Post by : Sami Jeet

With tax scams evolving in complexity, fraudsters are increasingly employing sophisticated technology to impersonate governmental entities, pilfer personal data, and deceive individuals into making erroneous payments. As digital interactions rise, so do the threats of phishing emails, fraudulent phone calls, and refund schemes. Thankfully, AI-driven detection tools are emerging as potent solutions, assisting individuals in spotting dubious activities promptly and safeguarding their financial identities. This guide delves into how contemporary tax scams operate, the mechanisms through which AI identifies them, and the ways you can leverage technology to enhance your safety during tax season.

The surge in tax-related fraud cases can be attributed to scammers' quick adaptability to digital environments.

A growing number of online tax submissions.

Lack of awareness regarding new scam formats.

Fraudsters employing deepfake voices and AI-enhanced emails.

Deficient verification practices among taxpayers.

As detection of scams becomes more daunting, the need for innovative protective measures grows.

Grasping the mechanics of these scams is crucial for self-defense.

Scammers claim you are entitled to a refund, soliciting your banking information.

Fraudsters impersonate tax officials, insisting on immediate payments.

Emails mimic legitimate government platforms, directing users to counterfeit login pages.

Scammers file taxes using your personal identity to illicitly claim refunds.

Counterfeit forms and altered PDF statements utilized to extract personal details.

Each scam preys on urgency, fear, or confusion—highlighting why AI detection is increasingly critical.

AI solutions scrutinize patterns, behaviors, and data, pinpointing suspicious activities often overlooked by humans.

AI systems recognize fraudulent email domains, spoofed entities, and writing quirk patterns linked to scams.

Tools emit warnings when login attempts or information submissions appear anomalous.

AI algorithms can distinguish unusual vocal patterns in calls claiming to be tax representatives.

AI validates the authenticity of tax-related forms, refund notices, and financial documentation.

AI notifies you if your personal identifiers such as SSN or PAN show up in questionable contexts online.

These features diminish the likelihood of falling prey to scams that appear professionally crafted.

Even individuals without technical expertise can adopt AI-driven services.

Services like Gmail and Outlook leverage AI to autonomously filter out scam communications.

These tools inform you when your credentials surface in compromised databases.

Certain services monitor the dark web for your tax or financial information.

These tools obstruct rogue websites impersonating genuine tax agencies.

AI can flag spoofed government contacts, alerting you prior to answering.

Employing a blend of these resources markedly enhances your security.

AI models analyze vast data archives to uncover fraudulent patterns.

Suspicious email senders posing as officials.

Malware-laden attachments.

Links redirecting users to non-official websites.

Urgent payment requests or requests for gift cards.

Language patterns typical of known scam networks.

With access to extensive datasets, AI's accuracy improves over time, establishing its reliability in fraud detection.

The threat of tax identity theft is escalating, as scammers file returns fraudulently under others' names.

Multiple refund requests from the same IP.

Inconsistent personal details across tax submissions.

Anomalous timestamps or device identifiers.

Early detection allows individuals to freeze accounts, report fraud, and mitigate significant financial harm.

AI will persist in advancing, delivering even more robust safeguarding measures.

Tailored fraud detection dashboards.

AI systems directly integrated with tax authorities.

Instantaneous facial verification for authenticating legitimate filings.

Enhanced predictive models that intercept fraud preemptively.

Such innovations promise to enrich the safety and transparency of tax frameworks.

As tax scams grow increasingly more sophisticated, conventional awareness alone is insufficient. AI-fueled fraud detection presents an indispensable ally for individuals, monitoring emails, identifying deepfake calls, authenticating documents, and securing personal information. By fusing cutting-edge technology with prudent online practices, you can navigate tax season with confidence, irrespective of how inventive scammers may become.

This article serves purely for informational purposes and should not be viewed as financial, legal, or professional tax guidance. Tax laws and fraud tactics fluctuate by region, and security measures may vary according to individual situations. Readers are encouraged to consult a certified tax expert or cybersecurity consultant for advice tailored to their specific circumstances.

Tragic Fall Claims Life of Teen at Abandoned Filming Site

A 19-year-old woman tragically fell to her death from an abandoned building in Atlanta, previously f

Dhurandhar Surpasses 800 Crore Mark at the Box Office

Ranveer Singh's Dhurandhar rakes in ₹800 crore globally, with the hit song Shararat captivating audi

Kriti Sanon Discusses Her Complex Role in Tere Ishk Mein

Kriti Sanon initially found her role in Tere Ishk Mein negative but grew to understand and appreciat

Release of 130 Students From St Mary’s Catholic School Marks Hopeful Turn in Nigeria

Nigerian authorities announce the release of 130 students from St Mary’s, ensuring no pupil remains

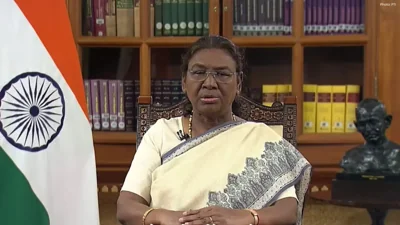

President Murmu Endorses SHANTI Bill to Propel Nuclear Energy Expansion

President Droupadi Murmu endorses the SHANTI Bill, facilitating private sector involvement in nuclea

New Zealand Claims Test Series with Decisive Victory Over West Indies

New Zealand triumphed over West Indies by 323 runs in the final Test, securing a 2-0 series win with