Post by :

Photo:Reuters

Oil markets reacted strongly on Tuesday after a sudden military strike in Qatar by Israel raised fresh concerns about security in the Middle East. The strike, described as a “precise attack,” targeted senior Hamas leaders based in Qatar. The news quickly spread across financial markets and caused oil prices to jump by nearly 2%.

By 3 p.m. GMT (9 p.m. IST), Brent crude futures were trading at $67.32 per barrel, up almost 1.97% from the previous session. At the same time, WTI crude futures also climbed 2.12%, reaching $63.59 per barrel. Analysts say the strike not only added fear of instability in the region but also came during a period when oil supply decisions by OPEC+ are already making the market sensitive.

Why Did Prices Go Up?

There are two major reasons:

1. The Strike in Qatar – Investors worry that fresh tensions in the Middle East could disrupt oil production and transport routes, even if Qatar itself is not a major exporter on the scale of Saudi Arabia or Iraq. The Middle East as a whole is still the world’s energy hub, and any conflict in the region usually leads to quick reactions in oil markets.

2. OPEC+ Decision – On Sunday, OPEC+ members announced that they would increase oil output by only 137,000 barrels per day, much lower than what many traders and market experts expected. Some analysts believed producers might not increase output at all, but the small rise confirmed that OPEC+ is trying to keep prices firm by controlling supply.

At present, OPEC+ production levels stand at around 1.65 million barrels per day (mb/d). The smaller-than-expected increase means supply will remain tight, adding more upward pressure on prices at a time when demand is gradually recovering.

What This Means for Global Markets

For countries that rely heavily on imported oil, this rise in crude prices could mean higher fuel costs in the coming weeks. Airlines, shipping companies, and industries that depend on fuel might face increased expenses. For everyday consumers, the impact may show up as higher prices for petrol, diesel, and goods that require transport.

Energy market experts point out that oil has been trading in a delicate balance for months. On one side, producers are trying to protect their revenues by avoiding oversupply. On the other side, buyers are worried about costs rising too much, especially as inflation has already been troubling many economies.

Middle East Tensions and Energy Security

The strike in Qatar is also significant because of the country’s role in international diplomacy. Qatar has been a key broker in talks between Israel and Hamas over the Gaza conflict and the release of hostages. By targeting Hamas leaders on Qatari soil, Israel has not only escalated tensions with the group but also created uncertainty in diplomatic channels.

This adds another layer of risk to an already unstable region, which is why energy traders immediately pushed oil prices higher. Even if oil production itself has not been disrupted in Qatar, the fear of possible escalation is enough to influence prices.

Expert Reactions

Several market observers said the combination of limited supply growth from OPEC+ and unexpected military action in Qatar created the perfect environment for a price rally. Some believe that if tensions in the region rise further, crude could climb even higher in the short term.

S&P Global and other research agencies noted that markets were expecting OPEC+ to keep production flat, but the small increase has now made traders more cautious. The strike then added another shock, giving oil the push it needed to jump nearly 2% in a single day.

Looking Ahead

Investors and governments will closely watch two things:

* Whether Israel’s strike will trigger more instability in Qatar or the wider Gulf region.

* How OPEC+ will react if oil prices keep rising too quickly, especially if it starts to hurt demand.

For now, the combination of geopolitical risks and supply management is keeping crude oil markets under pressure. If tensions continue, consumers around the world could feel the pinch in fuel and energy prices sooner rather than later.

Kazakhstan Boosts Oil Supply as US Winter Storm Disrupts Production

Oil prices inch down as Kazakhstan's oilfield ramps up production, countered by severe disruptions f

Return of Officer's Remains in Gaza May Open Rafah Crossing

Israel confirms Ran Gvili's remains identification, paving the way for the Rafah border crossing's p

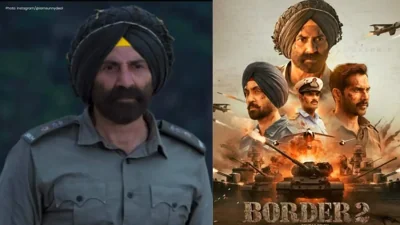

Border 2 Achieves ₹250 Crore Globally in Just 4 Days: Sunny Deol Shines

Sunny Deol's Border 2 crosses ₹250 crore in 4 days, marking a significant breakthrough in global box

Delay in Jana Nayagan Release as Madras HC Bars Censorship Clearance

The Madras High Court halts the approval of Jana Nayagan's censor certificate, postponing its releas

Tragedy Strikes as MV Trisha Kerstin 3 Accident Leaves 316 Rescued

The MV Trisha Kerstin 3 met an unfortunate fate near Jolo, with 316 passengers rescued. The governme

Aryna Sabalenka Advances to Semi-Finals, Targeting Another Grand Slam Title

Top seed Aryna Sabalenka triumphed over Jovic and now faces Gauff or Svitolina in the semi-finals as