Post by : Vansh

The financial landscape in 2025 is marked by rapid shifts, unexpected shocks, and unpredictable swings. From inflation spikes and interest rate fluctuations to geopolitical tensions and tech disruptions, today’s market environment is anything but stable. Yet, seasoned investors know that even in turbulence, there’s opportunity. With crash-proof investing strategies, you can not only protect your wealth but also find ways to grow it — no matter how volatile the economy becomes.

Before we dive into tactics, it’s important to understand what defines volatile markets. Volatility refers to the rate at which the price of assets moves up and down. A market is considered volatile when prices swing sharply in either direction within a short period.

Increased volatility can be caused by political instability, economic uncertainty, natural disasters, or emerging financial trends like digital currencies or AI-driven trading platforms. For investors, volatility creates a dual effect: while it raises the risk of losses, it also opens the door to significant gains — if you know how to navigate it.

One of the most effective strategies for crash-proof investing is diversification. Spreading your investments across different asset classes, industries, and geographies helps minimize your exposure to any single risk.

In 2025, successful portfolios include a blend of equities, bonds, commodities, real estate, and digital assets. Within equities, it's wise to invest in both growth and value stocks, across large and small caps. Diversifying internationally can also shield your portfolio from local economic shocks.

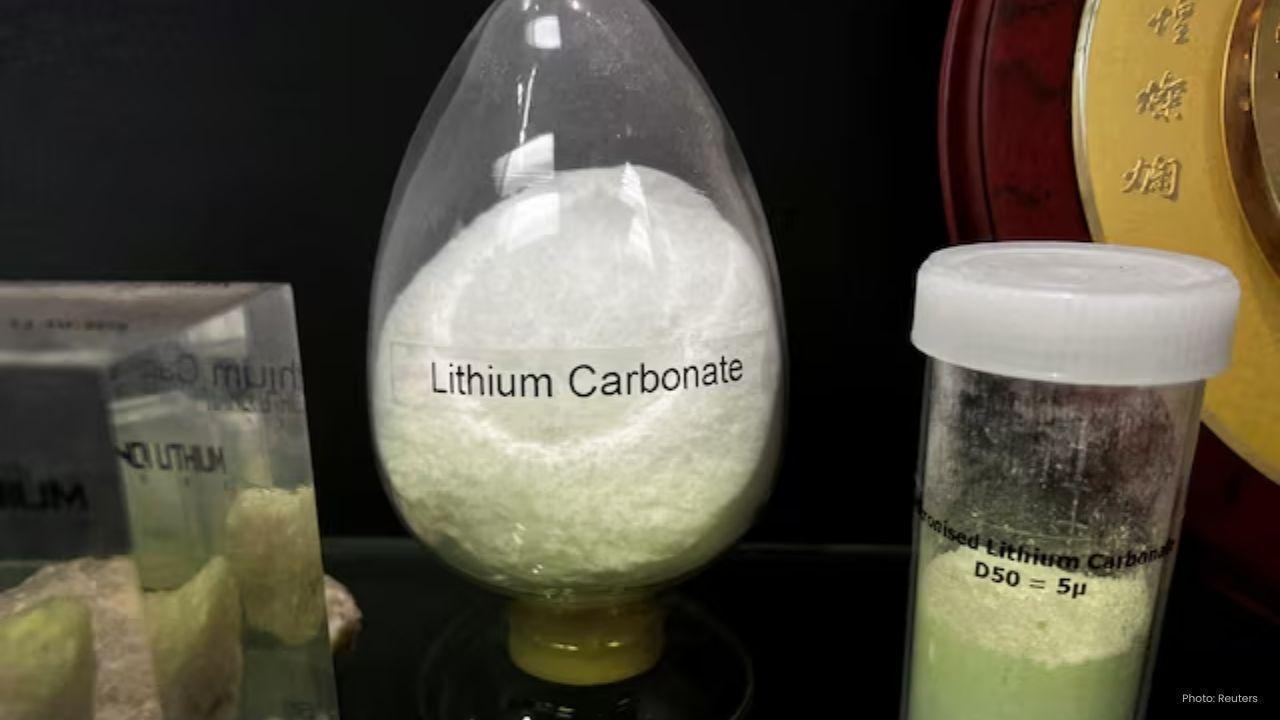

Moreover, alternative investments such as gold, fine art, and even cryptocurrency (in small, controlled percentages) are being used by savvy investors to hedge against market crashes and inflation.

When markets become volatile, not all sectors react the same way. Defensive stocks — such as those in healthcare, utilities, and consumer staples — tend to remain stable because demand for these services remains constant even in economic downturns.

Investing in recession-resistant sectors is a classic move in crash-proof investing. Companies that produce essential goods, offer basic services, or generate strong cash flow regardless of the economic cycle are considered safe havens. These may not deliver explosive growth, but they provide stability and steady dividends — which are especially valuable during a market downturn.

Panic is the enemy of profitable investing. One of the hallmarks of crash-proof investing is the ability to look beyond short-term volatility and focus on long-term value. Historical data shows that markets recover after downturns, and those who stay invested tend to come out ahead.

Dollar-cost averaging — investing a fixed amount regularly regardless of market conditions — can help smooth out the effects of volatility. Over time, this strategy reduces the average cost per share and builds discipline in your investment routine.

The information provided in this article is for general informational purposes only and does not constitute financial, investment, or professional advice. Readers are encouraged to consult with a qualified financial advisor before making any investment decisions. This content is published by MiddleEastBulletin.

Pageau's Overtime Goal Propels Islanders to 4-3 Victory Over Golden Knights

In a thrilling overtime finish, Jean-Gabriel Pageau leads the Islanders past the Golden Knights 4-3,

MLB Awards: deGrom and Acuna Jr. Shine as Comeback Players

Jacob deGrom and Ronald Acuna Jr. celebrated MLB Comeback Player Awards, alongside Ohtani and Judge

Portugal Confronts Ireland in Pivotal World Cup Qualifier

Portugal, led by Cristiano Ronaldo, faces Ireland in a vital Group F World Cup qualifier that could

Haaland's Brilliance Leads Norway to 4-1 Victory Against Estonia

Erling Haaland showcases leadership as Norway crushes Estonia 4-1, boosting their World Cup ambition

Hawks Triumph Over Jazz; Suns and Raptors Secure Victories

Hawks' Onyeka Okongwu and Jalen Johnson lead in a thrilling win against Jazz; Suns and Raptors also

Indian Men's Recurve Team Clinches First Asian Gold in Nearly Two Decades

The Indian men's recurve team triumphed over South Korea, securing their first Asian gold in 18 year