Post by : Anees Nasser

NFTs burst into mainstream consciousness with astonishing speed. Within a short period, they turned unknown artists into global stars, transformed digital files into valuable assets, and reshaped conversations around intellectual property. Their rise was fueled by several key factors:

artists seeking independence from traditional systems

collectors searching for new forms of ownership

investors exploring speculative digital assets

communities rallying around decentralised creativity

NFTs did not simply introduce a new technology; they introduced an entirely new economic model for digital content.

A Non-Fungible Token is a unique digital identifier stored on a blockchain. Unlike cryptocurrencies such as Bitcoin or Ethereum, NFTs cannot be interchangeably exchanged because each token carries distinct metadata.

This uniqueness allows NFTs to represent ownership of:

digital art

music

videos

virtual fashion

metaverse assets

collectibles

domain names

digital real estate

It essentially solves the age-old digital problem: “If it can be copied infinitely, how do you prove ownership?”

Blockchain technology acts as a digital ledger. Every time an NFT is created or transferred, the transaction is recorded publicly. This gives buyers something digital files always lacked:

authenticity

traceable ownership

verifiable scarcity

For digital artists, these features are revolutionary.

Digital art existed long before NFTs, but monetising it was difficult. Platforms often controlled visibility, distribution, and earnings. NFTs changed the landscape by giving artists direct ownership and revenue opportunities.

Artists now enjoy:

independent pricing power

direct access to global collectors

higher revenue retention

royalties on secondary sales

NFTs have turned digital artists into entrepreneurs.

Collectors traditionally sought physical objects. Today, digital collections are:

displayed in virtual galleries

showcased via metaverse exhibitions

stored in digital wallets

traded across global marketplaces

This shift normalises digital ownership on a scale never witnessed before.

When creators release new works — known as “drops” — collectors rush to buy limited-edition tokens. Scarcity and demand create immediate market value.

Unlike traditional markets where artists rarely benefit from resales, NFT platforms enable creators to receive:

5% to 10% royalties every time their work is resold

This model ensures long-term revenue even after the initial sale.

NFT valuations are heavily influenced by:

fan communities

brand collaborations

celebrity endorsements

online reputation

Digital communities play a major role in determining which collections thrive.

With the NFT boom, geographic and institutional barriers collapsed. Artists from remote regions gained global visibility, independent creators competed with established names, and niche styles found mainstream relevance.

Memes, GIFs, generative art, and AI-generated visuals have become serious collectible assets. These formats rarely received recognition before NFTs emerged.

Artists now integrate:

interactive elements

augmented reality

motion graphics

generative algorithms

AI collaborations

NFTs allow multidimensional digital expressions that cannot exist in traditional formats.

Digital art thrives in virtual environments. Metaverse platforms enable people to:

buy virtual land

host exhibitions

display NFT galleries

attend digital concerts

curate themed experiences

Art is no longer confined to physical walls.

Digital fashion is gaining traction as avatars become an extension of identity. Luxury brands and indie designers alike release wearable NFTs for virtual environments.

NFT technology blends with VR and AR to create immersive experiences where art reacts to viewer movement, music, or world elements.

NFT markets are notoriously volatile. Prices often shift dramatically based on:

market sentiment

media attention

social trends

investor speculation

This makes NFTs risky financial assets.

Many collections skyrocket in value only to collapse once hype fades. Understanding artistic merit, utility, and creator credibility becomes crucial for serious collectors.

Fake NFTs, plagiarized art, and impersonation incidents remain challenges. Buyers must verify authenticity through trusted channels.

Early blockchains used energy-intensive systems. This raised concerns about:

carbon emissions

sustainability

responsible digital ownership

By 2025, many blockchains adopted efficient consensus mechanisms requiring minimal energy. The shift has reduced environmental criticisms significantly.

Museums and galleries now:

host digital exhibitions

acquire NFTs for permanent collections

collaborate with digital creators

This validates digital art as a serious category.

Prestigious brands use NFTs to:

verify authenticity

create loyalty programs

release exclusive collectibles

offer digital twins of physical items

Game developers integrate NFTs as:

in-game assets

character skins

virtual real estate

tradeable collectibles

Ownership becomes transferable across platforms, pushing gaming into a new commercial era.

NFTs provide a reliable system for verifying digital ownership. Whether for art, collectibles, music, or virtual property, this infrastructure will shape future digital economies.

NFTs reduce dependence on traditional gatekeepers and empower creators financially.

Scams, volatility, and regulatory uncertainties still complicate adoption. Widespread stability will require clearer frameworks.

Future NFTs will focus on:

access passes

exclusive memberships

event tickets

premium services

This shifts NFTs from pure collectibles to functional assets.

Artists increasingly collaborate with AI tools, creating dynamic, evolving artworks recorded as NFTs.

Creators bridge physical artworks with digital twins, giving collectors layered ownership.

Governments may introduce guidelines addressing intellectual property, taxation, and consumer protection.

NFTs have changed how the world creates, owns, and distributes digital content. While volatility and hype cycles may rise and fall, the underlying idea — secure digital ownership — is here to stay.

Digital art has transcended its limitations. Artists now have global reach. Collectors have verifiable assets. Communities shape value. And as technology matures, NFTs will integrate deeper into mainstream culture, virtual worlds, and creative industries.

Whether as art, access tools, or digital identity markers, NFTs represent a new chapter in creative ownership — one that will continue evolving long after the hype fades.

This article is for informational purposes only. NFT trends change rapidly and may vary across regions, platforms, and market conditions. Readers should evaluate personal circumstances before making financial decisions.

Dhurandhar Surpasses 800 Crore Mark at the Box Office

Ranveer Singh's Dhurandhar rakes in ₹800 crore globally, with the hit song Shararat captivating audi

Kriti Sanon Discusses Her Complex Role in Tere Ishk Mein

Kriti Sanon initially found her role in Tere Ishk Mein negative but grew to understand and appreciat

Release of 130 Students From St Mary’s Catholic School Marks Hopeful Turn in Nigeria

Nigerian authorities announce the release of 130 students from St Mary’s, ensuring no pupil remains

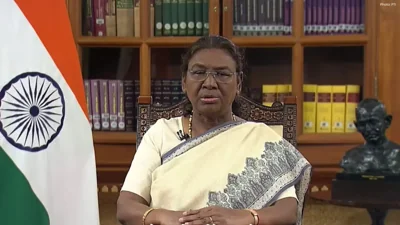

President Murmu Endorses SHANTI Bill to Propel Nuclear Energy Expansion

President Droupadi Murmu endorses the SHANTI Bill, facilitating private sector involvement in nuclea

New Zealand Claims Test Series with Decisive Victory Over West Indies

New Zealand triumphed over West Indies by 323 runs in the final Test, securing a 2-0 series win with

Centre Affirms Protection for Aravalli Hills Amidst Mining Concerns

Government asserts over 90% of Aravalli hills remain protected, dismissing mining concerns as misinf