58% in July 2025 marks another chapter in an unusually long period of price stability and decline. Combined with a sharp drop in retail inflation to 1.55% this trend is offering relief to households and businesses alike.

While the Reserve Bank of India remains cautious about the months ahead — particularly about food price volatility — its lower inflation forecast suggests a generally positive economic outlook.

For now, India is benefiting from strong harvests, lower commodity prices, and stable demand, making it one of the better-performing major economies when it comes to managing inflation.

If these conditions hold, the country could maintain stable prices well into 2026, though the RBI and policymakers will be watching closely for any signs of a rebound in price pressures.

Kazakhstan Boosts Oil Supply as US Winter Storm Disrupts Production

Oil prices inch down as Kazakhstan's oilfield ramps up production, countered by severe disruptions f

Return of Officer's Remains in Gaza May Open Rafah Crossing

Israel confirms Ran Gvili's remains identification, paving the way for the Rafah border crossing's p

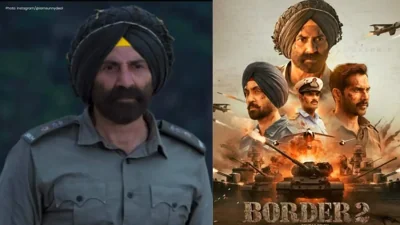

Border 2 Achieves ₹250 Crore Globally in Just 4 Days: Sunny Deol Shines

Sunny Deol's Border 2 crosses ₹250 crore in 4 days, marking a significant breakthrough in global box

Delay in Jana Nayagan Release as Madras HC Bars Censorship Clearance

The Madras High Court halts the approval of Jana Nayagan's censor certificate, postponing its releas

Tragedy Strikes as MV Trisha Kerstin 3 Accident Leaves 316 Rescued

The MV Trisha Kerstin 3 met an unfortunate fate near Jolo, with 316 passengers rescued. The governme

Aryna Sabalenka Advances to Semi-Finals, Targeting Another Grand Slam Title

Top seed Aryna Sabalenka triumphed over Jovic and now faces Gauff or Svitolina in the semi-finals as