Post by : Mina Rahman

This week, the Bank of Canada is anticipated to maintain its benchmark interest rate, concluding the year without adjustments due to surprising signs of economic robustness.

The last time the central bank adjusted its policy rate was in October, lowering it to 2.25 percent, with indications that this would likely signal the end of a prolonged easing cycle. Recent reports concerning inflation, production, and job growth have surpassed analysts' expectations, revealing that the Canadian economy has coped with U.S. tariffs more effectively than expected.

Following four rate cuts in 2025, totaling nine reductions since mid-2024, current market forecasts indicate that the central bank will hold rates steady for much of 2026, with the chance of a rate hike now outweighing that of another reduction.

Meanwhile, the U.S. Federal Reserve is projected to reduce its benchmark rate by a quarter point this week, decreasing the fed funds rate from 3.75 to 3.5 percent. Economists observe that the Fed's position remains restrictive, attributed to deteriorating labor conditions in the U.S.

Recent comments from members of the Fed suggest a possible cut, despite inflation rates staying above the target of 2 percent and delays in data due to the U.S. government shutdown.

As the new year approaches, uncertainty looms regarding the leadership of the U.S. central bank, with Kevin Hassett, a close associate of President Trump, speculated to be the top candidate, expected to advocate for reduced borrowing costs.

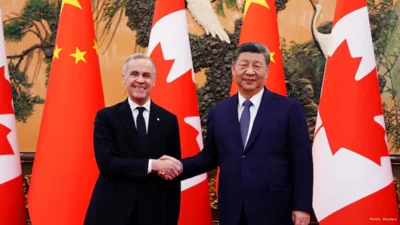

Contrastingly, conditions in Canada appear more straightforward. Bank of Canada Governor Tiff Macklem mentioned in October that rates were “around the right level” for maintaining inflation targets while allowing economic adjustments. He indicated that further easing would necessitate a significant downturn in the economic outlook.

Recent data supports this cautious approach, showing annual CPI inflation at 2.2 percent in October, with core inflation measures close to 3 percent. The job market reflects gradual recovery, adding 54,000 jobs in November and bringing the unemployment rate down to 6.5 percent.

Economic growth also stabilized in the third quarter, managing to avoid a technical recession. While much of the 2.6 percent annualized growth stemmed from lower imports, this figure was higher than predictions. Historical adjustments to GDP from 2022 to 2024 suggest stronger economic momentum than previously established.

Analysts assert that the firmer economic trend contributes to the persistence of core inflation and raise questions about the extent of prior easing if earlier data had been available.

As we look at 2026, risks remain, including a review of the USMCA trade agreement. However, policymakers stress that monetary policy is not the correct approach to address trade disruptions, highlighting the limitations of interest rates in facilitating adjustments within specific sectors.

The central bank's primary focus, they argue, is on mitigating spillover effects and supporting overall economic adjustment, rather than responding directly to tariffs or trade uncertainties.

Mattel Revives Masters of the Universe Action Figures Ahead of Film Launch

Mattel is reintroducing Masters of the Universe figures in line with its upcoming film, tapping into

China Executes 11 Members of Criminal Clan Linked to Myanmar Scam

China has executed 11 criminals associated with the Ming family, known for major scams and human tra

US Issues Alarm to Iran as Military Forces Deploy in Gulf Region

With a significant military presence in the Gulf, Trump urges Iran to negotiate a nuclear deal or fa

Copper Prices Reach Unprecedented Highs Amid Geopolitical Turmoil

Copper prices soar to all-time highs as geopolitical tensions and a weakening dollar boost investor

New Zealand Secures First Win Against India, Triumph by 50 Runs

New Zealand won the 4th T20I against India by 50 runs in Vizag. Despite Dube's impressive 65, India