Post by : Vansh

How Technology and Innovation Power Fintech Growth

In today’s fast-evolving digital world, Fintech Frontiers How Startups Are Changing the Future of Global Finance is not just a trend—it's a revolution. These agile and innovative companies are shaking up the global financial ecosystem, challenging long-standing norms, and offering smart solutions that are faster, cheaper, and more user-friendly than traditional banking systems. From digital payments to decentralized finance, startups are leading the charge into a new era of financial technology.

The Rise of Fintech Startups in the Global Landscape

The last decade has seen an explosive growth in fintech startups across the world. Fueled by advancements in mobile technology, cloud computing, and artificial intelligence, startups are reimagining every part of the financial process. From securing online payments to lending without paperwork, Fintech Frontiers How Startups Are Changing the Future of Global Finance shows how small teams with big ideas are disrupting major banks and institutions that have existed for centuries.

Emerging markets, in particular, have embraced this wave. In countries where traditional banking access is limited, fintech startups are offering mobile-based services that bring banking to the fingertips of millions. These solutions are not only faster but also more inclusive, helping bridge the gap between the banked and the unbanked.

Disrupting Traditional Banking Models

Banks have long held the monopoly on financial services—but not anymore. With agile platforms and minimal overhead costs, fintech startups can offer services like peer-to-peer lending, mobile wallets, robo-advisory, and micro-investments at a fraction of the cost. As a result, Fintech Frontiers How Startups Are Changing the Future of Global Finance is evident in the way traditional institutions are now scrambling to adapt or partner with startups to stay relevant.

Neobanks (digital-only banks) are a prime example. They provide a full suite of banking services without any physical branches, attracting young, tech-savvy customers who prefer managing money through apps. The low fees, quick setup, and seamless interfaces make them popular choices over conventional banks.

The Role of Innovation and Technology

At the heart of this fintech movement lies innovation. Artificial intelligence is enabling smarter fraud detection, personalized customer service, and data-driven investment strategies. Blockchain technology is enhancing security and transparency while enabling faster cross-border payments.

Fintech Frontiers How Startups Are Changing the Future of Global Finance becomes even clearer when we examine how these startups use data. By analyzing user behavior and financial history, fintech platforms offer personalized financial products—from insurance to savings plans—that align with individual needs. This level of customization was almost unheard of in traditional banking.

Financial Inclusion and Global Impact

Fintech is not just about profits; it’s also about people. One of the most powerful impacts of fintech startups is financial inclusion. In regions where banking services were previously unavailable or too expensive, mobile banking and digital lending platforms are providing easy access to credit and savings.

For example, farmers in rural areas can now get instant loans through apps, students can fund education through crowdfunding platforms, and small businesses can accept digital payments without complex infrastructure. These developments illustrate how Fintech Frontiers How Startups Are Changing the Future of Global Finance is empowering individuals and communities around the globe.

Disclaimer:

The information provided in this article is for general informational purposes only. While every effort has been made to ensure the accuracy and relevance of the content, MiddleEastBulletin news network does not guarantee the completeness or reliability of any information contained herein. Readers are advised to conduct their own research or consult with a qualified financial advisor before making any financial decisions. MiddleEastBulletin news network is not responsible for any losses or damages resulting from the use of this content.

Dhurandhar Surpasses 800 Crore Mark at the Box Office

Ranveer Singh's Dhurandhar rakes in ₹800 crore globally, with the hit song Shararat captivating audi

Kriti Sanon Discusses Her Complex Role in Tere Ishk Mein

Kriti Sanon initially found her role in Tere Ishk Mein negative but grew to understand and appreciat

Release of 130 Students From St Mary’s Catholic School Marks Hopeful Turn in Nigeria

Nigerian authorities announce the release of 130 students from St Mary’s, ensuring no pupil remains

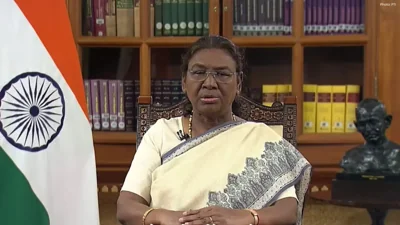

President Murmu Endorses SHANTI Bill to Propel Nuclear Energy Expansion

President Droupadi Murmu endorses the SHANTI Bill, facilitating private sector involvement in nuclea

New Zealand Claims Test Series with Decisive Victory Over West Indies

New Zealand triumphed over West Indies by 323 runs in the final Test, securing a 2-0 series win with

Centre Affirms Protection for Aravalli Hills Amidst Mining Concerns

Government asserts over 90% of Aravalli hills remain protected, dismissing mining concerns as misinf