Post by : Monika

On October 9, 2025, Taiwan Semiconductor Manufacturing Company (TSMC), the largest contract chipmaker in the world, announced its third-quarter financial results for 2025. The company reported a strong revenue increase, surpassing analysts’ expectations.

This growth was mainly driven by the high demand for chips used in artificial intelligence (AI) technologies, reflecting the global shift toward AI-driven applications and computing solutions.

TSMC’s performance in Q3 2025 shows that the company continues to play a critical role in the global semiconductor industry. Its advanced manufacturing technology and strategic partnerships with leading tech companies allow TSMC to meet the rising demand for cutting-edge chips.

These chips are essential not only for smartphones and computers but increasingly for AI applications, cloud computing, and other next-generation technology solutions.

Financial Performance Overview

During the period from July to September 2025, TSMC reported a revenue of T$989.92 billion, which is approximately $32.47 billion USD. This represents a 30% increase from the same quarter in 2024, when the company earned T$759.69 billion. The revenue also exceeded the LSEG SmartEstimate of T$973.26 billion, based on projections from 22 analysts who closely follow TSMC’s performance.

The reported revenue aligns with TSMC’s guidance earlier this year, which had forecast a Q3 revenue range of $31.8 billion to $33 billion. The company’s ability to surpass market expectations demonstrates its strong operational performance and robust demand for its products.

TSMC’s Q3 results are particularly impressive because the global semiconductor market has faced supply chain challenges over the past few years. Despite disruptions and competition, TSMC has maintained consistent growth and continues to be a preferred supplier for major technology companies worldwide.

Factors Driving Revenue Growth

The main factor behind TSMC’s revenue growth is the rising demand for AI chips. Technology giants such as Nvidia, Apple, and other semiconductor-dependent companies are increasingly investing in AI-driven products and services. These companies rely heavily on TSMC’s advanced chips for high-performance computing, graphics processing, and data center applications.

TSMC’s ability to produce cutting-edge chips at scale allows it to serve multiple clients simultaneously, maintaining high quality and reliability. The company’s focus on research and development, particularly in advanced manufacturing processes, has made it the global leader in semiconductor production.

Another key factor contributing to TSMC’s strong performance is its strategic expansion of production capacity. The company has invested billions of dollars in new fabrication plants and equipment to support the production of smaller, more efficient chips. These chips are essential for modern devices that require high processing power and low energy consumption, including AI applications, smartphones, gaming devices, and servers.

Advanced Chip Technology and Innovation

TSMC is known for its leadership in advanced semiconductor technology. The company produces chips using leading-edge processes, such as 3-nanometer (nm) and 2-nm technology nodes, which allow for smaller, faster, and more energy-efficient chips. These innovations are particularly important for AI applications, where large amounts of data need to be processed quickly.

By continuously improving its manufacturing technology, TSMC ensures that its clients can deliver cutting-edge products to the market. For example, Nvidia uses TSMC chips to power its AI graphics cards, which are essential for machine learning and advanced gaming applications. Similarly, Apple relies on TSMC for its M-series processors, which power Macs and other devices with high efficiency and speed.

TSMC’s commitment to innovation and quality helps it stay ahead of competitors and maintain a leading position in the global semiconductor market. The company also focuses on customized solutions for clients, allowing them to design chips optimized for specific applications.

Stock Market Reaction

Following the announcement of Q3 results, TSMC’s stock performance has shown strong growth. As of October 9, 2025, TSMC shares have risen by 34% since the beginning of the year, significantly outperforming the broader market, which increased by 18.5% over the same period.

Investors have responded positively to TSMC’s revenue beat and the strong demand for AI chips, reflecting confidence in the company’s ability to maintain growth in a competitive and rapidly changing market. The stock’s upward trend also highlights the market’s recognition of TSMC’s critical role in powering AI and advanced technology applications worldwide.

Global Semiconductor Market Context

TSMC’s growth occurs amid rapid expansion in the global semiconductor market, driven by AI, cloud computing, 5G networks, and smart devices. The demand for advanced chips has surged as more industries adopt automation, machine learning, and digital transformation technologies.

While other chipmakers are also expanding production, TSMC remains a preferred choice due to its advanced manufacturing capabilities and proven track record. Its strategic focus on high-performance chips for AI applications positions it to capture a larger share of the growing market.

TSMC’s performance also reflects the resilience of the semiconductor industry. Despite global supply chain disruptions, geopolitical challenges, and fluctuations in demand, leading companies like TSMC continue to achieve record revenues and strong financial results.

Future Outlook

TSMC will release its full Q3 earnings report on October 16, 2025, providing a detailed breakdown of revenue, profit margins, and operating expenses. Analysts and investors will closely watch this report for guidance on the company’s performance in the current quarter and the remainder of 2025.

The company’s continued investment in advanced technology nodes and capacity expansion is expected to sustain growth, particularly in AI-related markets. TSMC’s roadmap includes the development of 2-nanometer and smaller chips, which will enable clients to design even more efficient and powerful devices.

Additionally, TSMC’s strategic partnerships with major technology companies will likely continue driving revenue. These partnerships allow TSMC to provide customized solutions for specific applications, giving clients a competitive advantage in their respective markets.

Challenges Ahead

Despite strong growth, TSMC faces some challenges. These include global competition from other chip manufacturers, such as Samsung and Intel, as well as geopolitical tensions that could affect supply chains. The semiconductor industry is also highly sensitive to market fluctuations, including demand cycles for electronics and computing devices.

Energy consumption is another factor. Advanced chip manufacturing requires significant electricity and water usage. TSMC has invested in sustainable practices, such as renewable energy and efficient production processes, to reduce its environmental impact.

Finally, customer demand for advanced chips is evolving rapidly. TSMC must continue innovating to meet the needs of AI, cloud computing, and high-performance computing applications, ensuring it stays ahead of competitors.

TSMC’s Role in AI Development

The demand for AI chips is a major growth driver for TSMC. AI applications, including machine learning, autonomous vehicles, natural language processing, and data centers, require specialized high-performance semiconductors. TSMC’s technology allows companies to process complex AI algorithms efficiently, enabling faster and smarter applications.

As AI becomes more integrated into business, healthcare, entertainment, and everyday life, TSMC’s role as a key supplier of advanced chips will continue to expand. The company’s strong position in the market ensures that it remains a critical player in global technological innovation.

TSMC’s Q3 2025 revenue results show that the company is strong, resilient, and well-positioned for the future. With revenue reaching $32.47 billion, the company exceeded expectations, driven by the surging demand for AI chips and other advanced semiconductor products.

TSMC continues to lead in chip technology, producing smaller, faster, and more efficient semiconductors that power AI, computing, and smart devices. Its strategic investments, partnerships, and innovation are key to maintaining its global leadership position.

The company faces challenges such as competition, geopolitical risks, and market fluctuations, but its strong technology base and market strategy provide confidence for sustained growth. TSMC’s Q3 results highlight its critical role in the global semiconductor ecosystem, providing essential components that enable the next generation of AI and high-tech applications.

As AI adoption grows and technology evolves, TSMC’s advanced chips will remain vital for innovation worldwide, ensuring that the company continues to deliver strong financial performance and technological leadership.

OpenAI Highlights Growing Cybersecurity Threats from Emerging AI Technologies

OpenAI has raised alarms about the increasing cyber risks from its upcoming AI models, emphasizing s

Manchester City Triumphs 2-1 Against Real Madrid, Alonso Faces Increased Scrutiny

Manchester City secured a 2-1 victory over Real Madrid, raising concerns for coach Xabi Alonso amid

Cristiano Ronaldo Leads Al Nassr to 4-2 Victory Over Al Wahda in Friendly Face-Off

Ronaldo's goal helped Al Nassr secure a 4-2 friendly win over Al Wahda, boosting anticipation for th

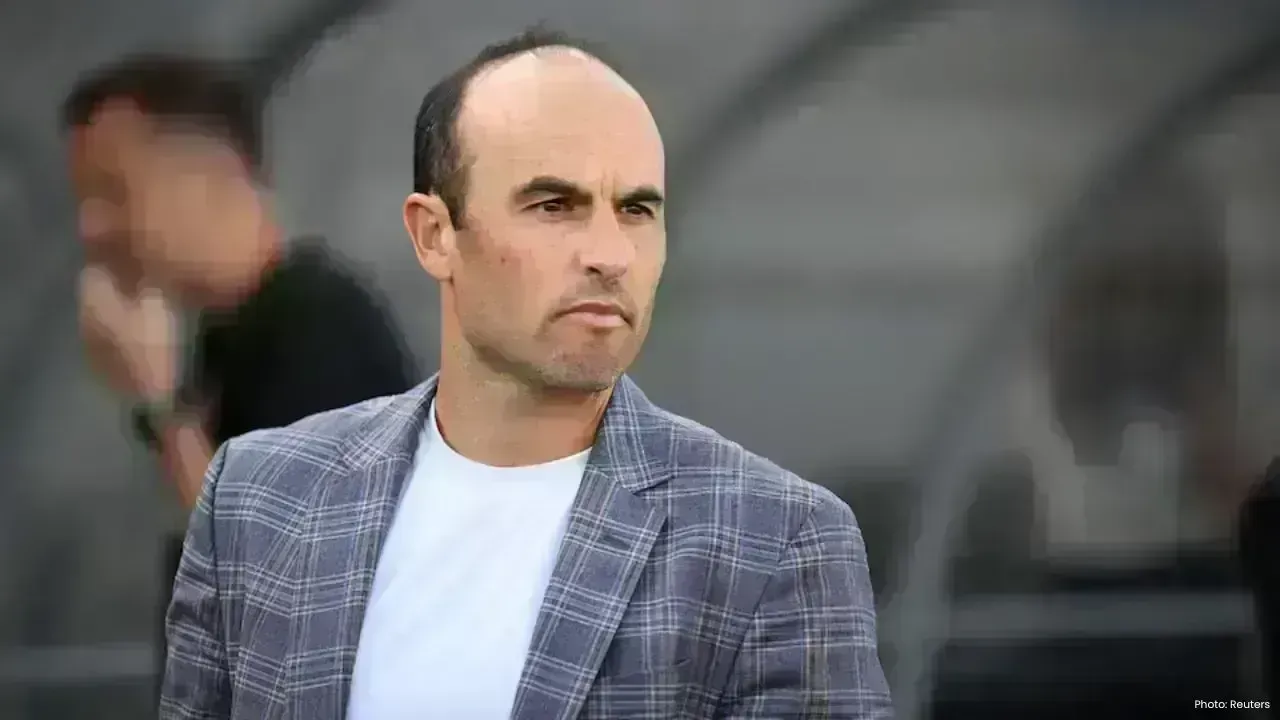

Landon Donovan Challenges Australia Coach on World Cup Prospects

Landon Donovan counters Australia coach Tony Popovic’s optimism for the World Cup, expecting an earl

Mercedes-Benz Forms Landmark Partnership with WTA

Mercedes-Benz and the WTA unveil a significant partnership effective January 2026, with major invest

Abhishek Addresses Divorce Rumours Concerning His Family

Abhishek Bachchan confirms that daughter Aaradhya remains oblivious to divorce speculations, focusin