Post by : Naveen Mittal

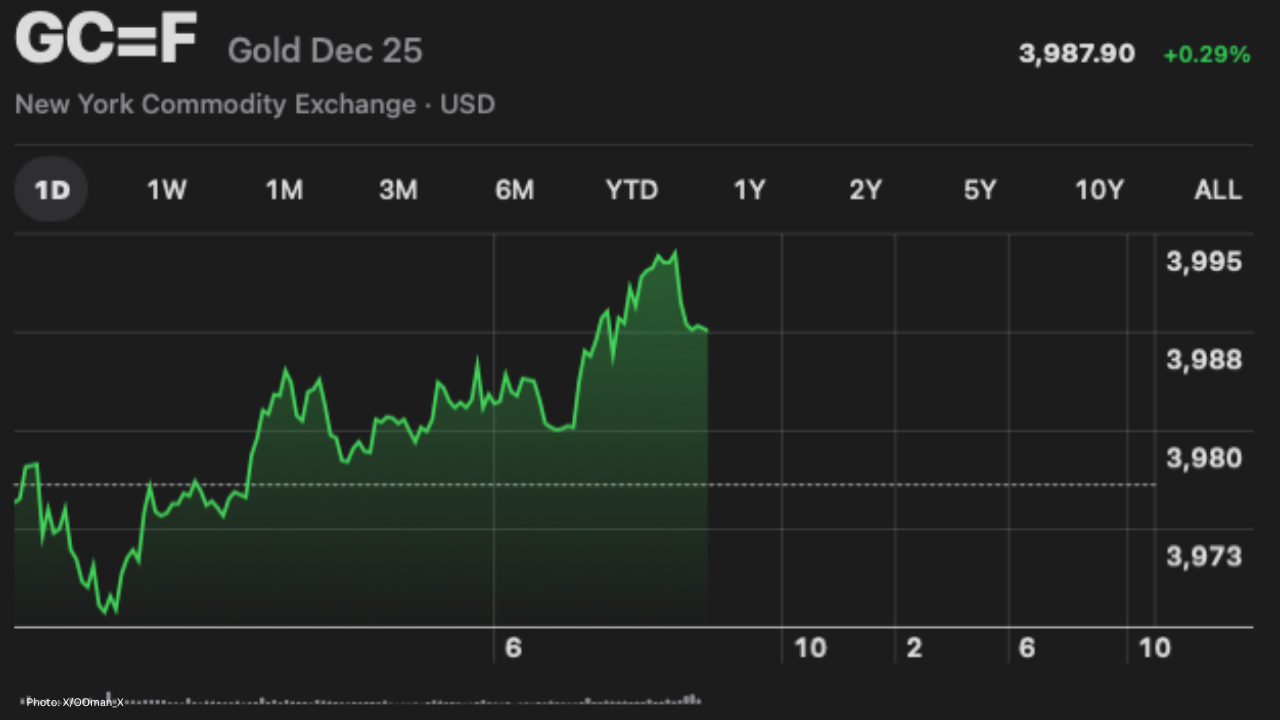

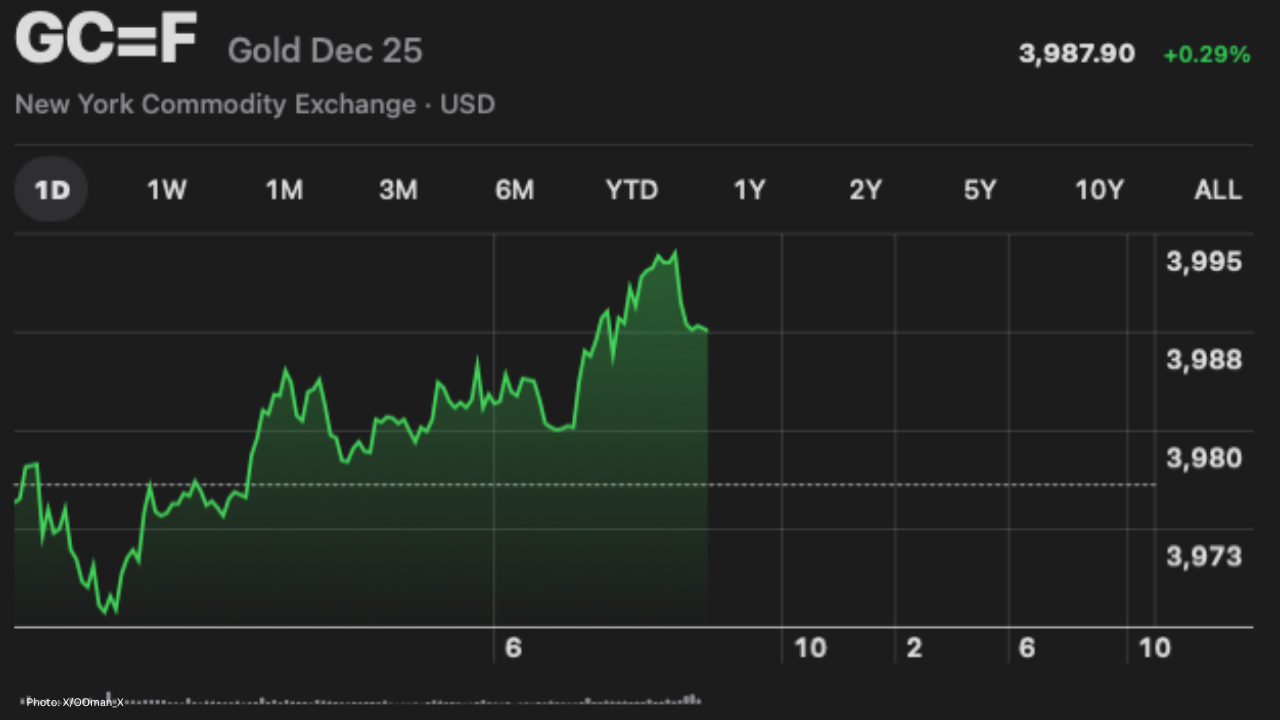

Equity markets took a cautious turn as U.S. indexes edged lower after hitting record highs, reflecting a tug of war between optimism over future gains and anxiety over macro risks. The S&P 500 retraced slightly, while Nasdaq’s momentum cooled. Safe-haven demand sent gold futures to an all-time high near $4,000 per ounce. Treasury yields softened ahead of a major upcoming U.S. bond auction and a critical Federal Reserve meeting.

Investors are navigating a complex mix of forces. The U.S. government’s ongoing shutdown debate is injecting uncertainty into fiscal policy and markets. At the same time, political instability in France and Japan rattled investor confidence, spurring volatility in currencies and bonds. The yen weakened sharply after Japan’s ruling party picked a pro-stimulus leader. In France, an abrupt government resignation raised questions about budget stability and investor trust.

Adding to the global mix, the World Bank upgraded China’s 2025 GDP forecast to 4.8 percent, citing stronger-than-expected momentum. However, the bank warns that growth may slow in 2026 if export demand weakens and domestic stimulus eases. Investors are watching how China’s macro guidance and policy support unfold, as the country remains a pivotal anchor for global growth expectations.

Gold surged as uncertainty dominated, with safe-haven flows pushing prices toward new highs.

Treasury yields dipped modestly, reflecting demand ahead of auctions and cautious outlooks for U.S. rates.

Oil prices slipped amid concerns over demand in major economies and supply uncertainties.

Currencies: The yen slid against the dollar, while the euro weakened on France’s political shakeup.

Fed decisions and signals: Investors expect the Fed’s policy tone and dot plot revisions to drive markets.

U.S. fiscal gridlock: Continued shutdown risk could stall economic data releases and dampen sentiment.

China growth trajectory: Any signs of weakening momentum or policy pullback would reverberate across global markets.

Geopolitical / political surprises in major economies that could spark sudden shifts in risk appetite.

This article is based on publicly available market reporting and credible economic sources as of October 2025. It is intended for informational purposes only and does not constitute investment advice or endorsement. Readers should consult financial professionals before making decisions.

global stocks, gold surge, treasury yields, U.S. shutdown, China GDP forecast, market volatility, economic policy, Japan stimulus, France politics, safe-haven inflows

Taylor Swift's 'The Life of a Showgirl' Breaks Sales Records

Taylor Swift's new album, 'The Life of a Showgirl,' sold 2.7 million copies on its first day, breaki

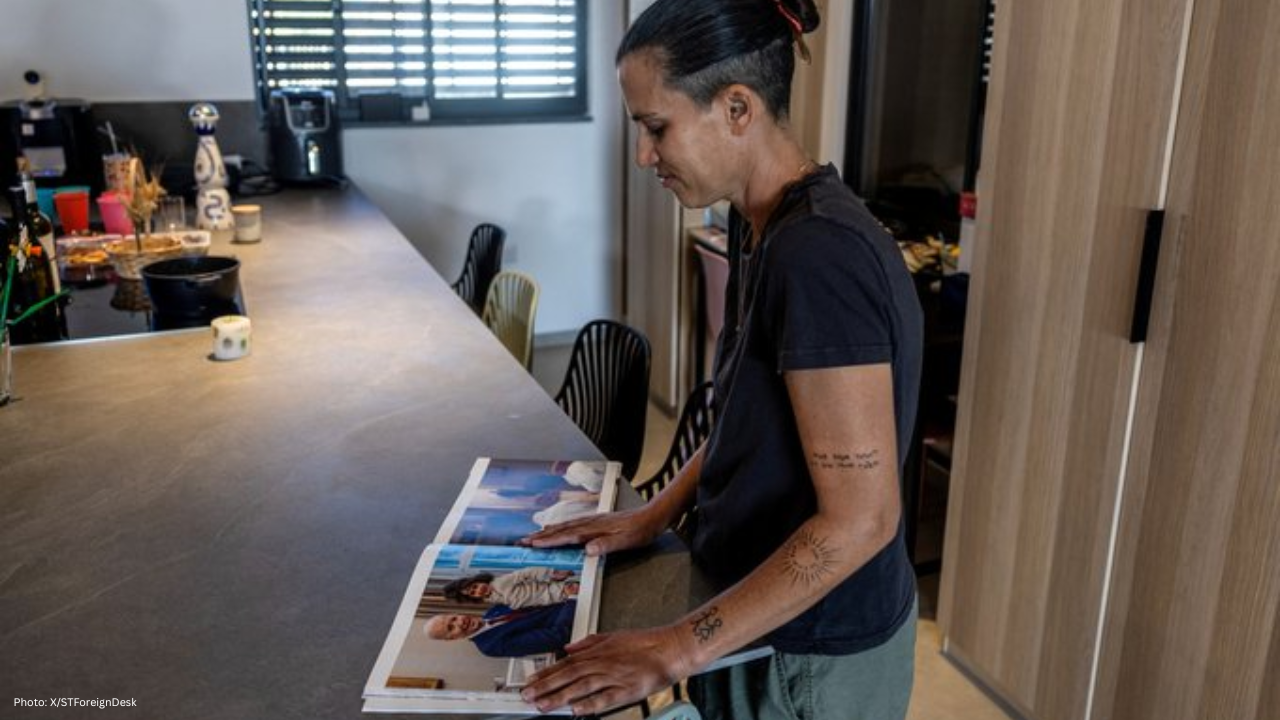

Israel Marks 2 Years Since Hamas Attack Amid Ongoing War

Israel commemorates two years since Hamas's deadly attack; war continues with hostages still held, a

Yen Falls to Two-Month Low After Japan Election

The Japanese yen drops to a two-month low against the dollar and hits a record low against the euro

Global Markets Pause After AI Surge; Fed Speeches Awaited

Global stocks hit record highs due to AI deals and mergers; markets await Federal Reserve signals am

UEFA Approves Milan and Barcelona Matches Abroad

UEFA allows AC Milan and Barcelona to play league matches abroad, but says it is an unusual exceptio

Amateurs Get Shot at Big Win in Aussie Open One-Point Contest

In 2025, 10 amateur tennis players will face top pros in a one-point “Million Dollar” contest at the