Post by : Saif Ali Khan

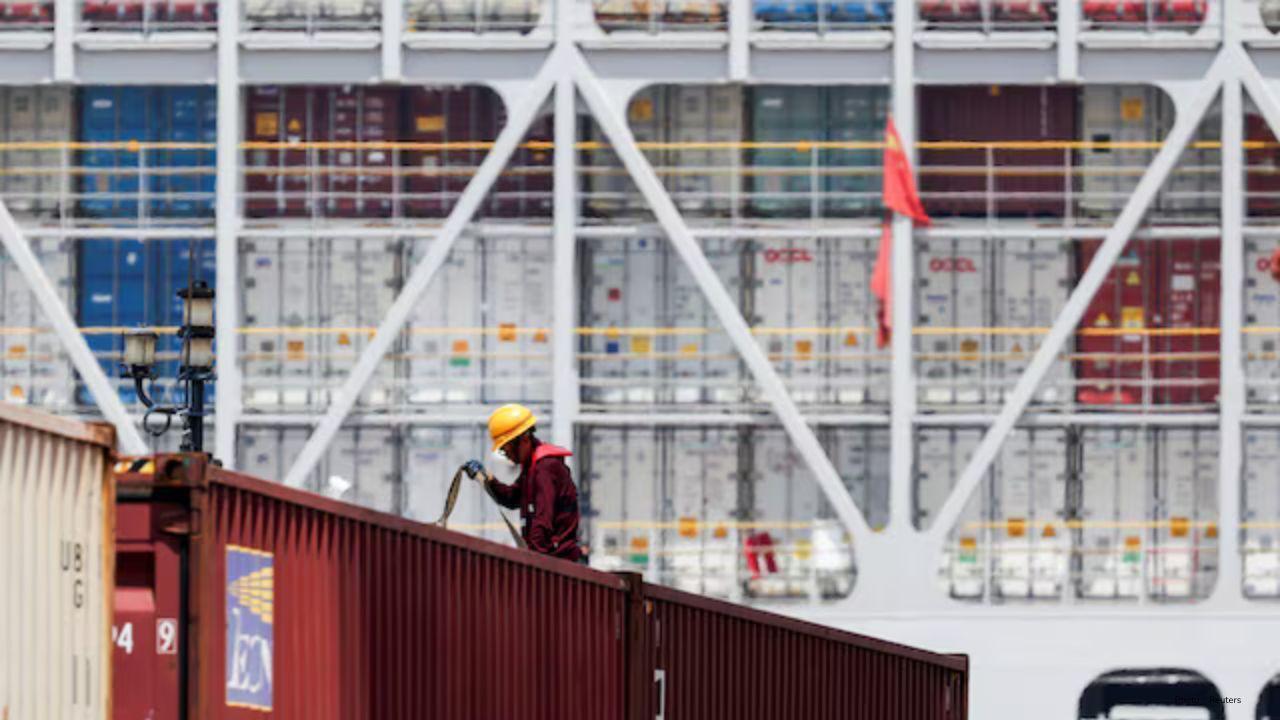

The trade fight between the United States and China has flared up again. On Friday, U.S. President Donald Trump announced that his government will impose 100% tariffs on Chinese goods starting November 1, reopening a trade war that had been calm for months.

The decision marks a sharp change in U.S.-China relations and threatens to shake global markets once again. Trump said the move was a response to China’s recent step to limit the export of rare earth minerals — materials that are crucial for making high-tech products like electric vehicles, smartphones, and military equipment.

New Tariffs and Software Controls

According to the announcement, the U.S. will double tariffs on all goods imported from China and also place new restrictions on the export of “critical software.” These export controls will prevent American companies from selling advanced software to China that could help in developing technology, artificial intelligence, or cloud systems.

Trump said on social media that China’s latest actions were “very bad” and accused Beijing of trying to use its control over rare earth elements to gain power in the global economy. He described China’s decision as a “hostile order” and promised to counter it financially.

He wrote, “For every element they have monopolized, we have two.” Trump also hinted that he had received messages from several other countries upset by China’s export restrictions.

Possible Breakdown of U.S.-China Talks

The rising tension comes just weeks before a planned meeting between Trump and Chinese President Xi Jinping. The two leaders were expected to meet in South Korea at the end of October during the Asia-Pacific Economic Cooperation (APEC) summit.

But Trump now says there may be “no reason” to meet Xi, suggesting that the chances of direct talks are fading. While Trump has not officially canceled the meeting, Beijing has not confirmed it either.

The new tariffs and export controls mark the most serious break in U.S.-China economic relations in six months. Earlier this year, both countries had agreed to pause their trade fight after long negotiations. That short period of calm appears to be over.

China’s Role in Rare Earth Exports

China is the largest producer of rare earth minerals, accounting for about 90% of the world’s supply. These minerals are used in important industries such as electronics, renewable energy, and defense.

On Thursday, Beijing announced it was adding more rare earth materials and refining technologies to its export control list. This means China can limit or stop foreign access to these critical materials whenever it wants. It also demanded that companies using Chinese raw materials follow its new rules.

This move alarmed many countries, including the U.S., Japan, and European nations that depend on China for these supplies. Trump called China’s step “shocking” and said the U.S. had no choice but to respond strongly.

Financial Markets React

The U.S. stock market reacted quickly and sharply to Trump’s announcement. The S&P 500 index dropped more than 2%, its biggest one-day fall since April.

Investors began moving their money into safer assets like gold and U.S. Treasury bonds, while the U.S. dollar weakened against other major currencies. Technology companies were hit hardest, with many losing value after hours, as Trump’s export control rules could restrict their business with China.

Financial experts say the new tariffs could drive up prices for American consumers and disrupt global supply chains, especially in technology and manufacturing sectors.

Craig Singleton, a China expert at the Foundation for Defense of Democracies, said that Trump’s decision “could mark the beginning of the end of the tariff truce.” He added that Washington viewed China’s export control moves as a “betrayal,” while Beijing likely underestimated how sharply the U.S. would respond.

Trade War May Escalate Further

Trump has long used tariffs as a tool to pressure countries in trade disputes. This time, he also threatened to expand export controls on airplanes and airplane parts, which could directly affect major industries like Boeing and Airbus.

A person familiar with the administration’s discussions said that officials were preparing a list of other possible targets for future restrictions.

In addition, the Trump administration recently proposed banning Chinese airlines from using air routes that pass through Russian airspace to reach or leave the U.S. On the same day, the Federal Communications Commission (FCC) said major online retailers in America had removed millions of Chinese-made electronic devices that did not meet U.S. standards.

These actions show that Washington is using many different tools — tariffs, export limits, and travel restrictions — to challenge China’s growing influence in global trade.

Economic and Political Impact

The renewed trade war could have wide-reaching consequences for both economies. The U.S. is China’s largest export market, while China is a key supplier of goods and materials to American companies. Higher tariffs could raise costs for both sides, increase inflation, and hurt global growth.

Beijing has criticized the U.S. for using what it calls “unilateral trade restrictions” that it says go against the rules of fair global commerce. China has not yet announced its own countermeasures, but it is expected to respond soon, possibly with new tariffs on American products or restrictions on U.S. companies doing business in China.

Many analysts believe that Trump’s latest move may also have political motivations. As the U.S. presidential election draws nearer, taking a tough stand against China could appeal to voters who believe that Beijing has taken advantage of America in trade deals.

Experts Warn of Global Consequences

Scott Kennedy, a China business expert at the Center for Strategic and International Studies, said, “Things are going to get interesting. Both leaders are trying to pressure the other side before the APEC meeting. But if talks fail, this could be the start of another long trade war.”

If Trump’s new tariffs and export bans go into full effect, economists warn they could damage technology industries, slow trade, and add pressure on already fragile global markets.

At the same time, consumers may see price increases on everyday products — from electronics and clothing to cars — that depend on parts imported from China.

Disclaimer

President Trump’s decision to raise tariffs and impose software export controls on China marks a new and risky chapter in the ongoing U.S.-China trade conflict. What began as a disagreement over rare earth minerals has quickly turned into a test of economic power between the world’s two largest economies.

#trending #latest #USTradeWar #China #Trump #Tariffs #GlobalEconomy #TradeConflict #RareEarths #Beijing #USChinaRelations #MiddleEastBulletin

Lazio Denies Qatari Sale Rumors, Files Legal Complaints

Lazio refutes online claims of Qatari takeover talks, files reports with Italian regulators and judi

Penn State Fires Coach Franklin After Third Straight Loss

Penn State parts ways with James Franklin after 3 conference defeats, naming Terry Smith as interim

Denmark Beats Greece 3-1 to Stay Top in Qualifiers

Denmark wins 3-1 at home over Greece, keeps unbeaten record, and stays ahead of Scotland in Group C

Panthers Edge Cowboys 30-27 with Dowdle’s Big Game

Rico Dowdle dominates former team with 239 total yards as Panthers win 30-27 over Cowboys by last-se

Mariners Beat Blue Jays 3-1 to Win ALCS Game 1

Seattle shuts down Toronto’s bats and wins Game 1 of the ALCS 3-1, with strong pitching and timely h

Dutch Government Seizes Control of China-Owned Chipmaker Nexperia

The Netherlands government steps in over governance risks at Nexperia, suspends its Chinese parent’s