Post by : Anees Nasser

For many years, possessing a car in India represented more than mere transportation; it conveyed status, safety, and freedom. A car indicated that you had achieved a level of comfort, able to travel at your leisure without reliance on others. However, the landscape of this dream has shifted dramatically. Traffic congestion is more prevalent, fuel prices have surged, and parking has become increasingly scarce. Meanwhile, alternatives like metro systems, ride-hailing services, and flexible work situations have emerged as serious contenders against traditional car ownership.

For the modern professional or entrepreneur, a car has transformed into a complicated financial liability that impacts monthly budgets, savings, and overall well-being. The reality of owning a vehicle encompasses more than just its purchase price; factors like EMIs, insurance fees, maintenance costs, and volatile fuel prices contribute to a hidden financial burden that is often underestimated.

The inquiry into car ownership now transcends mere desire; it is rooted in sustainability, practicality, and financial discipline. Do you genuinely need a car, or are societal expectations driving your decision? If you opt to purchase one, what unforeseen expenses should you anticipate? Understanding the true economics behind everyday commuting in contemporary India is crucial.

Many potential buyers begin their journey at the dealership, captivated by enticing offers, low down payments, and festive promotions. However, the overall cost of owning a car unveils itself over time, habitually draining funds in manners that first-time buyers often overlook.

While a car loan can seem manageable by distributing costs over several years, the cumulative amount paid often surpasses the initial price more than buyers expect. Interest sneaks in silently, as processing fees, extended warranties, and service add-ons often accompany financing. When income becomes unpredictable, the once-manageable EMIs can morph into a burden. In contrast to rent, which can be adjusted by relocating, car loans are fixed and relentless.

Taking on a loan locks your future earning to an asset that inherently loses value. Every car loan thus demands unwavering honesty about financial realities, especially if job stability or emergency savings are lacking.

No sooner does a new car leave the lot than its value begins to plummet. Unlike real estate or precious metals, vehicles depreciate rather than appreciate. Immediate wear and tear sets in, new models are released every year, and insurance claims diminish resale appeal. Within five years, many vehicles lose over half of their value, leaving owners disappointed at the return on their investment.

This depreciation is often overlooked yet represents one of the most significant financial losses throughout a car's lifespan.

Insurance premiums arrive as a yearly obligation, with failure to pay resulting in illegal driving. Applicants may feel compelled to increase coverage, further inflating costs. Maintenance expenses grow as the vehicle ages, especially after warranties expire, leading to unexpected repairs and replacements.

These ongoing costs rarely factor into the pre-purchase calculation but become central to long-term ownership.

Fuel prices fluctuate significantly, making each monthly commute potentially costly. Even short daily journeys can accumulate substantial expenses over time.

Parking permissions add another layer of complexity; housing societies charge fees, workspaces impose rental costs, and street parking is fraught with risks like theft and damage.

Time, too, becomes a precious resource. Searching for parking, navigating traffic, and standing in fuel queues consume hours that could otherwise be spent with family or invested in personal growth.

Finance is only one side of the story; cars provide emotional security and societal endorsement. For many, a vehicle signifies safety for their loved ones or freedom from unreliable public transport.

However, stress has taken the place of freedom in numerous cities, as traffic jams and constant vehicle maintenance transform driving into a tiresome ordeal. Owners often find themselves serving their vehicles rather than enjoying them.

While emotional considerations often drive buyers, logical reasoning should dictate ownership choices.

Today's commuting options extend beyond mere ownership. Comprehensive transport systems have come forth.

Metro pathways and suburban trains provide speed and lower costs, while ride-hailing services take care of maintenance aspects. Flexible work arrangements reduce the need for constant travel, allowing individuals to rethink their commuting strategies.

Even two-wheelers have gained popularity for their lower acquisition costs and ease of maneuvering in crowded urban areas.

Today's decision should center on lifestyle integration rather than just transportation needs.

This question profoundly depends on individual circumstances.

If you maintain a steady income, possess healthy savings, have manageable debts, and require frequent travel, purchasing a car still makes sense. Families with dependents might very well need private transport regardless of the financial implications.

Conversely, if your commuting patterns are erratic or public transportation is viable, acquiring a vehicle could morph into a costly habit rather than an essential investment.

A car should enhance your life, not monopolize it.

If you decide to make a purchase, execute it judiciously.

Eschew excessive financing and aim for higher down payments to lessen interest burdens. Opt for practical models instead of aspirational options that might strain your budget. Furthermore, factor in costs beyond just EMIs, including insurance, fuel, and maintenance.

Buy with intent, not due to social pressure.

In contemporary India, true liberation has shifted from merely owning a vehicle. It now encompasses financial flexibility, peace of mind, and adaptability.

A car that drains your resources while sitting unused only yields ownership devoid of joy. Conversely, a car aligned with your lifestyle can provide both comfort and convenience.

The dream of car ownership has evolved; it has matured.

India is transitioning toward access over ownership. From valuing possession to optimizing usage, the focus has turned towards service-driven mobility rather than accumulating assets.

The pertinent question today isn't, “Can I afford a car?” but rather, “Does this vehicle genuinely enhance my life to justify its expenses?”

If you find the answer is affirmative, purchase confidently; if negative, it's prudent to walk away with your head held high.

Sometimes, the wisest purchase is one left unmade.

This article is for informational purposes only and does not constitute financial or legal counsel. Readers are encouraged to evaluate their personal financial situations and consult with qualified advisors before making any purchasing or investment decisions.

OpenAI Highlights Growing Cybersecurity Threats from Emerging AI Technologies

OpenAI has raised alarms about the increasing cyber risks from its upcoming AI models, emphasizing s

Manchester City Triumphs 2-1 Against Real Madrid, Alonso Faces Increased Scrutiny

Manchester City secured a 2-1 victory over Real Madrid, raising concerns for coach Xabi Alonso amid

Cristiano Ronaldo Leads Al Nassr to 4-2 Victory Over Al Wahda in Friendly Face-Off

Ronaldo's goal helped Al Nassr secure a 4-2 friendly win over Al Wahda, boosting anticipation for th

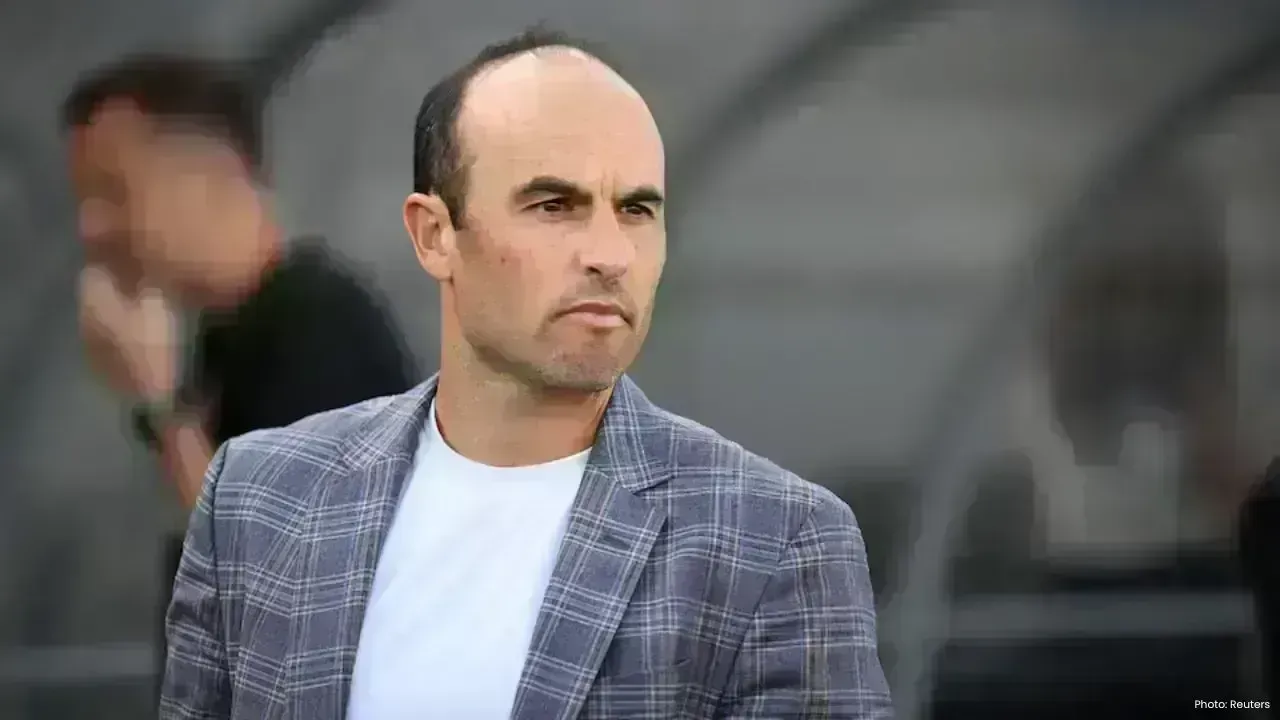

Landon Donovan Challenges Australia Coach on World Cup Prospects

Landon Donovan counters Australia coach Tony Popovic’s optimism for the World Cup, expecting an earl

Mercedes-Benz Forms Landmark Partnership with WTA

Mercedes-Benz and the WTA unveil a significant partnership effective January 2026, with major invest

Abhishek Addresses Divorce Rumours Concerning His Family

Abhishek Bachchan confirms that daughter Aaradhya remains oblivious to divorce speculations, focusin