Post by : Monika

Asian stock markets surged on October 9, 2025, reaching new highs after weeks of uncertainty. Investors found new confidence as oil prices dropped sharply following the news of a ceasefire between Israel and Hamas. The development helped calm fears of a wider Middle East conflict that could have affected global trade and energy prices.

At the same time, China’s stock markets reopened after a long national holiday, showing strong gains as domestic travel and spending data reflected improving consumer confidence. Across the region, tech stocks and companies linked to artificial intelligence continued to lead market growth, with investors optimistic about future profits.

Asian Stocks Surge to New Highs

Asian markets performed strongly across the board. The MSCI Asia-Pacific Index, excluding Japan, rose about 0.3%, marking one of its highest points in months. In Japan, the Nikkei 225 index jumped by 1.5%, supported by strong demand for technology shares and a record inflow of foreign investment.

In the past week alone, global investors reportedly poured more than $16 billion into Japanese markets. This surge of foreign capital is a sign that Japan remains a key destination for those seeking stable returns amid uncertain global conditions.

Taiwan’s stock market also touched a new record, led by gains in semiconductor companies and technology exporters. Analysts said the enthusiasm around artificial intelligence and next-generation chips was the main reason behind the bullish trend in Taiwan’s market.

Meanwhile, South Korea’s KOSPI index rose modestly as tech and auto companies performed better than expected. However, local investors remained cautious due to concerns about inflation and currency fluctuations.

China Markets Reopen After Holiday

After a week-long closure for the Golden Week holiday, China’s financial markets reopened with strong activity. The Shanghai Composite Index climbed 0.4%, while the CSI 300 index of large-cap companies gained 0.5%.

The Chinese government released data showing that domestic tourism was robust during the holiday. Around 888 million trips were made across the country, generating about 809 billion yuan (around $114 billion) in revenue. While this number showed a strong rebound in travel, average spending per person was slightly lower than last year, suggesting that consumers are still careful with their money.

Economists believe this pattern reflects cautious optimism in China’s economy. People are traveling and shopping again, but many still prefer to save instead of spend heavily.

Trade and Industrial Updates

China’s government announced new restrictions on rare earth exports, materials essential for producing electronics, electric vehicles, and military equipment. These export controls added to trade tensions with Western countries, especially the United States, which relies on China for these crucial minerals.

The decision came as China continues to strengthen its control over critical industries while encouraging domestic production. Analysts said these moves could cause global supply chain disruptions if not handled carefully.

Despite these concerns, Chinese technology and energy stocks performed well, helping lift investor sentiment after the holiday break.

Oil Prices Drop After Gaza Ceasefire

Oil prices had been rising in recent weeks due to the escalating conflict in Gaza. However, when Israel and Hamas agreed to a ceasefire, global oil markets reacted quickly. Prices fell as traders grew more confident that the risk of a wider regional war had eased.

Brent crude, the global benchmark for oil, dropped to around $65.90 per barrel, while U.S. crude settled near $62.10 per barrel. Experts said the fall was mainly driven by reduced geopolitical risk rather than a major change in demand or supply.

Lower oil prices were welcomed by many countries, as they could help ease inflation pressures caused by high energy costs. Transportation, manufacturing, and food production industries are expected to benefit the most if fuel prices remain stable.

Gold and Currency Movements

As oil prices declined, gold prices stayed near record highs at around $4,037 per ounce. Many investors continued to buy gold as a safe-haven asset, especially after months of global uncertainty related to wars, elections, and shifting interest rates.

The U.S. dollar remained firm, supported by strong employment data and cautious statements from the Federal Reserve. The euro traded steadily despite weak industrial production numbers from Germany and ongoing political challenges in France.

In Asia, the Japanese yen weakened slightly, making Japanese exports more competitive but raising import costs. The Chinese yuan stayed stable, supported by central bank intervention to prevent excessive volatility.

U.S. Federal Reserve Policy Outlook

Minutes from the Federal Reserve’s latest meeting showed that officials are still watching inflation closely but may consider interest rate cuts if the economy continues to slow. Analysts said the tone of the report suggests the Fed wants to balance inflation control with economic growth.

If rates start falling next year, it could provide a major boost to technology and growth stocks, as lower borrowing costs generally help these sectors expand faster. Investors around the world are watching the Fed’s next move carefully since U.S. monetary policy often influences global markets.

Investor Confidence Strengthened

Investor confidence improved across Asia and Europe following several weeks of volatility. The ceasefire news, combined with the possibility of interest rate cuts, gave traders more reasons to invest. Technology, renewable energy, and finance sectors were the biggest winners.

Market experts say the combination of easing geopolitical tensions and lower oil prices could help boost global economic stability. However, they also warned that inflation and trade disputes could still pose risks.

Global Trends and Sector Highlights

Technology and AI Boom:

Artificial intelligence continues to dominate investor interest. Companies that produce AI chips, software, and cloud services saw major share price increases across Asia.

Tourism and Retail Recovery in China:

China’s Golden Week spending shows that domestic travel and retail are bouncing back, although average consumer spending remains below pre-pandemic levels.

Trade Tensions Rising:

China’s restrictions on rare earth minerals raised concerns about potential retaliation from Western nations, which could impact global supply chains.

Energy Sector Impact:

The decline in oil prices is likely to reduce inflation and lower costs for energy-dependent industries such as airlines and manufacturing.

Safe-Haven Investments:

Gold and government bonds continue to attract investors who want stability amid uncertain global conditions.

Outlook for Global Markets

Overall, experts suggest maintaining a balanced investment approach — focusing on strong sectors like technology and renewable energy while staying cautious about inflation-sensitive areas.

The global market outlook turned more optimistic this week. The ceasefire in Gaza brought calm to oil markets, while Asia’s stock exchanges benefited from renewed investor confidence and strong tech demand. China’s post-holiday rebound showed resilience, though questions remain about consumer strength.

Oil’s decline, gold’s stability, and signs of potential interest rate cuts all signal a period of opportunity for global investors. However, caution is still necessary, as inflation and trade tensions could return quickly if economic or political conditions shift.

Kazakhstan Boosts Oil Supply as US Winter Storm Disrupts Production

Oil prices inch down as Kazakhstan's oilfield ramps up production, countered by severe disruptions f

Return of Officer's Remains in Gaza May Open Rafah Crossing

Israel confirms Ran Gvili's remains identification, paving the way for the Rafah border crossing's p

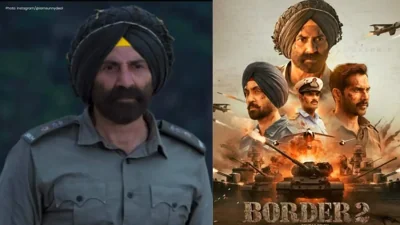

Border 2 Achieves ₹250 Crore Globally in Just 4 Days: Sunny Deol Shines

Sunny Deol's Border 2 crosses ₹250 crore in 4 days, marking a significant breakthrough in global box

Delay in Jana Nayagan Release as Madras HC Bars Censorship Clearance

The Madras High Court halts the approval of Jana Nayagan's censor certificate, postponing its releas

Tragedy Strikes as MV Trisha Kerstin 3 Accident Leaves 316 Rescued

The MV Trisha Kerstin 3 met an unfortunate fate near Jolo, with 316 passengers rescued. The governme

Aryna Sabalenka Advances to Semi-Finals, Targeting Another Grand Slam Title

Top seed Aryna Sabalenka triumphed over Jovic and now faces Gauff or Svitolina in the semi-finals as