Post by : Anish

In recent years, the MENA media landscape has been undergoing rapid shifts. What once revolved around traditional broadcasting and print has expanded into digital-first models dominated by streaming services and artificial intelligence-driven strategies. Adding to this transformation is a wave of new corporate taxation frameworks across the region, reshaping how companies balance innovation, profit, and compliance.

One of the most notable changes in the region has been the introduction and implementation of corporate tax frameworks. Historically, many media firms operating in the MENA region benefited from tax-free environments, particularly in hub cities like Dubai. However, governments are now introducing moderate taxation to diversify revenue streams and reduce dependency on oil-driven economies.

For media companies, this shift means rethinking cost structures. Content creation, licensing agreements, and cross-border collaborations are now being re-evaluated through the lens of taxation. While some firms may face short-term challenges, experts believe this push toward structured taxation will create a more transparent, competitive, and sustainable media market.

Streaming platforms are driving the largest disruption in MENA’s media landscape. With audiences increasingly favoring on-demand entertainment, platforms are racing to acquire local content and produce regionally relevant shows. Saudi Arabia, the UAE, and Egypt are emerging as creative hubs, attracting investments in original programming.

The rise of streaming also means a shift in taxation strategies. International players entering the region must comply with local tax regulations, leveling the playing field with domestic firms. This development is expected to boost local content creators who can now operate on a fairer economic ground.

AI is no longer a futuristic add-on for MENA’s media industry—it is a necessity. From personalized recommendations on streaming platforms to AI-driven news production, machine learning tools are reshaping efficiency and creativity.

AI is also playing a critical role in data analytics. Media companies can now better understand audience behaviors, tailor marketing campaigns, and optimize production decisions. However, with increased reliance on AI comes new taxation debates, particularly concerning intellectual property rights and revenue-sharing models. Governments in the region are starting to evaluate how AI-driven revenues should be categorized under corporate tax systems.

MENA’s media sector is caught between two forces: global expectations and local priorities. On one hand, international investors expect streamlined tax compliance and transparency. On the other, governments want to ensure local talent and content benefit from this evolving ecosystem.

The new taxation landscape is encouraging partnerships. Local production houses are teaming up with global platforms to create stories that resonate with both domestic and international audiences. This hybrid approach is fueling both cultural representation and economic growth.

The convergence of corporate taxation, streaming dominance, and AI integration is reshaping how media operates in the region. For companies, adaptability will be the key to survival. Those who invest in AI, comply with evolving tax structures, and engage in locally relevant content creation are poised to thrive.

For audiences, these changes mean greater access to diverse, high-quality content. For governments, it signals a more structured and resilient industry contributing steadily to national economies. What lies ahead is not just a transformation of media consumption but also a redefinition of media as a pillar of regional economic development.

This article is intended for informational and editorial purposes only. It provides an overview of industry trends and taxation impacts within the MENA media landscape and does not constitute financial or legal advice.

#MENAMedia #StreamingTrends #CorporateTax #AIInMedia #MiddleEastBusiness #DigitalTransformation #ContentCreation #TaxPolicy #EntertainmentIndustry #MENAStreaming #ArtificialIntelligence #RegionalEconomy #MediaInnovation #CulturalContent #BusinessTrends #MENAInvestment #FutureOfMedia #GlobalStreaming #TechAndMedia #EconomicShift

Mahindra's SUV Sales Rise After India's Tax Cut

Mahindra's SUV sales to dealers increased by 10% in September 2025, following India's GST reduction

Bollywood Stars Sue Google Over AI Videos Misusing Their Image

Bollywood actors Abhishek Bachchan and Aishwarya Rai Bachchan have filed a lawsuit against Google, s

India's Central Bank Keeps Interest Rate Unchanged at 5.50%

India's Reserve Bank holds repo rate at 5.50%, indicating potential rate cut in December amid low in

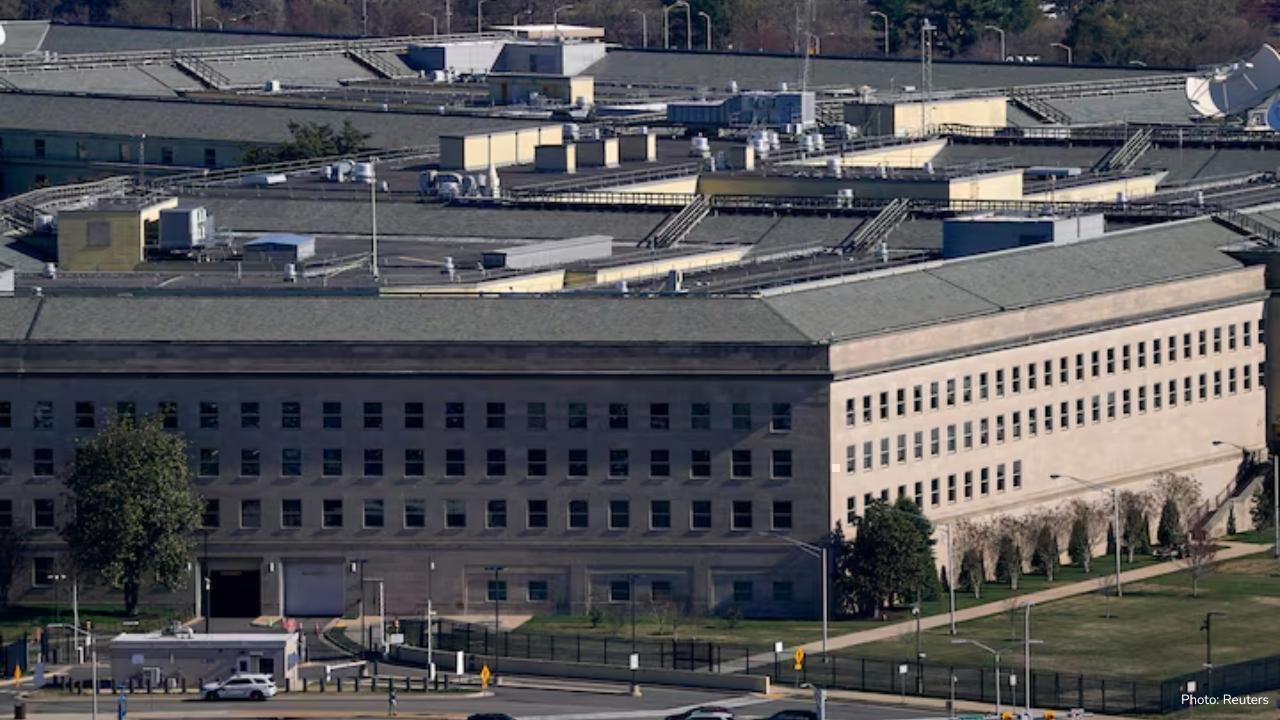

Trump's Gaza Peace Plan: Ceasefire, Hostage Exchange, and Future Governance

President Trump's 20-point plan aims to end the Gaza conflict with ceasefire, hostage exchange, and

Israeli Tech Sector Grows Amid Gaza Conflict

Despite the ongoing Gaza war, Israel's high-tech industry thrives in 2025, with increased funding an

Global Markets React to China's Economic Slowdown and Policy Changes

Global markets face uncertainty as China's economic slowdown and policy changes impact investor conf