Post by : Naveen Mittal

The global financial markets are bracing for a crucial announcement from the United States Federal Reserve. The Fed is expected to cut its benchmark interest rate by a quarter of a percentage point, lowering it to the range of 4.00%–4.25%. While the rate cut itself is mostly anticipated, all eyes are on Federal Reserve Chair Jerome Powell, whose comments about the outlook of U.S. monetary policy will be closely examined by investors worldwide.

Financial experts believe that traders are almost challenging the Federal Reserve to deliver a strong signal of easing. According to analysts, markets have already priced in several interest rate cuts for the coming months, so Powell’s message needs to be carefully worded to avoid unsettling traders.

“Markets are effectively daring the Fed to be more dovish than expected,” one strategist said. The bigger question is whether Powell can meet those expectations or if his remarks will cause a shakeup in both the U.S. dollar and gold positioning.

The U.S. dollar index, which measures the greenback against six major global currencies, inched up by 0.1% to 96.723. However, this slight rise came after a steep 0.7% drop on Tuesday, which was the lowest level since early July.

The euro traded at $1.1855, just below its recent peak of $1.1867, the highest since September 2021. Meanwhile, the Japanese yen remained steady at 146.43 per dollar, holding gains from the previous session when it strengthened by 0.6%.

Analysts noted that if Powell’s tone is more dovish than expected, it could push the dollar further down. However, with five rate cuts already priced into the market cycle, many question how much weaker the dollar can realistically get from here.

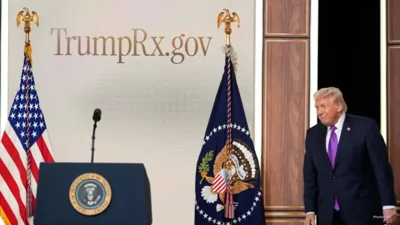

The Fed also welcomed a new governor this week. Stephen Miran was sworn into his position after narrowly being confirmed by the U.S. Senate. Meanwhile, a separate court ruling blocked President Donald Trump from dismissing Fed Governor Lisa Cook. These developments add to the intrigue surrounding the central bank’s decision-making team.

Asian and global stock markets reflected cautious optimism. The MSCI index of Asia-Pacific shares outside Japan rose by 0.2%, marking its ninth straight gain. Japan’s Nikkei, however, slipped by 0.1% after hitting a record high earlier in the week.

Hong Kong’s Hang Seng Index jumped 1.4%, supported by reports of progress in talks that may allow Chinese-owned social media giant TikTok to continue operating in the U.S.

In Europe, futures markets indicated a firmer start, with German DAX and Euro Stoxx 50 both moving higher. U.S. stock futures remained flat ahead of the Fed announcement.

The Bank of Canada is also preparing to cut interest rates to support its weakening job market and address trade tensions. Japan, meanwhile, reported that exports have fallen for the fourth month in a row, highlighting the pressure major economies face from global trade disputes and tariffs imposed by the Trump administration.

In energy markets, U.S. crude oil prices slipped 0.1% to $64.45 per barrel, following a strong three-day rally. Russia’s pipeline monopoly Transneft warned that producers may need to reduce output due to Ukraine’s drone attacks on key facilities.

Investors seeking safe assets turned to gold, which rose 0.2% to $3,683.29 per ounce. On Tuesday, the precious metal crossed the $3,700 mark for the first time, cementing its reputation as a reliable refuge during times of market uncertainty.

In digital assets, Bitcoin fell 0.2% to $116,687.18, while Ethereum dropped 0.18% to $4,490.76. The small declines reflect investor caution ahead of the Fed’s policy announcement.

The outcome of the Fed’s meeting and Powell’s comments will set the tone for global markets in the coming weeks. Traders will watch closely to see if the central bank signals further rate cuts, or if Powell tries to strike a more balanced message.

For now, the dollar is struggling, gold is shining, and the world’s investors are waiting for the words of the Fed Chair that could shake markets across currencies, stocks, commodities, and crypto alike.

Mattel Revives Masters of the Universe Action Figures Ahead of Film Launch

Mattel is reintroducing Masters of the Universe figures in line with its upcoming film, tapping into

China Executes 11 Members of Criminal Clan Linked to Myanmar Scam

China has executed 11 criminals associated with the Ming family, known for major scams and human tra

US Issues Alarm to Iran as Military Forces Deploy in Gulf Region

With a significant military presence in the Gulf, Trump urges Iran to negotiate a nuclear deal or fa

Copper Prices Reach Unprecedented Highs Amid Geopolitical Turmoil

Copper prices soar to all-time highs as geopolitical tensions and a weakening dollar boost investor

New Zealand Secures First Win Against India, Triumph by 50 Runs

New Zealand won the 4th T20I against India by 50 runs in Vizag. Despite Dube's impressive 65, India

BTS Tour Sparks Global Demand: Mexico Appeals for Additional Shows

BTS' comeback tour creates immense demand in Mexico, prompting President Sheinbaum to urge more conc