Post by : Anees Nasser

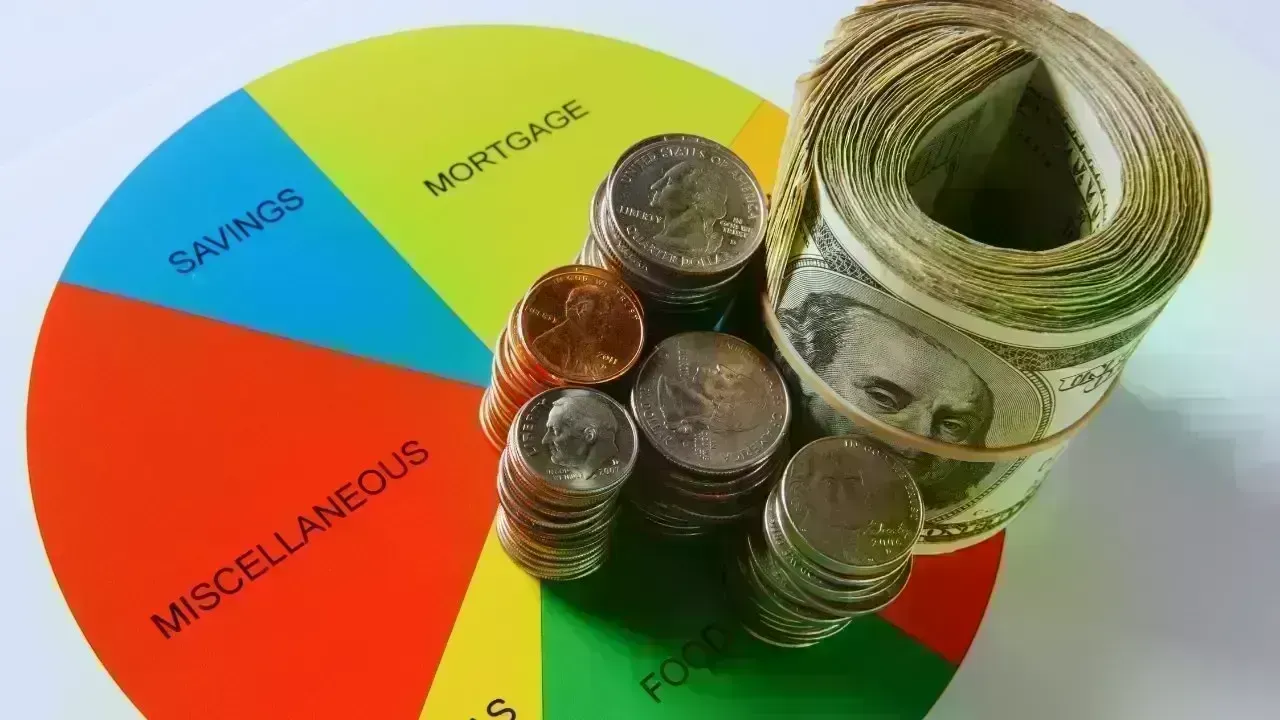

The Evolution of Household Budgeting

Traditionally, households have followed a monthly budgeting approach, outlining expenses for salaries, rent, utilities, groceries, and more. However, this method is becoming outdated as inflation, market fluctuations, and irregular work patterns prompt a reevaluation of financial management strategies.

Increasingly, families are adopting a weekly budgeting model. This approach provides a more adaptable, practical, and transparent means of managing finances. By budgeting weekly, families can swiftly respond to price variations, relieve month-end financial stress, and maintain better oversight of their spending.

This trend underscores a shift in modern living, where individuals no longer wait to identify overspending at month’s end. Instead, they seek real-time insights into their financial situation each week.

Economic Factors Influencing the Transition

Weekly budgeting is gaining traction due to various economic pressures:

– Prices for essentials like produce and dairy are inconsistent

– Fuel and transportation costs fluctuate frequently

– The ease of digital payments complicates spending tracking

– Impulse online purchases disrupt monthly allowances

– Subscription services renew automatically

– Work engagements and earnings vary widely

Unlike a rigid monthly framework, weekly budgeting allows for more immediate adaptations to changing circumstances.

The Practical Advantages of Weekly Budgeting

Families have found that a weekly budgeting system enhances their control over finances. Shorter budgeting intervals encourage better discipline and a more mindful approach to spending.

Key benefits include:

– Reduced pressure from tracking long-term expenses

– Simpler corrections for off-course spending

– Improved predictability in grocery shopping

– Enhanced meal preparation

– Decreased chances of spontaneous purchases

– A clearer understanding of cash flow

This method transforms budgeting from an overwhelming monthly chore into a series of manageable weekly tasks.

Implementing Weekly Budgeting at Home

Typically, families begin by identifying four essential spending categories for the week:

– Groceries

– Transportation

– Children’s needs (snacks, supplies, minor expenses)

– Daily household expenses

Next, they assign specific amounts to each category, utilizing methods such as cash envelopes or digital tracking. Weekly resets help to ensure expenditures remain within set limits.

For instance:

– ₹3,000 for groceries

– ₹1,000 for transport

– ₹800 for household items

– ₹500 for children’s needs

Any leftover funds can be saved or carried over.

The Role of Digital Tools

The increase in digital payment options has highlighted the necessity for effective budgeting tools. Families frequently use:

– Notes applications

– Budgeting software

– Collaborative trackers

– Spending calculators

– Digital envelope systems

– Weekly reminder notifications

These resources enable households to visualize their daily spending more effectively, thus simplifying the weekly budgeting process.

Facing the Grocery Challenge

To combat fluctuating prices, many families embark on weekly grocery challenges, which involve:

– Price comparison across different stores

– Purchasing only necessary items

– Planning meals ahead

– Assessing existing supplies at home

– Cutting unnecessary snack expenses

– Opting for alternative brands to save money

These strategies help to prevent the financial drain associated with unplanned grocery trips.

Minimizing Food Waste

By adopting a weekly budgeting approach, families significantly reduce food waste. A month’s worth of groceries often leads to spoilage, but a weekly system allows for:

– Only purchasing items that will be used

– Avoiding excess perishables

– Remaining aware of expiration dates

– Cooking with available ingredients

This leads to fresher kitchens and more organized meal planning.

Tracking Transport and Fuel Costs

Weekly budgeting also eases the tracking of rapidly changing fuel prices and transportation needs that can shift based on various factors. Families can:

– Assess weekly travel requirements

– Organize carpools for cost savings

– Adjust work-from-home days to reduce fuel costs

– Limit unnecessary travel

– Choose shopping days that avoid crowds

This flexibility alleviates the financial strain associated with commuting.

Managing Children's Expenses Efficiently

Children frequently incur small but ongoing expenses—snacks, supplies, school activities, and transportation—that can pile up in a monthly budget.

Weekly budgeting allows parents to:

– Set reasonable spending limits

– Closely monitor expenses

– Manage pocket money effectively

– Adjust for busy seasons or events

This results in better financial awareness without overwhelming stress.

Encouraging Mindful Spending

A defined weekly budget encourages families to be intentional with their spending habits. For example:

– Weekend activities are planned with care

– Shopping experiences become less impulsive

– Discounts and offers are scrutinized

– The question "Is this necessary?" arises regularly

This mindful approach alleviates excessive financial pressure.

Balancing Essential and Discretionary Purchases

Weekly budgeting allows families to clearly differentiate between essentials and lifestyle purchases. Essential needs remain constant, and discretionary spending is managed based on:

– Weekly savings

– Adjustments in grocery allocations

– Avoiding unnecessary purchases

– Opting for more affordable alternatives

This balance facilitates enjoyment without the risks of overspending.

Improved Communication through Weekly Budgeting

Couples often report that adopting weekly budgeting enhances their communication. Rather than month-end disagreements over finances, they regularly engage in discussions regarding their budget.

Topics commonly addressed include:

– Grocery needs

– Social outings

– Repairs around the home

– Weekly costs

– Shared responsibilities

This approach aligns both partners on financial matters.

Modernizing the Envelope Method

The classic envelope budgeting method—storing cash in labeled envelopes—has transitioned into digital formats in recent times.

Contemporary versions comprise:

– App-based envelope categories

– Weekly expenditure records

– QR codes for payment tracking

– Shared access lists

This modern adaptation retains the benefits of the traditional system while embracing digital convenience.

Strengthening Financial Discipline with Weekly Budgeting

Families that implement weekly budgeting often find marked improvements, such as:

– Fewer unexpected purchases

– Enhanced transparency regarding spending

– Increased savings

– More stable financial habits

– Less emotional spending

– Fewer instances of mid-month borrowing

Ultimately, this consistency is the key advantage of a weekly budget.

Managing Subscriptions Effectively

Households frequently face challenges from automatic renewals of subscriptions for services like streaming, apps, and educational platforms that impact monthly budgets.

Weekly budgeting assists families in monitoring:

– Due renewals

– Unnecessary subscriptions

– Plans to pause or downgrade

– Duplication of services

This foresight enables households to trim costs effectively before they multiply.

Streamlining Home Repairs and Utilities

Instead of managing home repair costs monthly, families can address smaller tasks weekly.

This includes:

– Replacing bulbs

– Buying cleaning products

– Minor plumbing work

– Refilling gas cylinders

– Spreading cleaning services across weeks

This practice prevents unforeseen spikes in household expenditure.

Achieving Savings Goals Weekly

The idea of saving ₹1,000 each week is often more psychologically palatable than saving ₹4,000 monthly. Weekly budgeting fosters realistic savings habits:

– Establishing a separate weekly savings fund

– Utilizing a digital savings account

– Setting up automatic transfers each week

– Implementing “round-up” savings for digital transactions

These small, consistent savings can accumulate significantly over time.

Meal Planning in Sync with Weekly Budgeting

Weekly meal planning aids families in avoiding unnecessary food purchases, minimizing waste, and preparing healthier meals while adhering to budgets.

This practice also diminishes cravings that often result in expensive food delivery orders.

Understanding Emotional Spending Patterns

Recognizing that spending can often be influenced by emotions, weekly budgeting helps families identify these habits:

– Shopping driven by stress

– Impulsive weekend buys

– Spending as a reward

– Unneeded snack purchases

– Last-minute online shopping

Once these tendencies are discovered, families can work to cultivate healthier habits.

Adapting to Rising Costs with Weekly Budgeting

In an era of escalating prices, a weekly budget allows for immediate recalibration rather than waiting until the end of the month.

Families can:

– Reduce certain expenditures

– Switch to more economical brands

– Explore cheaper product options

– Alter meal planning

– Rethink transport strategies

– Identify superfluous spending

Weekly flexibility mitigates the impact of economic inflation.

Conducting Weekly Budget Reviews

Most families dedicate a brief ten minutes each weekend to review their budget. During this check-in, they:

– Examine the week’s spending

– Compare it against their budget

– Reflect on successful strategies

– Make necessary adjustments

– Identify wasteful expenditures

– Prepare for unforeseen costs

These targeted assessments are often more effective than cumbersome monthly evaluations.

Embracing the Simplicity of Weekly Planning

Monthly budgets can overwhelm due to their complexity, while weekly budgets feel more manageable and straightforward.

People typically feel:

– More in command

– More motivated

– More aware

– More confident

– Less anxious

This reassuring quality is a significant factor in the rising popularity of weekly budgeting.

Conclusion: Weekly Budgeting as a New Financial Standard

As lifestyles change alongside economic unpredictabilities, and with the prevalence of digital payment solutions, weekly budgeting is poised for sustained growth. Households adopting this practice experience heightened control, enhanced savings, and more stable financial conditions.

Its appeal lies in its practicality and resonance with contemporary life, establishing it as a valuable financial habit for modern families.

Disclaimer:

This article offers general financial advice. Readers should evaluate their financial circumstances and seek guidance from certified financial professionals as necessary.

Kazakhstan Boosts Oil Supply as US Winter Storm Disrupts Production

Oil prices inch down as Kazakhstan's oilfield ramps up production, countered by severe disruptions f

Return of Officer's Remains in Gaza May Open Rafah Crossing

Israel confirms Ran Gvili's remains identification, paving the way for the Rafah border crossing's p

Border 2 Achieves ₹250 Crore Globally in Just 4 Days: Sunny Deol Shines

Sunny Deol's Border 2 crosses ₹250 crore in 4 days, marking a significant breakthrough in global box

Delay in Jana Nayagan Release as Madras HC Bars Censorship Clearance

The Madras High Court halts the approval of Jana Nayagan's censor certificate, postponing its releas

Tragedy Strikes as MV Trisha Kerstin 3 Accident Leaves 316 Rescued

The MV Trisha Kerstin 3 met an unfortunate fate near Jolo, with 316 passengers rescued. The governme

Aryna Sabalenka Advances to Semi-Finals, Targeting Another Grand Slam Title

Top seed Aryna Sabalenka triumphed over Jovic and now faces Gauff or Svitolina in the semi-finals as