Post by : Monika

India is exploring the launch of a nationwide climate-linked insurance scheme to support people affected by extreme weather events such as floods, heatwaves, cyclones, and droughts. The scheme aims to provide quick and reliable financial assistance to individuals, farmers, and communities who face losses from climate-related disasters.

Unlike traditional insurance that requires time-consuming damage assessments, this new parametric insurance model can trigger payouts automatically based on measurable weather events, ensuring faster help for those in need.

The country has faced significant climate-related challenges over the past decades, including frequent floods in Assam and Bihar, heatwaves in central India, and cyclones along the eastern coast. Such disasters have caused economic losses, destroyed crops, damaged infrastructure, and disrupted the livelihoods of millions of Indians. Recognizing these challenges, the government is actively considering innovative financial tools like climate-linked insurance to protect citizens and strengthen climate resilience.

What Is Climate-Linked or Parametric Insurance?

Climate-linked insurance, also called parametric insurance, works differently from traditional insurance. Traditional insurance typically requires a post-disaster assessment to determine the extent of damage before issuing payments. This process can take weeks or even months, delaying assistance to affected people.

Parametric insurance, however, uses pre-defined parameters, such as rainfall levels, wind speed, or temperature thresholds, to automatically trigger payments. For example, if rainfall exceeds a certain level in a district or if a heatwave lasts for several days above a defined temperature, the insurance payout is released instantly. This method allows for faster and more predictable financial support, helping communities recover more quickly.

Parametric insurance is already used in several countries around the world. For example, Pacific island nations like Fiji and Vanuatu have adopted parametric schemes to deal with cyclones, while some African countries use it for drought and crop loss coverage. India is considering scaling this approach nationwide to cover multiple regions and weather-related risks.

Why India Needs Climate-Linked Insurance

India is highly vulnerable to climate change. The country experiences extreme weather events frequently due to its diverse geography, large population, and dependence on agriculture. Data from the past three decades show:

Current disaster management measures rely heavily on government relief funds, which can be delayed or insufficient during widespread disasters. Climate-linked insurance could shift some financial burden to the insurance sector while ensuring timely payouts for citizens.

Moreover, parametric insurance encourages financial inclusion, as even small farmers and self-employed individuals can be covered under a low-cost, easy-to-administer scheme. Quick access to funds can prevent affected families from falling into poverty after disasters, reduce dependence on informal loans, and help rebuild livelihoods faster.

Pre-Defined Trigger Points: Insurance payouts will be automatically triggered when specific weather conditions, such as rainfall, wind speed, or heat duration, exceed predefined thresholds.

Instant Payouts: Once the trigger is met, insured individuals or communities will receive immediate payments, without waiting for traditional damage assessments.

Wide Coverage: The scheme is expected to cover farmers, urban residents, small businesses, and self-employed individuals, especially those vulnerable to extreme weather events.

This process allows for faster recovery and minimizes the economic and social impact of disasters.

Pilot Programs in India

Some states have already piloted parametric insurance programs with encouraging results:

Gujarat, Rajasthan, and Maharashtra: In 2024, around 50,000 women who were self-employed received insurance payouts when temperatures exceeded 40°C over several days. Each woman received a flat payment, and some received additional support depending on local conditions.

Potential Funding Sources

Challenges and Considerations

Global Context

Future Outlook

If implemented successfully, the scheme could transform disaster management in India. Citizens would have faster access to financial support, reducing hardship and enabling quicker recovery. Farmers would be able to protect crops against erratic rainfall, and urban populations could receive aid after floods or heatwaves.

Additionally, this initiative aligns with India’s commitment to COP30 discussions, emphasizing financial solutions to climate risks. By demonstrating an effective model for climate-linked insurance, India could lead globally in climate adaptation measures.

India’s plan to introduce a nationwide climate-linked insurance scheme represents a major step toward resilient, climate-ready governance. By combining parametric insurance technology, government support, and public-private collaboration, India aims to ensure that citizens affected by floods, heatwaves, and other disasters receive fast, reliable financial aid.

This initiative can improve the lives of millions, reduce dependence on delayed government relief, and strengthen the country’s ability to adapt to the growing challenges of climate change. It also demonstrates India’s commitment to innovation, financial inclusion, and sustainable development.

If successfully implemented, this scheme could serve as a global example for other nations seeking effective ways to mitigate the financial impact of climate disasters.

OpenAI Highlights Growing Cybersecurity Threats from Emerging AI Technologies

OpenAI has raised alarms about the increasing cyber risks from its upcoming AI models, emphasizing s

Manchester City Triumphs 2-1 Against Real Madrid, Alonso Faces Increased Scrutiny

Manchester City secured a 2-1 victory over Real Madrid, raising concerns for coach Xabi Alonso amid

Cristiano Ronaldo Leads Al Nassr to 4-2 Victory Over Al Wahda in Friendly Face-Off

Ronaldo's goal helped Al Nassr secure a 4-2 friendly win over Al Wahda, boosting anticipation for th

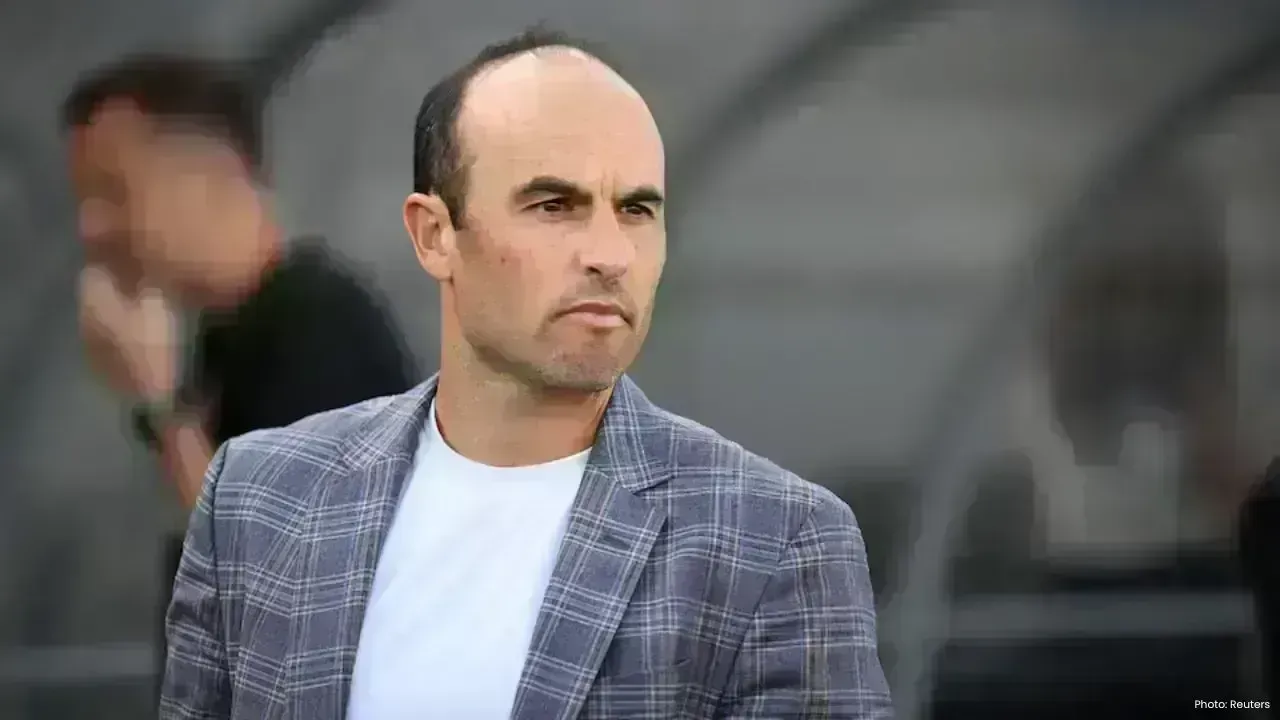

Landon Donovan Challenges Australia Coach on World Cup Prospects

Landon Donovan counters Australia coach Tony Popovic’s optimism for the World Cup, expecting an earl

Mercedes-Benz Forms Landmark Partnership with WTA

Mercedes-Benz and the WTA unveil a significant partnership effective January 2026, with major invest

Abhishek Addresses Divorce Rumours Concerning His Family

Abhishek Bachchan confirms that daughter Aaradhya remains oblivious to divorce speculations, focusin