Post by : Monika

Photo: Reuters

At the beginning of August 2025, Europe’s stock markets are moving through uncertain times. Investors are trying to understand many different issues happening at once—like weaker signs from the U.S. economy, new tariff threats from the U.S. government, and the careful actions of central banks in Europe and the UK.

But not everything is bad news. Many European businesses have shared better profits than expected, which has helped calm some fears and given hope that the economy is still strong underneath.

1. U.S. Worries Spill Into Europe

In the United States, recent reports show that the services sector didn’t grow much in July. At the same time, business costs rose faster than they have in nearly three years. This unusual mix is known as stagflation—when prices go up, but the economy doesn’t grow much and job growth slows down.

This matters to Europe because the U.S. is one of Europe’s biggest customers. If the U.S. slows down, it could mean fewer American purchases of European goods like cars, machines, or luxury items.

Big U.S. companies like Caterpillar and Yum Brands have already said they are seeing lower demand and rising costs, mainly because of new tariffs—which are taxes on imported goods. These signs suggest that trouble in global trade is starting to affect business profits.

2. Europe’s Central Banks Watch Carefully

In the UK, the Bank of England is expected to start cutting interest rates, possibly lowering its main rate to about 4%. This wouldn’t be a huge drop, but it could mark the start of a longer process of making money cheaper to borrow. Experts believe this might become one of the slowest rate-cutting periods in the UK’s recent history.

The situation is delicate. Inflation in the UK is still above the bank’s target. At the same time, job growth is weak, and uncertainty is still high, especially after past issues like Brexit, the COVID pandemic, and energy price shocks.

The European Central Bank, which oversees the euro zone, faces its own set of problems. If U.S. trade fights push more cheap Chinese goods into Europe, that could cause inflation in Europe to fall even lower. If that happens, the ECB might have to cut rates too, especially since core inflation is still below the 2% target.

3. Tariff Troubles Return

U.S. President Donald Trump has recently announced new tariffs, including stricter taxes on goods coming from Europe. This has affected several industries, including Swiss companies, which have been hit especially hard.

Even though there have been some trade deals between the U.S. and Europe in recent months, many business leaders in Europe feel these agreements benefit U.S. exporters more and leave Europe at greater risk of economic harm.

Markets are feeling the stress. Every time new tariffs are introduced or threatened, stock markets tend to drop, and investor confidence weakens.

4. Strong Results from European Companies

Despite all these global issues, many European firms have surprised investors by performing well. For example, banks in countries like Germany and Switzerland are doing better than expected. One reason is that higher interest rates have allowed banks to earn good profits from loans and other services.

Even industries that are usually affected by global issues, like car manufacturing and exports, have managed to stay stable or close to expectations. A lot of this strength comes from government investments in infrastructure and defense, especially in Germany.

Popular stock market indices like France’s CAC 40, Germany’s DAX, and the UK’s FTSE 100 have all shown signs of strength at different times. Even though the overall Stoxx 600 index has fallen slightly in recent days, this may simply be due to investors collecting profits after earlier growth, especially in the tech sector.

5. Bonds Send Mixed Messages

Looking at government bonds, markets are showing signs of nervousness. In the U.S., short-term Treasury bond yields have risen after weaker labor and services data, while long-term yields have changed less. This difference shows that investors are unsure about the future—especially about when central banks will start cutting rates more aggressively.

In Europe, government bond markets are also under pressure. The central banks in the UK and euro zone are trying to balance two risks: cutting rates too much, which could push inflation higher, or doing too little, which could hurt growth.

6. Investor Confidence Is Slipping

Recent surveys, like those done by Sentix, show that European investors are becoming more worried. This has happened especially after a trade deal between the U.S. and the EU, which many believe heavily favored the U.S.

Switzerland, in particular, has felt the strain of new tariffs, which have affected both big and small businesses.

Meanwhile, some large global investment funds are reducing their holdings in U.S. stocks and moving their money into European stocks. They believe Europe’s stock markets are undervalued compared to the U.S. and may offer better long-term returns, especially if conditions improve.

7. Economic Growth Is Slow but Steady

In mid-2025, the euro zone economy grew by just 0.1%, which was a little better than most predictions. However, underneath this small improvement, some big countries like Germany and Italy actually saw their economies shrink. Both countries are facing weak demand at home and lower levels of investment.

Germany is also dealing with higher borrowing costs and political uncertainty under a new government. Italy, on the other hand, is struggling with high levels of public debt, which makes investors nervous.

Other long-term challenges include aging populations, high energy prices, less tech innovation, and fragmented capital markets. Still, analysts say recent positive earnings reports and the possibility of more rate cuts or government support could help turn things around in the coming months.

8. What Will Investors Watch Next?

Signs of government stimulus in Europe, particularly from Germany in the form of spending on roads, defense, or digital upgrades.

Topic What’s Happening

In August 2025, Europe is facing a mixed picture. On one side, there are serious challenges: a shaky U.S. economy, rising trade tensions, and uncertain central bank policies. But on the other side, European companies are showing strength, some investors are turning their focus toward undervalued markets, and central banks are carefully managing interest rates to avoid making things worse.

If trade tensions ease and governments provide smart economic support, Europe’s markets could come out stronger. For now, the continent’s economic future depends on careful decisions—and a bit of luck.

OpenAI Highlights Growing Cybersecurity Threats from Emerging AI Technologies

OpenAI has raised alarms about the increasing cyber risks from its upcoming AI models, emphasizing s

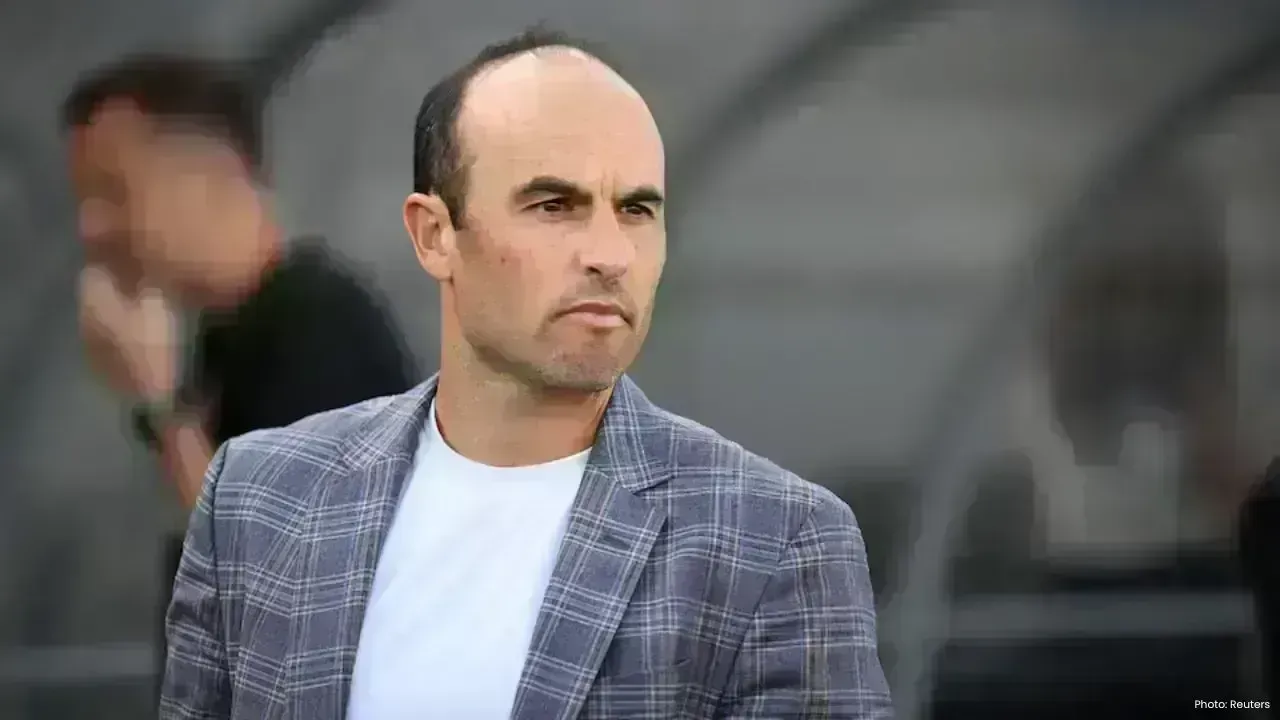

Manchester City Triumphs 2-1 Against Real Madrid, Alonso Faces Increased Scrutiny

Manchester City secured a 2-1 victory over Real Madrid, raising concerns for coach Xabi Alonso amid

Cristiano Ronaldo Leads Al Nassr to 4-2 Victory Over Al Wahda in Friendly Face-Off

Ronaldo's goal helped Al Nassr secure a 4-2 friendly win over Al Wahda, boosting anticipation for th

Landon Donovan Challenges Australia Coach on World Cup Prospects

Landon Donovan counters Australia coach Tony Popovic’s optimism for the World Cup, expecting an earl

Mercedes-Benz Forms Landmark Partnership with WTA

Mercedes-Benz and the WTA unveil a significant partnership effective January 2026, with major invest

Abhishek Addresses Divorce Rumours Concerning His Family

Abhishek Bachchan confirms that daughter Aaradhya remains oblivious to divorce speculations, focusin