Post by : Jyoti Singh

Photo: Dubai Government Media Office

Emirates NBD, one of the largest banks in the region, reported strong growth in the first half of the year 2025. The bank earned AED 23.9 billion in income during the first six months, which is a 12% increase compared to last year. This growth was possible because of several reasons, including strong lending, expansion into new regions, and new, easy-to-use banking products.

Big Increase in Lending and Deposits

Between January and June 2025, Emirates NBD gave out loans worth AED 41 billion. This is an 8% increase, and nearly half of these loans were made through the bank’s branches outside the UAE. This shows that the bank is growing not just in the UAE, but also internationally.

At the same time, deposits also went up by AED 70 billion, which is a 10% increase. A big part of this was a record AED 48 billion increase in Current and Savings Accounts. These types of accounts usually have low costs for banks and are considered stable sources of money.

Profit and Recovery

Even though interest rates had been cut earlier, the bank still managed to increase its operating profit by 9%. Emirates NBD also reported a small recovery of AED 0.3 billion from previously lost money. This is because the overall economy in the region has been doing well, and fewer loans are going unpaid. The bank’s impaired loan ratio improved to 2.8%, which means fewer people are

Struggling to repay

Emirates Islamic, a part of the Emirates NBD Group, also saw great success. It made a record profit of AED 1.9 billion in the first six months of 2025. The bank’s Islamic banking services are becoming more popular in the UAE.

Customer Services and Cards

Emirates NBD has been working hard to improve customer experience. One of its biggest achievements this year is capturing 35% of all credit card spending in the UAE. In total, people used the bank’s credit and debit cards to spend more than AED 100 billion in just six months.

HiThe bank also launched a new credit card called SHARE in partnership with Majid Al Futtaim Group. This card quickly became popular, reaching 10,000 users faster than any other card in the bank’s history.

Growing in Saudi Arabia and Across the Region

In Saudi Arabia, the bank’s loan business grew by 27% during the first half of 2025. Emirates NBD is focusing on expanding across the region, and this has played a key role in its overall growth. It also made AED 92 billion in new loans, which helped the retail and corporate lending side of the business grow by 13%.

The bank also introduced new financial products like structured credit and investment options, attracting both local and international customers. Emirates NBD Capital, the bank’s investment arm, remained one of the top banks in the UAE and the Middle East and North Africa (MENA) region.

Going Digital

Emirates NBD has been investing heavily in digital banking. Today, 93% of new current accounts are opened either on mobile or with help from staff using tablets. The bank launched “ENBD X” in Saudi Arabia to offer improved digital banking services there. It also introduced crypto trading through a platform called Liv X, working with partners like Aquanow and Zodia Custody.

The bank’s WhatsApp banking service now has over 750,000 users. It also partnered with Visa’s Cybersource to improve digital payments and worked with local governments to make banking services more automated and user-friendly.

New Technologies

The bank is using big data tools to understand its customers better and find new business opportunities. Emirates NBD has more than 50 active projects that use data to improve services. It is becoming a data-driven bank that focuses on offering smart, personalised services.

Environmental and Social Goals

Emirates NBD is also working to be environmentally friendly and socially responsible. It has the best ESG (Environmental, Social, and Governance) rating of any bank in the region, according to S&P Global. It was also the first bank in the Middle East and North Africa to publish a report following the new global sustainability standards. The bank has the most LEED Platinum certified branches in the world, showing its commitment to green buildings and sustainability.

Words from the Leadership

Hesham Abdulla Al Qassim, Vice Chairman and Managing Director of Emirates NBD, said that the bank’s income rose sharply due to strong lending and new product offerings. He also mentioned that the bank now expects to achieve double-digit loan growth by the end of the year.

He praised Emirates Islamic for its record profits and growing popularity in the Islamic banking sector. He also highlighted the success of the new SHARE credit card and the large volume of credit card spending in the UAE.

Shayne Nelson, the bank’s Group Chief Executive Officer, said that despite a drop in interest rates, the bank managed to grow its income. He said this was possible because of smart investments in the bank’s regional network, digital tools, and use of new technology. He added that the bank is focusing on areas like private banking, wealth management, and investment services.

Patrick Sullivan, the Chief Financial Officer, said that the bank made a profit of AED 12.5 billion in the first half of 2025, even after paying higher taxes. He also noted that the bank’s strong capital and steady business growth are helping it prepare for more success in the future.

The first half of 2025 has been a strong period for Emirates NBD. The bank has seen solid growth in loans and deposits, improved its services, and expanded in the region. With investments in technology and digital services, along with its efforts to be eco-friendly and responsible, Emirates NBD is positioning itself as one of the leading banks not only in the UAE, but across the Middle East.

Kazakhstan Boosts Oil Supply as US Winter Storm Disrupts Production

Oil prices inch down as Kazakhstan's oilfield ramps up production, countered by severe disruptions f

Return of Officer's Remains in Gaza May Open Rafah Crossing

Israel confirms Ran Gvili's remains identification, paving the way for the Rafah border crossing's p

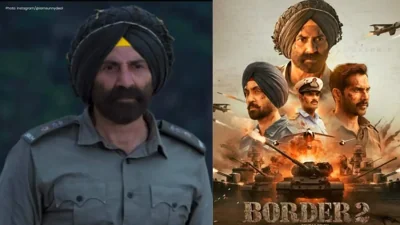

Border 2 Achieves ₹250 Crore Globally in Just 4 Days: Sunny Deol Shines

Sunny Deol's Border 2 crosses ₹250 crore in 4 days, marking a significant breakthrough in global box

Delay in Jana Nayagan Release as Madras HC Bars Censorship Clearance

The Madras High Court halts the approval of Jana Nayagan's censor certificate, postponing its releas

Tragedy Strikes as MV Trisha Kerstin 3 Accident Leaves 316 Rescued

The MV Trisha Kerstin 3 met an unfortunate fate near Jolo, with 316 passengers rescued. The governme

Aryna Sabalenka Advances to Semi-Finals, Targeting Another Grand Slam Title

Top seed Aryna Sabalenka triumphed over Jovic and now faces Gauff or Svitolina in the semi-finals as