Post by : Bianca Suleiman

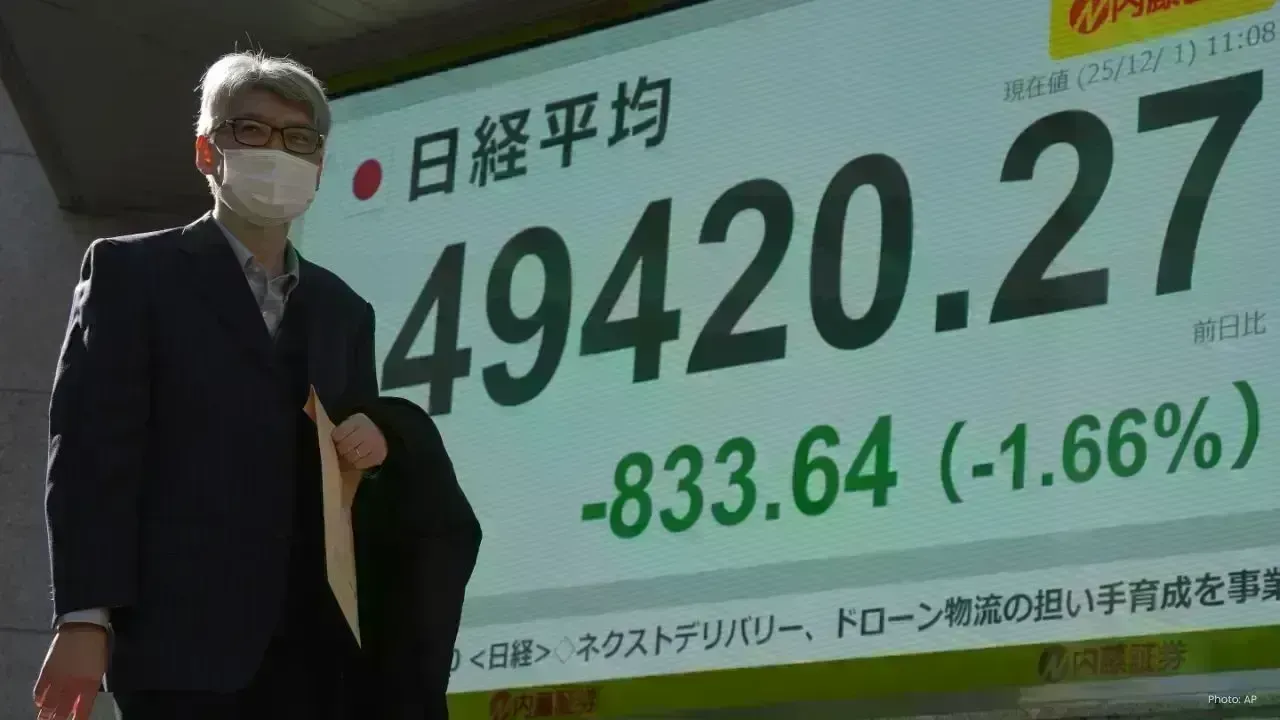

Global equity markets started the week on shaky ground Monday, with key indices falling as investors reacted to climbing oil prices and possible monetary tightening from Japan. Leading the declines in Asia, Tokyo’s Nikkei 225 slumped by 1.9%, closing at 49,303.28 after comments from Bank of Japan Governor Kazuo Ueda suggested a potential interest rate hike at the central bank’s meeting on December 19.

In the U.S., futures indicated a bearish start with the S&P 500 down by 0.6% and the Dow Jones Industrial Average retreating by 0.5%. European markets mirrored this trend, with Germany’s DAX dipping 1% to 23,589.90, France’s CAC 40 off by 0.5% at 8,079.94, while Britain’s FTSE 100 fell a marginal 0.1% to 9,707.68.

Surge in Oil Prices

Energy markets experienced a significant upswing, with U.S. crude rising by $1.14 to $59.69 per barrel and Brent crude following suit, climbing $1.14 to reach $63.52. The rise in oil prices intensified pressure on global markets, which were already grappling with fears of slowing growth and escalating trade tensions.

Manufacturing Signals Economic Slowdown in Asia

Manufacturing reports from the region pointed to inconsistent economic performance. Japan’s S&P Global Manufacturing PMI indicated a contraction for the fifth consecutive month at 48.7 in November. Meanwhile, China recorded its eighth month of contraction according to its official factory survey. Other Asian indices displayed mixed performances: Hong Kong’s Hang Seng increased by 0.7%, the Shanghai Composite also rose 0.7%, while South Korea’s Kospi dipped by 0.2%.

Experts highlighted that while exports in the region are seeing a rebound, weak domestic demand poses challenges for economic growth in the upcoming months.

Mixed Performance in Technology Stocks

Tech stocks on Wall Street showed volatility after a robust rally the previous week. Nvidia fell by 1.8% on Friday, concluding the month with a substantial decline, while Oracle and Palantir saw drops of 23% and 16%, respectively. In contrast, Alphabet performed well, nearing gains of 14% due to excitement around its new Gemini AI model.

Fluctuations in Currency Markets

In the foreign exchange sphere, the U.S. dollar weakened to 155.25 yen from 156.14 yen, while the euro gained slightly to $1.1622 from $1.1596. These fluctuations mirrored investor caution regarding central bank strategies and the ongoing geopolitical landscape.

As the global economic outlook reveals a blend of signals, market participants are closely monitoring shifts in policies, inflation data, and corporate earnings which are expected to shape the future of equities and commodities.

Telangana Women Tragically Killed in California Car Accident, Families Request Assistance

Two Telangana women in the US die in a tragic car crash, prompting families to seek government suppo

Dhurandhar Achieves Remarkable Success, Surpassing ₹1100 Cr Worldwide

Ranveer Singh's Dhurandhar continues its box office dominance, crossing ₹1100 crore globally and sur

Asian Markets Climb as Dollar Weakens and Silver Surpasses $80 on Rate Cut Anticipation

Asian equities hit six-week highs while silver crosses $80, buoyed by expectations of Federal Reserv

Kathmandu Mayor Balendra Shah Aligns with Rastriya Swatantra Party Ahead of Upcoming Polls

Mayor Balendra Shah partners with Rastriya Swatantra Party to challenge Nepal's entrenched political

Independent Review of Law Enforcement Initiated in Australia Following Bondi Tragedy

In response to the Bondi shooting, Australia announces an independent review of law enforcement to e

Jaideep Ahlawat Steps in for Akshaye Khanna in Drishyam 3

Akshaye Khanna exits Drishyam 3 over a wig dispute, with Jaideep Ahlawat stepping in as his replacem