Post by : Anees Nasser

Interest rates quietly control how affordable your life feels. They decide whether your monthly income is enough or always seems stretched. They influence your loan EMIs, your savings growth, and even your spending habits. A reduction in interest rates is not just a policy move, it is a change that touches millions of households.

For families repaying home loans, interest rates are more important than property prices. Even a slight increase can turn ₹5,000 into ₹7,000 overnight in additional EMI burden. Similarly, a reduction can feel like the lifting of invisible weight from the household budget.

Housing is not an emotional purchase alone; it is a financial decision that spans decades. When central bank signals begin suggesting easier borrowing, buyers feel hopeful. Property developers sense renewed interest. Banks begin preparing new offers. And borrowers start calculating future savings in their heads even before official announcements are made.

This renewed excitement comes from a simple truth: interest rates define affordability far more than headline loan amounts.

Every EMI you pay has two components working in the background. One part goes towards reducing your original loan amount, while the other is interest charged by the lender for using that money.

In the initial years of the loan, the interest portion is large. In fact, during the early stage, most of your EMI goes toward interest rather than repayment.

As months pass, the trend gradually reverses. Your principal reduces and interest becomes a smaller portion of the EMI.

This structure explains why early borrowers benefit most from a rate cut.

Borrowers often overlook the type of interest scheme they have chosen until rates change.

A floating rate loan moves with the market. If the lending benchmark falls, your loan rate falls. If it rises, your EMI will rise sooner or later.

A fixed rate loan works differently. Your rate remains unchanged for a specific duration mentioned in your agreement, regardless of external rate movements.

This is why floating loans are preferred when a rate cut cycle begins.

On paper, a half percent may not sound like much. In real life, it is enormous.

Consider this:

A borrower with a ₹50 lakh loan over 20 years at 9% pays around ₹45,000 per month.

If the interest falls to 8.5%, the EMI drops by roughly ₹3,000.

That means:

₹36,000 saved every year

₹3.6 lakh saved in a decade

Several lakhs saved over the full tenure

This is enough to fund education, health expenses, or retirement savings.

Rate cuts are not symbolic events. They are financial turning points.

Banks may give you two options when rates drop:

Reduce EMI and retain the original tenure

Keep EMI the same and reduce the total loan duration

While a lower EMI feels good immediately, reducing tenure can save you significantly more in interest.

For instance, continuing your EMI while shortening your tenure can shave years off your loan and reduce total repayment amount drastically.

Smart borrowers choose loan freedom over lifestyle upgrades.

Rate cuts may be universal, but benefits are not equally distributed.

The biggest winners are:

Individuals who took loans recently

Families with large home loans

Buyers with long tenures

Borrowers with strong credit scores

Those nearing loan completion will see limited relief.

If your interest burden is almost over, a rate cut will barely dent your EMI.

In theory, policy rate cuts encourage banks to reduce loan rates. In reality, the effect is slower.

Banks consider:

Their own funding costs

Future inflation risks

Competition levels

Profit targets

Sometimes rate cuts are passed on in stages.

Borrowers should actively check their loan statements. Waiting passively may lead to missed savings.

Refinancing involves transferring your loan to a lender offering lower interest.

It makes sense when:

Your outstanding amount is high

Difference in interest rate is meaningful

Cost of switching is minimal

You are early in the repayment cycle

It makes less sense if:

The loan is almost repaid

Processing fees are high

The interest difference is minor

Borrowers must calculate net benefit before deciding.

Lower rates increase affordability.

A buyer with a ₹40,000 EMI budget may suddenly afford a larger home or a better location.

Developers usually react fast. Offers, flexible payments, and discounts flood the market.

This is when buyers have power — not sellers.

However, impulsive buying remains a risk.

A rate cut should increase wisdom, not recklessness.

When demand rises, prices often follow.

But in oversupplied zones, developers negotiate.

This leads to:

Festival discounts

Payment holidays

Reduced booking amounts

Attractive financing plans

A rate cut does not always mean higher prices.

It often means better value.

As homeowners increase, pressure on rentals may ease.

In some cities, demand reduces slightly, stabilising rents.

Thus even non-borrowers indirectly benefit.

Families with:

Home loans

Car loans

Education loans

could suddenly see reduced obligations.

This can increase:

Savings

Investments

Quality of life

But discipline is essential.

Rate relief should create stability, not luxury debt.

Use smaller EMIs to:

Prepay loans

Increase investments

Build emergency reserves

Clear credit card dues

Strengthen insurance coverage

Avoid upgrading lifestyle the moment your EMI drops.

Paying no attention to loan statements

Wasting EMI savings

Avoiding prepayments

Blind refinancing

Overconfidence in future rates

A rate cut is an opportunity, not a guarantee.

Rates do not fall forever.

Inflation may force future hikes.

When that happens:

EMIs rise

Tenures extend

Budgets tighten again

Borrowers should reduce dependency on favourable conditions.

When financial pressure eases:

Couples argue less about money

Families plan vacations

Parents focus on education

Anxiety reduces

Financial comfort is emotional comfort.

Low-interest phases typically last 2–4 years.

This is the golden window for aggressive repayment.

Those who use this period wisely emerge debt-free faster.

Interest relief makes life easier.

But intelligence makes it secure.

Borrowers who plan outlive policies.

Those who wait suffer cycles.

Money management beats money movement — always.

This article is intended for general informational purposes only. It does not constitute financial, legal, or investment advice. Readers are encouraged to consult qualified professionals before making any loan-related or financial decisions based on interest rate movements.

OpenAI Highlights Growing Cybersecurity Threats from Emerging AI Technologies

OpenAI has raised alarms about the increasing cyber risks from its upcoming AI models, emphasizing s

Manchester City Triumphs 2-1 Against Real Madrid, Alonso Faces Increased Scrutiny

Manchester City secured a 2-1 victory over Real Madrid, raising concerns for coach Xabi Alonso amid

Cristiano Ronaldo Leads Al Nassr to 4-2 Victory Over Al Wahda in Friendly Face-Off

Ronaldo's goal helped Al Nassr secure a 4-2 friendly win over Al Wahda, boosting anticipation for th

Landon Donovan Challenges Australia Coach on World Cup Prospects

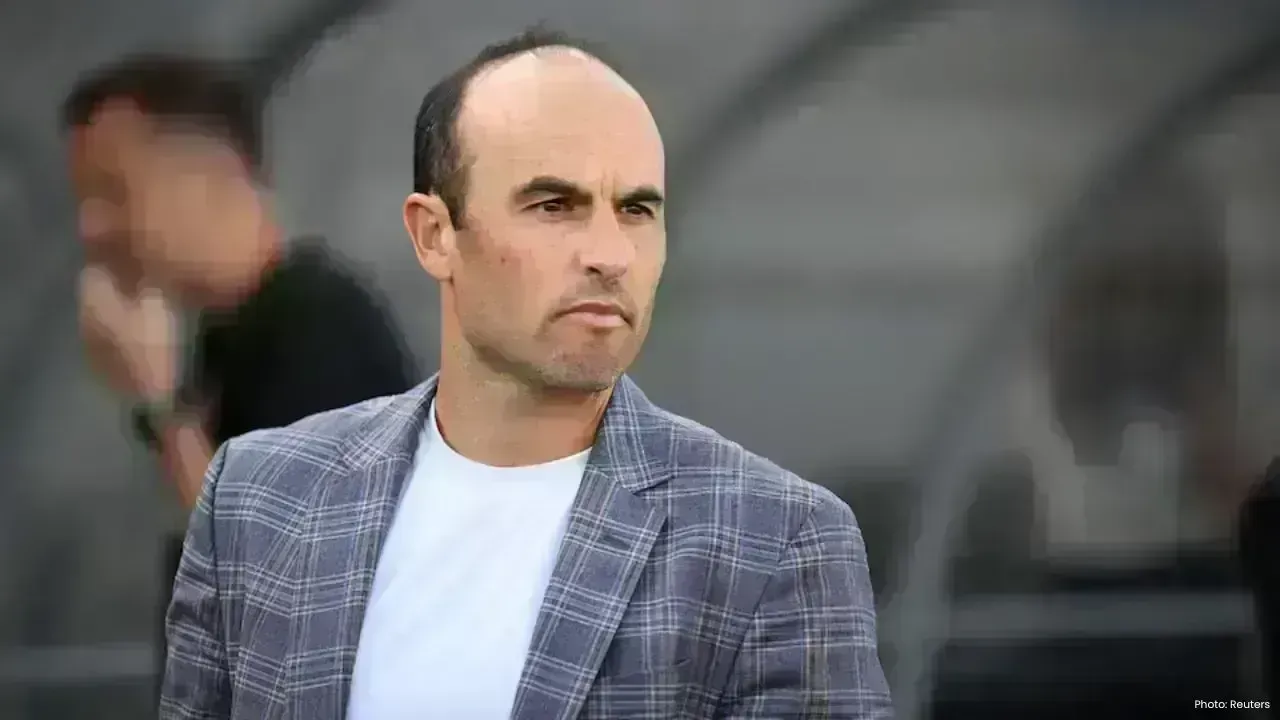

Landon Donovan counters Australia coach Tony Popovic’s optimism for the World Cup, expecting an earl

Mercedes-Benz Forms Landmark Partnership with WTA

Mercedes-Benz and the WTA unveil a significant partnership effective January 2026, with major invest

Abhishek Addresses Divorce Rumours Concerning His Family

Abhishek Bachchan confirms that daughter Aaradhya remains oblivious to divorce speculations, focusin