Post by : Bianca Suleiman

In a notable turn of events for India’s banking landscape, Kotak Mahindra Bank and Federal Bank are actively exploring a potential acquisition of Deutsche Bank’s retail and wealth management operations in India. As reported by the Economic Times, this marks the German lender’s second effort in eight years to withdraw from this sector, with discussions advancing on valuations and portfolio configurations.

Preliminary evaluations from both Indian institutions indicate substantial interest. The portfolio encompasses personal loans, select mortgage accounts, and a significant wealth management division that has consistently contributed to Deutsche Bank’s corporate framework. According to reports, Deutsche Bank’s India wealth segment manages assets valued at approximately Rs 25,000 crore, making it an attractive asset for any acquiring bank seeking to enhance its affluent customer outreach.

In FY25, Deutsche Bank’s retail branch generated segmental revenues of Rs 2,455 crore, reflecting growth from the previous year’s total of Rs 2,362 crore. By March 2025, the lender reported holding Rs 25,038 crore in retail banking assets, as per disclosures cited by ET. This potential divestiture aligns with the global restructuring strategy directed by CEO Christian Sewing, focusing on enhancing profitability and honing the bank’s market priorities.

Currently, India remains the only non-European nation where Deutsche Bank operates a retail arm, a strategic misalignment the bank is seeking to rectify. The institution operates 17 branches, several of which could be closed as the situation evolves.

Industry analysts note that foreign banks grapple with significant challenges in India, facing competition from large domestic entities capable of operating at lower costs with more competitive pricing. Past incidents include Citibank’s exit in 2022, when Axis Bank acquired its retail and credit card divisions for upwards of USD 1 billion. Earlier this year, Kotak Mahindra Bank also secured a personal loan portfolio worth Rs 3,330-crore from Standard Chartered. Interestingly, Deutsche Bank had also divested its credit card operations in 2011 to IndusInd Bank.

Current discussions appear more assertive, according to sources familiar with the negotiations, but valuation concerns might still pose challenges as Indian banks are noted for their stringent pricing discussions. Additionally, necessary approvals from both local and global headquarters could indicate that the discussions may extend over a significant timeframe.

Despite these potential shifts, Deutsche Bank’s performance in India remains robust. The bank’s profit surged by 55% in FY25, reaching Rs 3,070 crore, bolstered by a healthy increase in both interest and non-interest income. Total income saw an 11% rise, climbing to Rs 12,415 crore, while operating expenses largely stabilized. Throughout this period, Deutsche Bank has consistently supported its India franchise with capital investments—Rs 3,946 crore from 2018 to 2021, followed by Rs 5,113 crore in 2024, according to Crisil data.

For Kotak and Federal Bank, this acquisition opportunity stands out: an established wealth management segment, a functioning retail base, and better access to high-end clients. Conversely, Deutsche Bank could achieve a definitive exit from a market segment where foreign entities have struggled to maintain competitiveness.

Should negotiations unfold as anticipated, this transaction might become one of the most pivotal retail banking deals in India since Citibank’s departure, potentially transforming competitive dynamics in the premium lending and wealth management sectors.

Kazakhstan Boosts Oil Supply as US Winter Storm Disrupts Production

Oil prices inch down as Kazakhstan's oilfield ramps up production, countered by severe disruptions f

Return of Officer's Remains in Gaza May Open Rafah Crossing

Israel confirms Ran Gvili's remains identification, paving the way for the Rafah border crossing's p

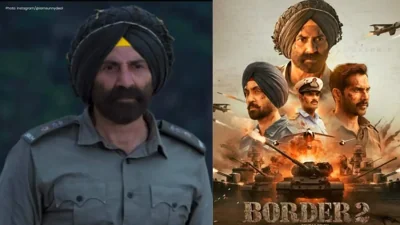

Border 2 Achieves ₹250 Crore Globally in Just 4 Days: Sunny Deol Shines

Sunny Deol's Border 2 crosses ₹250 crore in 4 days, marking a significant breakthrough in global box

Delay in Jana Nayagan Release as Madras HC Bars Censorship Clearance

The Madras High Court halts the approval of Jana Nayagan's censor certificate, postponing its releas

Tragedy Strikes as MV Trisha Kerstin 3 Accident Leaves 316 Rescued

The MV Trisha Kerstin 3 met an unfortunate fate near Jolo, with 316 passengers rescued. The governme

Aryna Sabalenka Advances to Semi-Finals, Targeting Another Grand Slam Title

Top seed Aryna Sabalenka triumphed over Jovic and now faces Gauff or Svitolina in the semi-finals as