Post by : Sami Jeet

Salaried individuals often view taxes as a burden that is hard to navigate. Many only contemplate tax-saving strategies as the financial year winds down, resulting in hasty, ineffective choices that miss out on potential benefits. The key takeaway is that tax management is less about evading taxes and more about legally minimizing liabilities to enhance financial stability.

This guide provides a comprehensive overview of key tax-saving strategies designed specifically for salaried employees, allowing for proactive planning rather than panic-driven decisions.

Before selecting tax-saving tools, it’s vital to grasp two essential concepts.

Old regime facilitates various deductions and exemptions

New regime presents reduced tax rates while eliminating most deductions

Tax-saving tactics are primarily beneficial under the old regime. Always run calculations for both before making a choice.

Results in investments that lack clear objectives

Entraps funds in unsuitable financial products

Forfeits long-term wealth-building opportunities

Effective tax planning should commence at the outset of the financial year, not at the finish.

Under Section 80C, deductions can reach up to ₹1.5 lakh annually, making it a favored option among salaried employees.

Employee Provident Fund (EPF)

Public Provident Fund (PPF)

Equity Linked Saving Scheme (ELSS)

Life Insurance Premiums

National Savings Certificate (NSC)

Principal Repayment on Home Loan

Each of these options serves distinct financial needs.

EPF and PPF cater to risk-averse individuals

ELSS is suited for those aiming for long-term wealth growth

Insurance should prioritize protection over tax savings

Diversifying within 80C can balance safety and growth.

EPF is regarded as one of the premier long-term savings mechanisms available to salaried personnel.

Employer contributions amplify savings

Tax-free interest (within stipulated limits)

Fosters long-term retirement planning

EPF is most efficiently utilized as a retirement asset rather than an emergency fund.

For employees prioritizing safety and tax efficiency, PPF is an ideal choice.

Backed by governmental security

Tax-free upon maturity

Encourages long-term compounding

PPF is particularly attractive for conservative and future-focused investors.

Investing in ELSS funds offers a three-year lock-in period, the briefest among tax-saving options under 80C.

Potential for higher long-term returns

Growth that outpaces inflation

SIP flexibility

Despite market risks, ELSS rewards long-term commitment.

As healthcare costs escalate at a rapid pace, Section 80D emphasizes tax-saving opportunities that prioritize health protection.

Premiums for health insurance for oneself and family members

Extra deductions applicable for parents

Exemptions for preventive health examinations

This provision encourages financial readiness, not just tax minimization.

HRA is a major component for salaried personnel renting their accommodation.

Exemptions depend on:

Your salary level

Rent disbursements

City of residence

Proper receipts and rental contracts are crucial.

Home loans provide multiple deduction opportunities across various sections.

Section 80C for principal repayments

Section 24(b) for interest payments

Home ownership can ensure long-term security but must be aligned with one's financial capacity.

Education loans provide significant tax relief without limitations.

The interest is fully deductible

Encourages skill and career advancement

This concession mitigates financial strain while supporting personal growth.

The NPS allows for an extra deduction under Section 80CCD(1B).

Additional tax relief beyond ₹1.5 lakh

Focuses on long-term retirement savings

Partial equity exposure

NPS is an excellent option for disciplined savers aiming for long-term growth.

LTA provides tax exemptions for domestic travel expenditures.

Covers travel costs but excludes lodging

Allows limited claims within a specified period

Strategic planning for vacations can maximize this advantage.

Many tax savings start from how your salary package is arranged.

HRA

LTA

Meal vouchers

Various reimbursements

A smart salary configuration increases disposable income without incurring additional expenses for employers.

A frequent error is blending insurance with investment.

Insurance should primarily mitigate risk

Investments must focus on wealth accumulation

Choosing insurance predominantly for tax benefits can lead to sub-par investment performance.

Investing without locking in periods

Overloading Section 80C with low-yield options

Neglecting health insurance

Not annually reviewing regime preferences

Imitating others' tax plans

Tailoring plans to fit personal circumstances is essential.

Assess anticipated taxable income

Evaluate different tax regimes

Prioritize coverage over tax-saving

Assign the remaining deductions to growth-oriented choices

Review mid-year and recalibrate

Tax planning should complement life goals rather than hinder them.

Enhanced savings

Improved cash flow

Minimized stress

Heightened financial responsibility

Clearer path to retirement

Effective tax planning positively influences overall financial health.

While taxes are inevitable, overpaying as a result of inadequate planning is not. By strategically selecting deductions, investments, and structuring salary, salaried employees can lighten their tax load while ensuring long-term financial growth and security.

The objective transcends mere tax-saving—it’s about leveraging tax regulations to enhance your financial trajectory.

This article serves as a general information resource and does not provide tax, legal, or financial guidance. Tax laws, limits, and their applicability may evolve in accordance with governmental mandates and personal situations. Readers are encouraged to consult a certified tax advisor or financial consultant before making decisions related to taxes.

Tragic Fall Claims Life of Teen at Abandoned Filming Site

A 19-year-old woman tragically fell to her death from an abandoned building in Atlanta, previously f

Dhurandhar Surpasses 800 Crore Mark at the Box Office

Ranveer Singh's Dhurandhar rakes in ₹800 crore globally, with the hit song Shararat captivating audi

Kriti Sanon Discusses Her Complex Role in Tere Ishk Mein

Kriti Sanon initially found her role in Tere Ishk Mein negative but grew to understand and appreciat

Release of 130 Students From St Mary’s Catholic School Marks Hopeful Turn in Nigeria

Nigerian authorities announce the release of 130 students from St Mary’s, ensuring no pupil remains

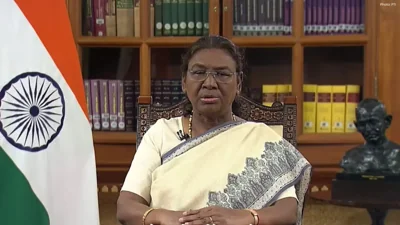

President Murmu Endorses SHANTI Bill to Propel Nuclear Energy Expansion

President Droupadi Murmu endorses the SHANTI Bill, facilitating private sector involvement in nuclea

New Zealand Claims Test Series with Decisive Victory Over West Indies

New Zealand triumphed over West Indies by 323 runs in the final Test, securing a 2-0 series win with