Post by : Sami Jeet

The UAE real estate market has long been a magnet for global investors, promising high returns, tax-free benefits, and luxurious living. But as property regulations evolve and government oversight tightens, foreign buyers must be more cautious than ever.

New compliance rules, transparency standards, and anti-money laundering checks have changed how international investors can buy and own property in Dubai, Abu Dhabi, and beyond. Before signing that contract, make sure you understand the latest due diligence checklist for property investment in the UAE.

Before investing, always confirm that the developer and the project are officially registered with the Dubai Land Department (DLD) or the relevant authority in other Emirates.

Why it matters:

Unregistered projects or developers could indicate financial instability or potential fraud. You can check project details using the DLD’s online platform or the “Dubai REST” app.

Pro Tip: Avoid developers who refuse to share their registration numbers or escrow account details.

All off-plan projects in the UAE are legally required to maintain an escrow account, where buyers’ payments are securely held until the developer completes certain construction milestones.

Why it matters:

Escrow protection ensures your money isn’t misused and that the project remains financially accountable.

Check this:

Verify the escrow account number through official government portals.

Confirm that all payments are made to that account — not directly to the developer.

Not all properties in the UAE are open to foreign ownership. Foreign buyers can only purchase freehold properties in designated zones, primarily in Dubai and Abu Dhabi.

Why it matters:

Buying outside of freehold zones could mean losing ownership rights or being restricted to leasehold terms.

Check before buying:

Ensure your desired property is in a freehold area.

Confirm ownership structure through your real estate agent or the DLD.

Scams and unauthorized agents are a real risk in booming property markets. Always work with a RERA-certified (Real Estate Regulatory Agency) agent or a registered brokerage.

What to do:

Ask for the agent’s RERA ID card.

Verify their license on the DLD website.

Be wary of anyone pressuring you to make fast payments.

Before any payment or agreement, review all property documents, including:

Title Deed or Oqood (for off-plan properties)

No Objection Certificate (NOC) from the developer

Payment receipts and completion certificates

Why it matters:

Small legal oversights can cause ownership disputes or delays during registration.

Tip: Consider hiring a real estate lawyer familiar with UAE property law to review contracts and handle documentation.

While the UAE remains tax-friendly, new anti-money laundering (AML) and due diligence regulations require foreign buyers to declare the source of their investment funds.

Key updates include:

Buyers may need to submit proof of income or bank statements.

Real estate agents and developers must report large or suspicious transactions.

Corporate buyers must comply with Ultimate Beneficial Owner (UBO) disclosure laws.

Why it matters:

Non-compliance can lead to legal penalties, transaction delays, or account freezes.

Beyond the property price, buyers should account for hidden costs such as:

DLD registration fees (usually 4% of property value)

Service charges and maintenance fees

Agency commissions (typically 2%)

Conveyance or legal costs

Why it matters:

Underestimating these expenses can affect your return on investment or delay your purchase process.

For investors, the property’s earning potential is as crucial as the purchase itself. Research:

Market trends and average rental yields in the area

Upcoming infrastructure projects nearby

Developer’s track record for delivery and quality

Tip: In Dubai, prime areas like Business Bay, Downtown, and Jumeirah Village Circle currently offer strong ROI potential, but always confirm with up-to-date market data.

The UAE continues to be one of the most attractive property markets for global investors — but the era of fast, paperwork-free deals is over. The new real estate regulations are designed to protect buyers and strengthen market transparency, not to complicate the process.

For foreign investors, success now depends on thorough due diligence, verified documentation, and compliance with local laws. Take the time to research every detail before you invest — your caution today could save your investment tomorrow.

Mattel Revives Masters of the Universe Action Figures Ahead of Film Launch

Mattel is reintroducing Masters of the Universe figures in line with its upcoming film, tapping into

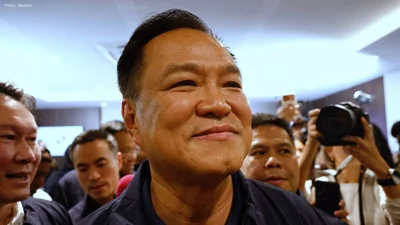

China Executes 11 Members of Criminal Clan Linked to Myanmar Scam

China has executed 11 criminals associated with the Ming family, known for major scams and human tra

US Issues Alarm to Iran as Military Forces Deploy in Gulf Region

With a significant military presence in the Gulf, Trump urges Iran to negotiate a nuclear deal or fa

Copper Prices Reach Unprecedented Highs Amid Geopolitical Turmoil

Copper prices soar to all-time highs as geopolitical tensions and a weakening dollar boost investor

New Zealand Secures First Win Against India, Triumph by 50 Runs

New Zealand won the 4th T20I against India by 50 runs in Vizag. Despite Dube's impressive 65, India