Post by : Anees Nasser

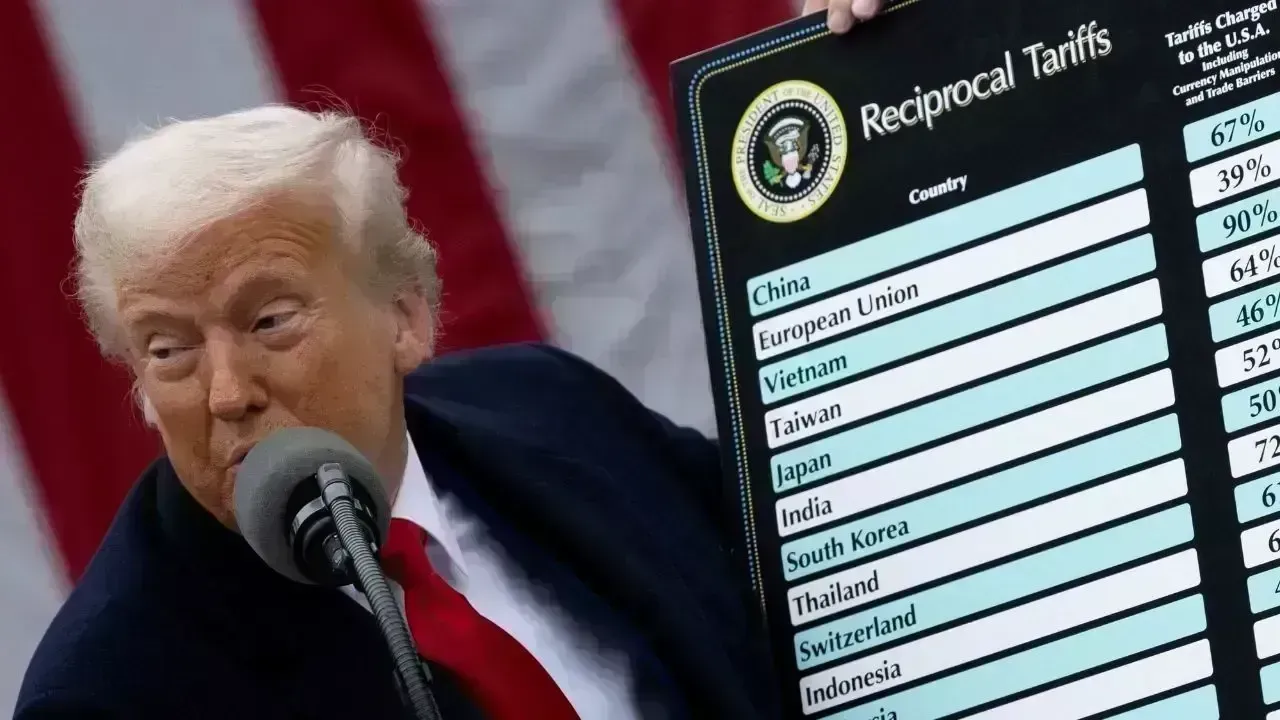

Initially thought to be a fleeting issue, the tariffs imposed on imported goods transformed into a lasting fixture in global supply chains. Many hoped that changes in political leadership would lead to their removal, but this expectation has proven illusory.

The tariffs integrated themselves into the very framework of commerce, affecting manufacturers, importers, and retailers daily without making headlines.

Tariffs act as taxes on foreign imports, which in turn make products more expensive for everyone in the supply chain. Importers typically pass these costs onto:

Wholesalers

Retailers

Ultimately, consumers

These tariffs sneak into product prices, functioning as a silent tax affecting day-to-day expenses.

Once established, trade policies do not simply reverse. They become embedded within:

Long-term agreements with suppliers

Logistical contracts

Decisions around manufacturing practices

Sourcing of materials

Transport routes

Shifts in production due to tariffs are not easily reversed when political leadership changes.

The initial imposition of tariffs saw prices increase swiftly, with expectations that they would fall as tensions eased. However:

Costs did not return to previous levels

Suppliers adjusted prices upward

Manufacturers restructured their operations

New tariffs took the place of previous ones

Economic uncertainties have persisted

This adaptation leads to a baseline where higher prices become normal.

Tariffs impact far beyond individual products; they create a ripple effect:

For instance, a tariff on steel:

→ leads to costlier tools

→ increases vehicle production costs

→ raises transport expenses

→ raises delivery fees

→ results in higher final prices for consumers.

This interconnected nature demonstrates how a tariff's repercussions extend across different sectors.

Electronics remain notably impacted, with devices like smartphones still bearing the burden of tariffs. Even if assembled locally, many parts are imported, causing prices to rise:

Chips incur tariffs

Screens are costlier

Batteries face additional taxes

Wiring costs increase

As a result, the pricing of electronics has not shown significant downward movement.

The clothing sector, one of the most globally integrated industries, shows tariff effects that often go unnoticed by consumers. A simple shirt involves:

Yarn from one nation

Dye from another

Stitching done elsewhere

Packaging in yet another country

Tariffs on textiles have quietly raised clothing costs, often masked as higher quality.

Though commonly associated with manufacturing, the influence of tariffs also extends to food items:

Grain pricing

Dairy prices

Soybean costs

Livestock feed pricing

Fertilizer expenses

As farming costs rise, grocery prices tend to follow suit, contributing to ongoing food inflation.

To navigate these tariffs, companies have adapted by rerouting shipments, which has reshaped the logistics landscape:

Abandoning old routes and developing new ones has led to increased expenses in transportation.

While large corporations navigate trade complexities with ease, small businesses face significant hurdles:

Bureaucratic customs processes

Sourcing alternative materials

Absorbing cost increases

Supplier adjustments

For many small enterprises, tariffs have posed existential challenges, resulting in closures or price hikes.

Despite promises that tariffs would induce manufacturers to return operations domestically, this has not occurred:

Firms have looked for cheaper production locations

Supply chains have become even more fragmented

Compliance costs have risen

Quality control has become more challenging

Indeed, consumers will still absorb costs, even if tariffs are adjusted. Structural changes lead to ongoing inflation, making dips unlikely.

Once in place, tariffs are politically sensitive to dismantle, as governments fear:

Upsetting domestic industries

Weakening trade advantages

Being perceived as weak

While tariffs did not create all inflation, they added significant pressure on prices through various channels, affecting everything from supply chain fluidity to agricultural productivity.

Consumers notice tariffs through:

Reduced product sizes

Decreased quality

Increased packaging expenses

Delayed discounts

Fewer budget-friendly options

Diminished brand variety

These trends mean that today's typical pricing reflects past premium costs.

While wealthier nations adapt more readily, developing economies often suffer severely under higher import costs, impacting crucial sectors:

Medicinal supplies

Machinery imports

Fuels

Fertilizer imports

Electronics

Tariffs also contributed to weakening global currencies as they widened trade gaps, necessitating greater debt management and leading to heightened inflation pressures.

Companies seldom absorb cost increases, preferring to adjust by:

Alter product dimensions

Downgrade quality

Gradually hike prices

Minimize customer incentives

While tariff modifications may happen, consumers shouldn't expect quick relief, as adjustments in pricing and trade policies typically take significant time to manifest.

Anticipate:

Stable pricing

Reduced market fluctuations

Minor price hikes

Fewer supply inconsistencies

While trade escalations may seem distant from daily life, they manifest profoundly in consumer pricing, reshaping industries and redefining expectations in ways that aren't easily undone.

This article serves for general information and educational purposes only and does not represent financial, political, or economic advice. Readers should consult specialists for more specific guidance regarding trade policies, investments, or economic strategies.

Establishment of Gaza Peace Board by White House

A new Gaza Peace Board has been created by the White House to supervise temporary governance amid an

India Unveils First Vande Bharat Sleeper Train

The inaugural Vande Bharat sleeper train connects Howrah and Kamakhya, enhancing overnight travel co

The Raja Saab Surpasses ₹133 Crore; Sequel in Development

Prabhas’ horror-comedy The Raja Saab collects ₹133.75 crore in 8 days. Director Maruthi hints at an

Malaysia's Strong Doubles Teams Excel at 2026 India Open

Pearly Tan & M. Thinaah and Aaron Chia & Soh Wooi Yik shine, reaching semifinals at the 2026 India O

Nvidia H200 Processor Shipments Stalled by Chinese Customs

Chinese customs have halted Nvidia's H200 shipments, leading to temporary production stops by suppli

US Military Strike Claims Lives of 47 Venezuelan Troops in Caracas

A US operation in Caracas led to the deaths of 47 Venezuelan soldiers and 32 Cubans amid an attempt