Post by : Sami Jeet

Dubai is frequently touted as a destination with generous salaries, luxurious lifestyles, and zero income tax. On the surface, the pay packages seem appealing compared to other global cities. However, many residents—particularly expatriates—often feel that their funds dwindle faster than anticipated. Even those with what would be considered substantial incomes in other locations frequently find it challenging to get by financially in Dubai.

This disparity arises because salary figures are only part of the equation. The cost of living structure, lifestyle expectations, and unforeseen expenses contribute to a perception of high living costs, even for those earning well. Grasping these factors is crucial for managing finances effectively in this dynamic city.

Just because a salary is high doesn't mean purchasing power is strong.

Many salaries in Dubai may seem substantial when viewed in foreign currency. Still, local pricing caters to wealthier consumers, resulting in daily expenses consuming a significant portion of earnings.

The absence of income tax can create an illusion of financial ease. However, residents indirectly bear costs through:

High rental prices

Costly private services

Utilities and transportation at premium rates

Out-of-pocket expenses for healthcare and education

The money saved from taxation often gets redirected into daily essential costs.

Housing is the largest factor contributing to Dubai's high living costs.

Rental costs typically consume 30–45% of monthly earnings, particularly in desirable locations. Prime areas demand rents comparable to global standards while tenant protections are minimal.

Many landlords mandate payment in one or a few lump sums each year, leading to:

Cash flow challenges

Mandatory savings habits

Initial financial strain

Even with a decent salary, these large up-front payments can be burdensome.

On top of rent, residents often face:

Maintenance fees

Cooling charges

Parking levies

Municipality fees

Such expenses are frequently underestimated during relocation preparations.

Dubai's environment encourages increased spending.

The city's layout emphasizes:

Malls rather than parks

Dining out over at-home activities

Paid activities instead of free time options

Living here often requires financial outlays for social engagement.

Dubai’s culture is heavily influenced by:

Excessive displays of wealth

Impact of social media

Expectations of professional appearance

Individuals frequently upgrade possessions and lifestyle faster than anticipated.

Convenience often comes at a price, including:

Food delivery

Cleaning services

Ride-hailing services

Same-day deliveries

Such minor costs can accumulate into substantial monthly outlays.

For families, the perception of expenses in Dubai escalates significantly.

Public school options for expats are scarce, leading to mandatory private education.

Tuition fees increase every year

Additional expenses include uniforms, transportation, activities, and trips

Educational costs can rival housing expenditures for families.

From daycare to extracurricular activities, children's costs are at international price levels.

Dubai does not provide subsidies for:

Education

Child care

Healthcare for families

Parents must manage all expenses themselves.

The healthcare system is top-tier, yet costs can be substantial depending on insurance.

Employer-sponsored insurance might:

Exclude specific treatments

Involve co-payments

Restrict hospital access

Out-of-pocket costs can add up quickly.

Visits to dental or mental health professionals, along with specialist appointments, often incur additional charges.

Healthcare expenses can come unexpectedly but are often burdensome when they arrive.

Car ownership is common in Dubai.

While public transit exists, it may not be practical for daily life. Owning a car entails:

Fuel costs

Insurance premiums

Tolls

Parking charges

Maintenance costs

Even modest vehicle choices can lead to substantial ongoing expenses.

Using taxis and ride-hailing services provides ease but can become expensive if relied upon too much.

A pivotal reason Dubai feels costly is stagnant wages.

Rent, school fees, utilities, and service fees tend to rise consistently, even as many salaries:

Remain static for extended periods

Increase at rates below inflation

Are rarely renegotiated

This creates a persistent pressure where outgoings increase faster than income.

Job security often hinges on contracts. This discourages proactive salary negotiations and instills cautious financial behaviors.

The transient nature of Dubai's populace influences financial habits.

Many residents adopt a short-term outlook, typically thinking:

“I’ll save when I can”

“I’m here to enjoy”

“I may leave soon”

Such perspectives promote consumption over strategic financial planning.

With no mandatory pension schemes for expatriates, individuals are responsible for their long-term savings. Those who don’t plan can find themselves in tight financial situations down the line.

Dubai relies heavily on imports.

With many goods and essentials brought in from abroad, prices are influenced by:

Global economic shifts

Fuel price fluctuations

Currency variations

Even everyday items can seem pricey compared to locally-sourced economies.

Dubai's perception of cost also has psychological roots.

As income rises, so do expectations. Expenditures that may appear justified at lower earnings suddenly seem burdensome.

Constant displays of wealth can create the impression that others are better off, even when many are in similar situations.

Those who manage their finances effectively in Dubai tend to adopt specific practices.

They focus on cost-effective living, opting for areas that offer:

Lower rent

Good transport links

Manageable service rates

They intentionally restrict:

Frequency of dining out

Impulse purchases

Subscription services

These actions contribute to better financial health.

Savings are set up automatically and regarded as non-negotiable.

They consider investing, exit strategies, and financial goals beyond their time in Dubai.

Dubai does not obscure its expenses; instead, it clearly delineates costs without hidden subsidies. The city favors:

Financial prudence

Mindful spending

Comprehensive financial planning

Those expecting substantial salaries to ensure comfort often face the most stress.

Life in Dubai may feel costly due to its combination of significant earning potential and self-shouldered living expenses. In the absence of taxes, the burden of costs rests firmly on individuals. Those who recognize and adapt to this reality tend to fare better, whereas those relying solely on their salaries may experience ongoing financial strain.

Dubai isn’t unattainable; it requires awareness, discipline, and deliberate financial management.

This article serves informational purposes only, reflecting common trends in cost of living and financial experiences. Personal expenditures will vary based on individual lifestyles, family sizes, locations, and employment conditions. It should not be considered financial or relocation advice. Readers are encouraged to evaluate their situations or consult with qualified experts prior to making any financial or relocation decisions.

Dhurandhar Surpasses 800 Crore Mark at the Box Office

Ranveer Singh's Dhurandhar rakes in ₹800 crore globally, with the hit song Shararat captivating audi

Kriti Sanon Discusses Her Complex Role in Tere Ishk Mein

Kriti Sanon initially found her role in Tere Ishk Mein negative but grew to understand and appreciat

Release of 130 Students From St Mary’s Catholic School Marks Hopeful Turn in Nigeria

Nigerian authorities announce the release of 130 students from St Mary’s, ensuring no pupil remains

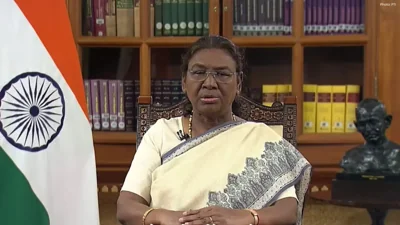

President Murmu Endorses SHANTI Bill to Propel Nuclear Energy Expansion

President Droupadi Murmu endorses the SHANTI Bill, facilitating private sector involvement in nuclea

New Zealand Claims Test Series with Decisive Victory Over West Indies

New Zealand triumphed over West Indies by 323 runs in the final Test, securing a 2-0 series win with

Centre Affirms Protection for Aravalli Hills Amidst Mining Concerns

Government asserts over 90% of Aravalli hills remain protected, dismissing mining concerns as misinf