Post by : Monika

A growing number of cryptocurrency companies are introducing tokenized stocks—digital versions of traditional company shares. These tokens are designed to track the value of real stocks but are traded on blockchain platforms. While they offer benefits like 24/7 trading and instant settlement, experts and regulators are raising concerns about investor protection and market stability.

What Are Tokenized Stocks?

Tokenized stocks are digital representations of traditional company shares. They are built on blockchain technology, which is a secure and transparent system for recording transactions. Unlike regular stocks, which are traded on stock exchanges during specific hours, tokenized stocks can be bought and sold at any time. This flexibility appeals to many investors, especially those in different time zones.

The total value of tokenized stocks aimed at retail investors reached approximately $412 million by September 2025, a significant increase from just a few million dollars the previous year.

Reuters

Benefits of Tokenized Stocks

Despite the advantages, there are significant concerns regarding tokenized stocks:

Lack of Investor Protections: Many tokenized stocks do not offer the same rights as traditional stocks. For instance, investors may not have voting rights or entitlement to dividends.

Regulatory Uncertainty: The legal status of tokenized stocks is unclear in many jurisdictions. In the U.S., the Securities and Exchange Commission (SEC) is considering whether to grant exemptions to tokenized securities, a move that has faced opposition from traditional financial institutions.

Market Fragmentation: The introduction of tokenized stocks could lead to fragmented liquidity, making it harder for investors to buy or sell large quantities without affecting the market price.

Regulatory Responses

Regulators around the world are paying close attention to the rise of tokenized stocks:

United States: The SEC is considering whether to apply traditional securities laws to tokenized stocks or to create new regulations. Some industry leaders argue for exemptions to encourage innovation, while others believe that existing laws should apply to ensure investor protection.

Europe: Under the Markets in Financial Instruments Directive (MiFID), some tokenized stocks are classified as derivatives. However, legal experts argue that MiFID may not be sufficient to address the unique aspects of tokenized assets.

Global: The World Federation of Exchanges has called for stricter oversight of tokenized assets to prevent market disruption and protect investors.

These varying approaches highlight the challenges regulators face in adapting existing frameworks to new financial products.

Industry Perspectives

Within the cryptocurrency industry, there are differing views on how to handle tokenized stocks:

Kraken: Emphasizes full collateralization and transparency in its tokenized stock offerings, aiming to provide a higher level of security for investors.

OpenAI Highlights Growing Cybersecurity Threats from Emerging AI Technologies

OpenAI has raised alarms about the increasing cyber risks from its upcoming AI models, emphasizing s

Manchester City Triumphs 2-1 Against Real Madrid, Alonso Faces Increased Scrutiny

Manchester City secured a 2-1 victory over Real Madrid, raising concerns for coach Xabi Alonso amid

Cristiano Ronaldo Leads Al Nassr to 4-2 Victory Over Al Wahda in Friendly Face-Off

Ronaldo's goal helped Al Nassr secure a 4-2 friendly win over Al Wahda, boosting anticipation for th

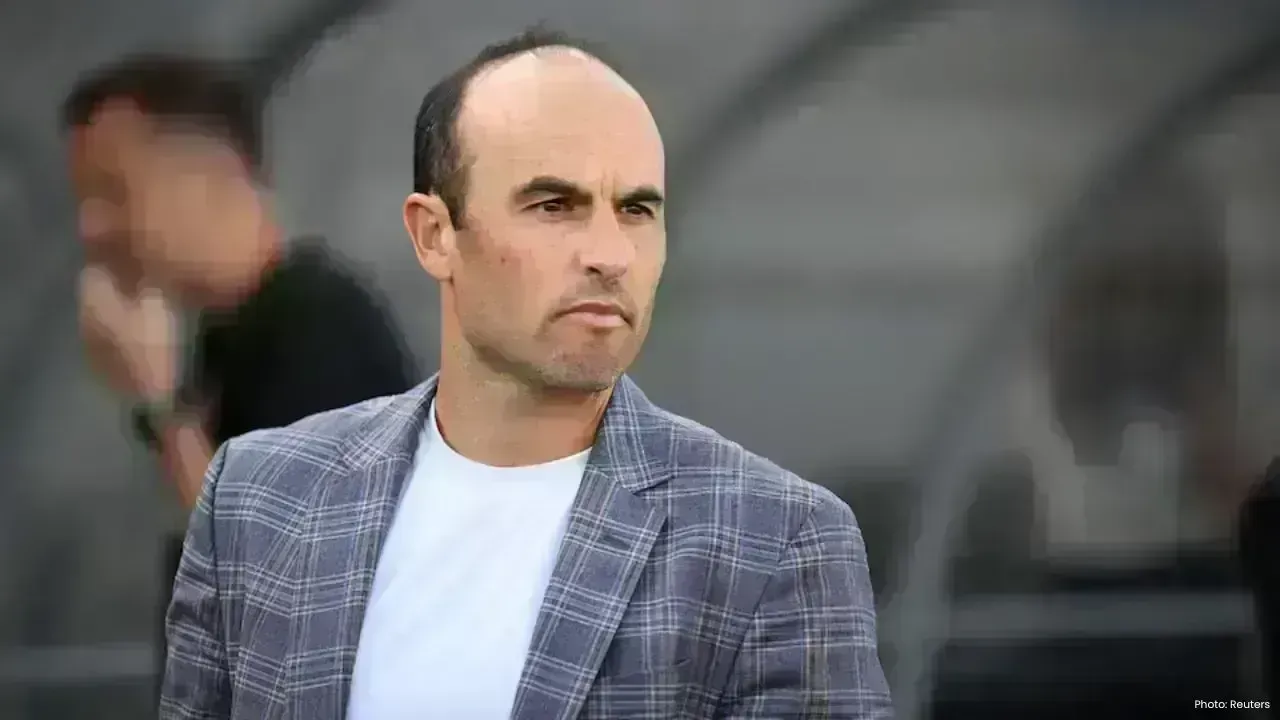

Landon Donovan Challenges Australia Coach on World Cup Prospects

Landon Donovan counters Australia coach Tony Popovic’s optimism for the World Cup, expecting an earl

Mercedes-Benz Forms Landmark Partnership with WTA

Mercedes-Benz and the WTA unveil a significant partnership effective January 2026, with major invest

Abhishek Addresses Divorce Rumours Concerning His Family

Abhishek Bachchan confirms that daughter Aaradhya remains oblivious to divorce speculations, focusin