Post by : Monika

Photo: Reuters

On August 25, 2025, U.S. President Donald Trump announced that he plans to make more government investments in healthy American companies. This idea follows a recent deal in which the government took nearly 10% ownership in Intel, a leading chipmaker.

That deal turned federal grants into shares in Intel. It was created through the CHIPS Act, a program to boost domestic chip production. Trump said he wants to duplicate this type of deal across other industries.

But many business leaders are worried. They fear that having the government own part of companies is a big shift away from America’s long-standing free-market approach. The key concern: will companies still be able to act quickly and compete effectively if the government is involved?

Why Is This a Big Shift?

Traditionally, the U.S. government only stepped in during extreme crises—like the 2008 financial meltdown or auto industry bailouts.

Now, the government is actively seeking ownership in companies even when they are not failing.

Critics say this move could slow companies down, burden them with extra red tape, and make them answer to political interests instead of customers and markets.

Bill George, a former CEO and Harvard fellow, said:

“We’re moving from a pure capitalistic economy to a much more state-engaged economy. That’s a huge change for America.”

What’s the Government Saying?

President Trump posted on his social media that he’d support companies that make “lucrative” deals similar to Intel’s.

Intel, for its part, said it plans to use the CHIPS Act money to build plants in the U.S. The company is not broke—it has about $9 billion in cash and a market value of $105 billion.

What Are the Risks?

Intel’s regulatory filing explains some new risks, including:

Possible damage to its international sales due to government involvement.

Difficulty winning future government grants.

New regulations or restrictions in other countries because of government ownership.

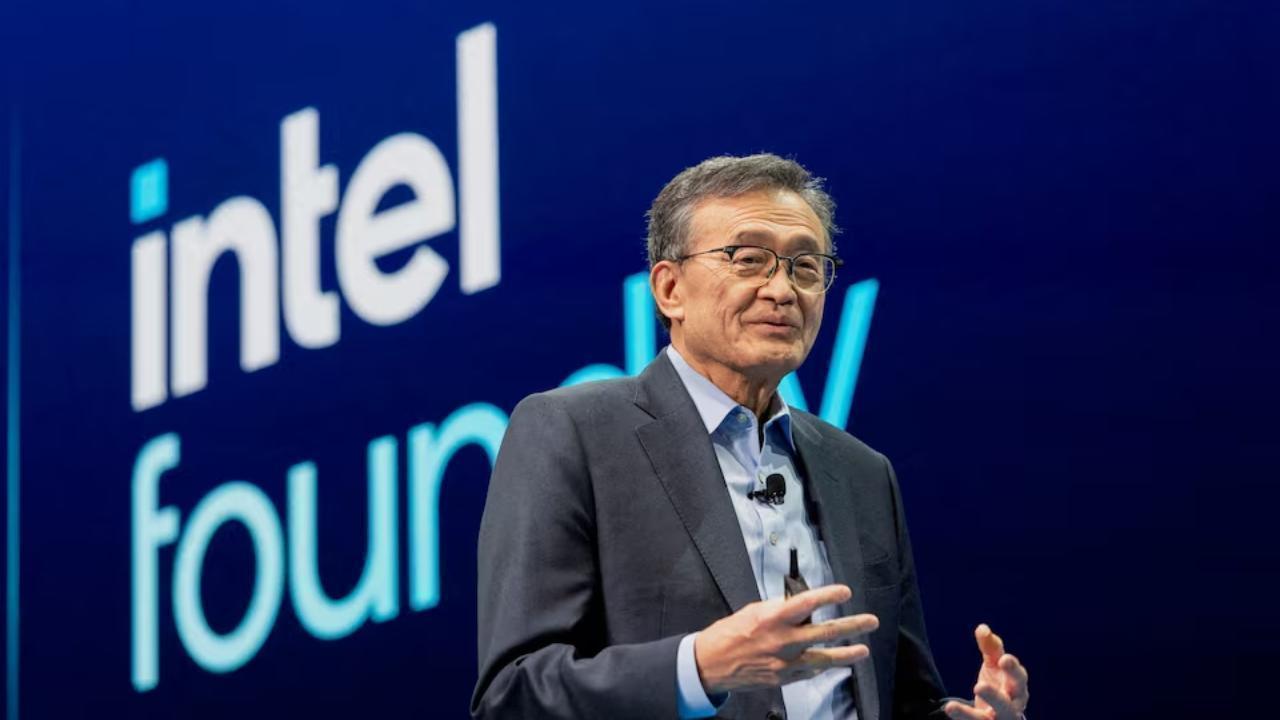

Intel’s CEO, Lip-Bu Tan, even said in a video:

“I don’t need the grant... but I really look forward to having the U.S. government be my shareholder.”

Could This Affect Customers?

Some analysts worry that this arrangement might pressure buyers to favor Intel over competitors. One analyst asked if the government might “encourage” customers to choose Intel over others.

Not Just Intel—More Deals to Come?

Intel is just the beginning.

The government took a “golden share” in U.S. Steel after it was purchased by Japan’s Nippon Steel. This gives the government a say over major decisions.

The government also invested in MP Materials—which produces rare earth minerals—and struck revenue-sharing deals with Nvidia and AMD to protect chip production.

Observers say the pattern suggests a growing interest by the government to invest in critical industries—not just chips, but steel, minerals, and possibly more.

How Is This Different from Before?

Previously, government intervention meant rescue actions in emergencies. Now, it’s proactive and strategic.

Analysts and business leaders fear companies may lose independence, suffer delays in decision-making, and face new political pressures. Governance expert Nell Minow said:

“Companies that are nationalized in whole or in part don’t do as well because they’re restricted from making strategic decisions based on the market.”

Why Is the Government Doing This?

The administration argues that these deals will:

Build domestic production in critical fields.

Reduce dependence on foreign countries for important materials and parts.

Strengthen U.S. technology and manufacturing for national security.

The goal is to ensure that America remains competitive and self-reliant.

Support and Criticism at Home

Supporters Say:

This strategy helps bring back manufacturing jobs and strengthen key industries.

It is similar to tax breaks and incentives used to attract big companies like Amazon.

It’s a practical way to protect the economy and ensure long-term stability.

Critics Say:

It undermines free-market capitalism, turning it into state-involved capitalism.

Government ownership leads to politicized decisions, reducing innovation.

Companies like Apple are already investing heavily in the U.S., and this trend could scare away private investment.

What Could Happen Next?

More companies in important areas—like energy, health, or tech—could face similar deals.

Some industries may resist these interventions.

Lawmakers, investors, and economists will closely watch what happens next.

This is a major test of government influence in business—a very different path than most U.S. presidents have taken in the past.

Quick Recap for Students

Question Answer

Who? U.S. President Trump and major companies like Intel.

What happened? Government bought nearly 10% of Intel via CHIPS Act; wants more deals.

Why? To boost domestic production and protect national security.

Risks? Corporate delays, regulatory risks, political influence on business.

Supporters say? Helps U.S. industries and builds self-reliance.

Critics say? Threatens capitalism, reduces private innovation.

Mattel Revives Masters of the Universe Action Figures Ahead of Film Launch

Mattel is reintroducing Masters of the Universe figures in line with its upcoming film, tapping into

China Executes 11 Members of Criminal Clan Linked to Myanmar Scam

China has executed 11 criminals associated with the Ming family, known for major scams and human tra

US Issues Alarm to Iran as Military Forces Deploy in Gulf Region

With a significant military presence in the Gulf, Trump urges Iran to negotiate a nuclear deal or fa

Copper Prices Reach Unprecedented Highs Amid Geopolitical Turmoil

Copper prices soar to all-time highs as geopolitical tensions and a weakening dollar boost investor

New Zealand Secures First Win Against India, Triumph by 50 Runs

New Zealand won the 4th T20I against India by 50 runs in Vizag. Despite Dube's impressive 65, India

BTS Tour Sparks Global Demand: Mexico Appeals for Additional Shows

BTS' comeback tour creates immense demand in Mexico, prompting President Sheinbaum to urge more conc