Post by : Monika

Global financial markets entered Monday, October 13, 2025, with a mix of caution and optimism. Investors were closely watching the latest developments in the ongoing trade tensions between the United States and China. After a week of uncertainty, some relief came from a softer tone from U.S. leadership, but concerns about tariffs, rare earth exports, and global economic growth continued to weigh on investor sentiment.

U.S.-China Trade Developments

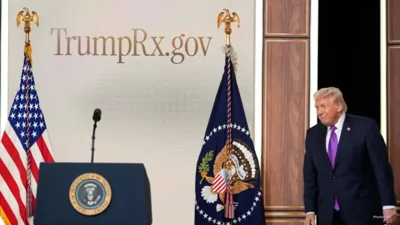

Over the weekend, U.S. President Donald Trump moderated his stance on the escalating trade war with China. He posted statements on social media assuring that there would be no immediate harmful actions and suggested that the two countries were still willing to cooperate. He said, “Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment. The U.S.A. wants to help China, not hurt it!!!”

This change in tone provided some short-term relief to financial markets. Investors had feared that the U.S. might impose additional tariffs on Chinese goods, which could have escalated into a full-scale trade conflict affecting industries worldwide.

However, despite this reassurance, China maintained a firm stance, defending its rare earth export restrictions. The Chinese government did not respond directly to the U.S. call, signaling that it would continue controlling critical materials essential for technology and defense industries.

China’s latest trade data for September also offered a mixed picture. Exports rose 8.3% year-on-year, surpassing market expectations, and imports also came in stronger than anticipated.

However, rare earth exports fell sharply, by 31% month-on-month, highlighting the impact of stricter controls. Rare earth minerals are crucial for the production of high-tech goods such as smartphones, computers, and defense equipment. This reduction in exports added uncertainty for global manufacturers that rely on these materials.

European Markets Show Stability

In contrast to the fluctuations in Asia, European stock markets displayed relative stability. European futures showed modest gains, ranging between 0.2% and 0.5%. Investors were cautiously optimistic, awaiting the start of the third-quarter earnings season. Major banks and other companies across Europe are scheduled to release results this week, which could provide more clarity on corporate health and economic trends in the region.

The German DAX index and the French CAC 40 both remained steady. Analysts suggest that the resilience in European markets reflects confidence in the region’s economic fundamentals. Despite geopolitical tensions and concerns about slower global growth, investors continue to see Europe as a relatively safe market for investment. Additionally, many European companies have diversified operations worldwide, which helps them withstand shocks from trade disputes or local economic fluctuations.

Commodities Reach Record Highs

Commodities, especially precious metals, have reacted strongly to market uncertainties. Gold prices surged to record levels as investors sought safe-haven assets amid global tensions. The yellow metal has traditionally been a hedge against economic instability and currency fluctuations. Gold reached unprecedented prices as trade tensions between the U.S. and China reignited investor concerns.

Silver prices also climbed to record highs, reflecting similar investor behavior. The rise in precious metals indicates that while equity markets are relatively stable, investors are preparing for potential turbulence by moving capital into safer assets. Commodities markets often serve as an early indicator of market sentiment, and the surge in gold and silver shows that some investors are expecting continued uncertainty in global markets.

Oil Prices Rebound

Oil prices rebounded on Monday after falling to five-month lows in the previous session. The rebound was fueled by hopes that talks between the U.S. and Chinese presidents could ease trade tensions and support global demand for energy.

Lower trade conflicts could encourage manufacturing and industrial activity, which would increase the need for oil and other energy resources. Analysts suggest that while short-term fluctuations are expected, oil prices are likely to remain sensitive to news about trade negotiations, geopolitical tensions, and economic data from major economies such as the U.S., China, and Europe.

Currency Markets and Forex Movements

Currency markets experienced fluctuations as investors reacted to trade developments and geopolitical signals. The U.S. dollar saw mixed movements against other major currencies.

The dollar index, which measures the greenback’s strength against a basket of six global currencies, fell slightly by 0.1% to 98.908. The euro remained largely steady, while the Japanese yen weakened, reflecting investor caution in Asia.

Cryptocurrency markets also showed volatility. Following a sharp selloff on Friday, digital currencies fluctuated between gains and losses on Monday. Investors in cryptocurrencies often respond to macroeconomic events such as trade disputes, interest rate expectations, and global financial uncertainty, making these markets highly sensitive to geopolitical news.

Outlook for the Week

Looking ahead, the financial world will be closely monitoring several key factors:

U.S.-China Trade Relations: Any progress or setbacks in trade negotiations will continue to drive investor sentiment. While recent reassurances have calmed some fears, both countries are still in a sensitive position regarding tariffs, technology controls, and supply chains.

Corporate Earnings: The start of the third-quarter earnings season will give insight into the health of companies across Europe and the U.S. Investors will watch bank results and other major corporate announcements closely, as they can influence stock prices and broader market trends.

Federal Reserve Policy: Expectations of U.S. interest rate cuts are influencing global markets. Monetary policy decisions by the Federal Reserve can impact currencies, commodities, and equities worldwide.

Geopolitical Events: Other global developments, including tensions in the Middle East, Africa, or Asia, could further affect investor confidence and market stability.

Despite the uncertainties, there is cautious optimism among investors. European markets’ resilience, combined with strong corporate fundamentals in some sectors, provides a counterbalance to fears about trade disputes and global slowdown. However, the surge in gold and silver prices indicates that many investors remain prepared for potential volatility and are protecting their portfolios through safe-haven investments.

Global markets are walking a fine line between optimism and caution. On one hand, reassurances from U.S. leadership and strong corporate earnings in Europe provide some confidence. On the other hand, trade tensions, rare earth export restrictions from China, and ongoing geopolitical uncertainties continue to create risks.

Investors are diversifying their strategies, moving some funds into precious metals, monitoring corporate earnings, and closely following currency fluctuations. This approach helps balance risk and potential reward in an unpredictable environment.

The coming days will be critical in shaping market trends. Positive developments in U.S.-China relations, steady corporate earnings, and stable economic indicators could lead to renewed investor confidence. Conversely, any escalation in trade tensions or unexpected geopolitical events could trigger market volatility.

Overall, the financial markets remain alert, balancing the mixed signals from trade policies, commodities, currency movements, and corporate performance. Investors and analysts alike are watching closely, ready to respond to new developments as they emerge.

Mattel Revives Masters of the Universe Action Figures Ahead of Film Launch

Mattel is reintroducing Masters of the Universe figures in line with its upcoming film, tapping into

China Executes 11 Members of Criminal Clan Linked to Myanmar Scam

China has executed 11 criminals associated with the Ming family, known for major scams and human tra

US Issues Alarm to Iran as Military Forces Deploy in Gulf Region

With a significant military presence in the Gulf, Trump urges Iran to negotiate a nuclear deal or fa

Copper Prices Reach Unprecedented Highs Amid Geopolitical Turmoil

Copper prices soar to all-time highs as geopolitical tensions and a weakening dollar boost investor

New Zealand Secures First Win Against India, Triumph by 50 Runs

New Zealand won the 4th T20I against India by 50 runs in Vizag. Despite Dube's impressive 65, India

BTS Tour Sparks Global Demand: Mexico Appeals for Additional Shows

BTS' comeback tour creates immense demand in Mexico, prompting President Sheinbaum to urge more conc