Post by : Anees Nasser

For centuries, cash represented not only money but also a sense of certainty. A banknote held in hand meant guaranteed value, instantly trusted by both giver and receiver. Today, that trust is being transferred to screens, apps, and digital wallets. The journey from cash to crypto is not just a technological upgrade but a complete rethinking of how humans perceive value and security. This transformation is redefining financial systems, business models, and the way people engage with money on a global scale.

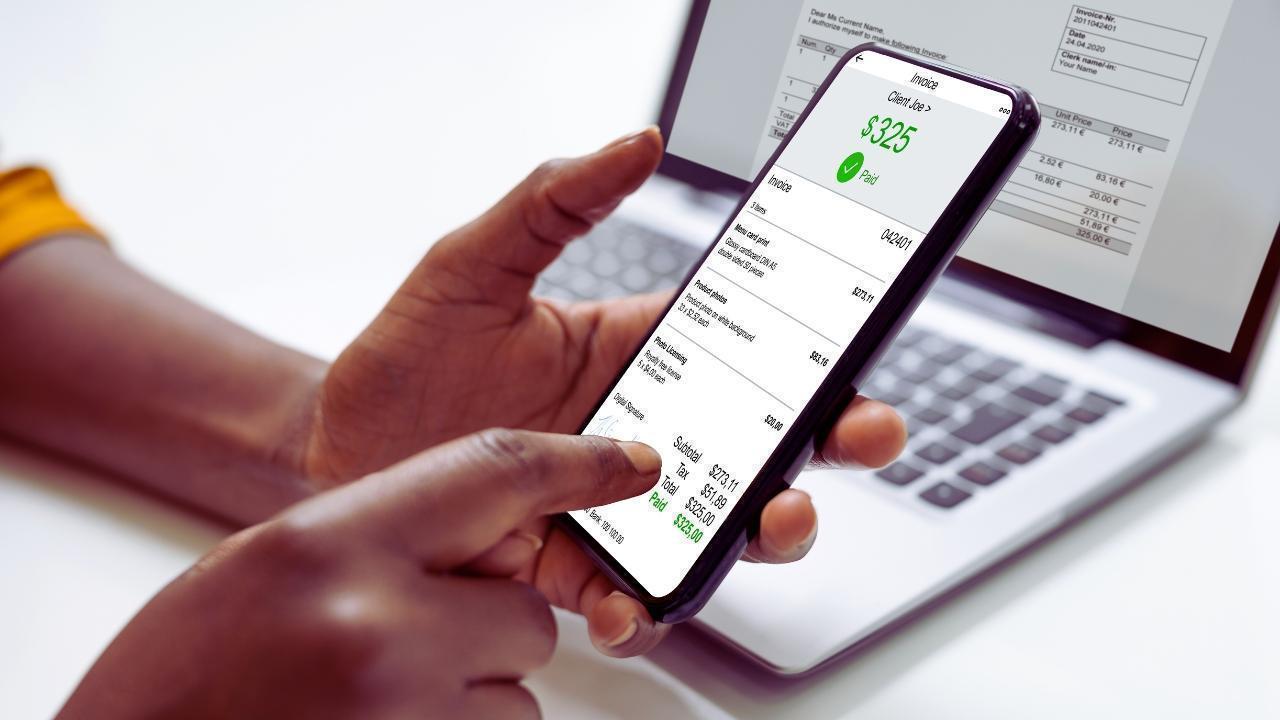

Cash is no longer king. In many developed and emerging economies, digital payments now surpass physical transactions. The convenience of swiping a card, tapping a phone, or scanning a QR code has reshaped consumer behavior. For governments, reducing cash usage also brings benefits: less tax evasion, better tracking of transactions, and more inclusive financial participation.

In countries like Sweden, cash is virtually disappearing. Even in parts of Asia, where small businesses once relied heavily on coins and notes, mobile wallets dominate marketplaces. This decline of cash is not merely a trend—it is a signal that societies are willing to place trust in invisible, technology-driven systems rather than tangible money.

Digital wallets are the modern equivalent of the leather wallet in our pockets. Platforms like Apple Pay, Google Pay, Alipay, and Paytm have transformed how people store and spend money. They integrate with banks, retailers, and even public transport systems, making payments faster and safer.

Fintech startups play a key role in this evolution. They combine technology and finance to simplify services such as loans, investments, and insurance. By doing so, they challenge traditional banks, offering consumers alternatives that often feel more transparent and user-friendly.

While digital wallets and mobile banking rely on trust in institutions, cryptocurrencies introduce a radical idea: trust in technology itself. Bitcoin, Ethereum, and other decentralized currencies are not governed by a central authority. Instead, they rely on blockchain technology, where every transaction is verified through consensus.

This shift questions the traditional idea of money being backed by governments. Crypto supporters believe that true financial freedom comes from removing intermediaries. Yet, skeptics argue that volatility, scams, and lack of regulation undermine this trust. Despite these concerns, cryptocurrencies continue to grow as both investments and payment tools, reshaping debates about the future of money.

Trust in cash was simple—it was physical, recognizable, and universally accepted. Trust in digital payments, however, rests on cybersecurity and transparency. Consumers must believe that their transactions are secure, their identities protected, and their money safe.

Blockchain introduces transparency, where transactions are visible to all participants yet remain tamper-proof. At the same time, financial institutions invest heavily in encryption and fraud detection to safeguard digital payments. Trust today depends on technology working flawlessly behind the scenes.

One of the most promising impacts of digital payments is financial inclusion. Billions of people worldwide lack access to traditional banking systems but own mobile phones. Mobile money services like M-Pesa in Africa have lifted millions out of poverty by enabling basic financial services through simple mobile networks.

Cryptocurrencies also present opportunities for cross-border transfers, especially for migrant workers sending money home. By bypassing traditional remittance services, fees are reduced, and access becomes easier. Digital payments, therefore, are not just reshaping economies but also empowering people who were previously excluded.

Governments face a delicate balance between encouraging innovation and protecting citizens. Unregulated digital currencies can become tools for illegal activities, while excessive regulation may stifle growth. Central banks are exploring Central Bank Digital Currencies (CBDCs) as a way to merge the benefits of crypto with the stability of traditional money.

CBDCs could redefine trust by combining government backing with the efficiency of digital systems. Yet, questions remain about privacy, surveillance, and control over individual spending habits. The future of digital payments depends heavily on how regulators address these challenges without breaking consumer trust.

Retailers, service providers, and even governments are adapting to the cashless economy. Small shops now display QR codes, international airlines accept crypto payments, and governments use digital wallets for subsidies. Businesses that fail to adapt risk being left behind, as consumers increasingly expect seamless, digital-first options.

For companies, digital payments also offer valuable data insights. Transaction histories reveal consumer preferences, helping businesses tailor products and services. However, this raises privacy concerns, as consumers worry about how their data is being used. Again, trust plays a central role.

Perhaps the most profound change is psychological. With cash, value was tangible. With digital payments, money has become invisible, existing only as numbers on a screen. Yet, people are learning to trust this system because of its convenience and efficiency.

The move from cash to crypto represents a deeper societal shift: we now trust code, algorithms, and encryption in place of physical notes and coins. This trust, once fragile, is becoming the new normal.

The journey from cash to crypto shows that trust is not static—it evolves with technology. As societies move toward cashless economies, and as cryptocurrencies gain mainstream acceptance, the question is no longer whether digital payments will dominate, but how trust will be maintained in these systems.

From governments issuing digital currencies to businesses integrating blockchain, the financial landscape is being rewritten. Trust, once built on paper money, is now being secured by code. The future of money will depend not only on innovation but also on how well institutions and technologies uphold this trust.

This article is a general editorial analysis and does not provide financial or investment advice. Readers are encouraged to conduct independent research or consult financial experts before making monetary decisions.

Mattel Revives Masters of the Universe Action Figures Ahead of Film Launch

Mattel is reintroducing Masters of the Universe figures in line with its upcoming film, tapping into

China Executes 11 Members of Criminal Clan Linked to Myanmar Scam

China has executed 11 criminals associated with the Ming family, known for major scams and human tra

US Issues Alarm to Iran as Military Forces Deploy in Gulf Region

With a significant military presence in the Gulf, Trump urges Iran to negotiate a nuclear deal or fa

Copper Prices Reach Unprecedented Highs Amid Geopolitical Turmoil

Copper prices soar to all-time highs as geopolitical tensions and a weakening dollar boost investor

New Zealand Secures First Win Against India, Triumph by 50 Runs

New Zealand won the 4th T20I against India by 50 runs in Vizag. Despite Dube's impressive 65, India