Post by : Anees Nasser

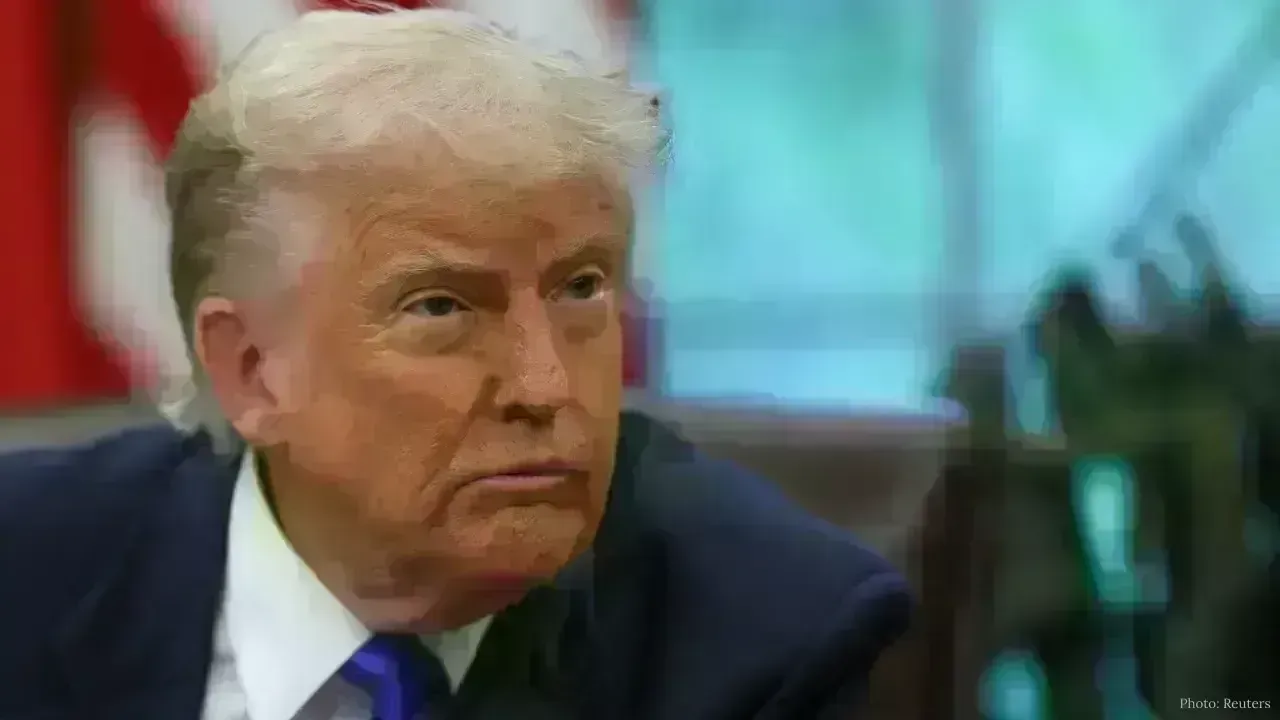

Today, stock markets in India and globally are witnessing sharp declines. Significant indices such as the Nifty 50 and Sensex have experienced consecutive drops, prompting investor unease. The principal factor behind this downturn is not an immediate economic crisis but escalating fears related to tariffs and trade tensions, particularly a tariff proposal associated with former U.S. President Donald Trump.

Tariffs are levies imposed on imported goods. The sudden or unpredictable onset of these trade barriers typically provokes negative reactions in stock markets, as they heighten costs, impede trade, and destabilize global supply chains. Today’s significant decline exemplifies the profound influence of trader anxieties, where even potential announcements can sway market reactions both in India and internationally.

This article elaborates on the reasons behind today's market downturn, examining how global political dynamics connect with investor sentiment, the impact on export-driven sectors, and the potential future implications.

The primary catalyst for today’s market drop stems from reports of a tariff initiative supported by Donald Trump. This proposed bill could impose extremely high import tariffs—rumored to be as high as 500%—on oil imported from Russia and other goods from nations trading with Russia.

The intention behind this measure is to penalize countries that continue to purchase Russian oil by imposing hefty tariffs. Although this bill is not yet law, uncertainty regarding future trade regulations typically leads to declines in markets. The mere anticipation of such high tariffs unnerves investors as:

Companies might face increased import and export costs.

Trading partners might respond with their tariffs.

Global trading dynamics may become sluggish, adversely affecting corporate profitability.

These tariff anxieties have led to extensive selling across financial markets worldwide.

Investors have not forgotten the consequences of tariff policies implemented during Trump's administration. In 2025, stock markets plummeted due to sweeping tariff policies in the U.S., catalyzing a significant global sell-off. A relevant example is the 2025 global market crash, which followed the introduction of broad U.S. trade barriers, causing notable declines across major indices like the S&P 500, Dow, and Nasdaq within days.

This past experience contributes to today’s anxiety, even in the absence of confirmation for the tariff plan, as traders recognize that changes in trade policy can rapidly alter perceptions of risk and growth.

In India, notable declines in the BSE Sensex and NSE Nifty 50 have emerged amidst escalating tariff concerns. Over the past four days, benchmark indices have considerably decreased, resulting in significant losses for investors.

On a global scale, stock prices across the U.S., Asia, and Europe have also faced downward pressures. Investors often tend to sell hurriedly during heightened geopolitical or economic risks, reflecting a common risk-off attitude in financial markets.

Foreign portfolio investors (FPIs) have increasingly sold off in Indian markets. Substantial outflows usually correlate with a stronger dollar as risk aversion rises. Such FPI sell-offs contribute to downward trends in indices like the Nifty.

Concern over tariffs constraining global growth has led international investors to become more wary of holding stocks in emerging markets, including those in India.

Companies reliant on exports are particularly hard hit by escalating tariff fears. Shares of textile manufacturers, agricultural exporters, seafood processors, and other export-intensive firms have seen declines of up to double digits as traders adjust for the risks of decreased foreign demand and heightened costs.

This is critical since export-oriented firms represent a significant segment of India’s stock market. Their decline consequently pulls broader indices down as well.

Tariffs can inflate the costs of goods crossing borders. When import taxes rise, firms incur higher expenses for raw materials or finished products, likely passing these costs on to consumers, adversely affecting profit margins and decelerating economic activity.

Investors typically respond quickly before realizing how these factors impact earnings—often leading to widespread selling in anticipation of lower future profits.

The tariff dilemma is global, not solely confined to India. Investors in the U.S. and Asia are closely monitoring developments, aware that increased trade barriers elsewhere can negatively influence global GDP forecasts.

Additionally, markets are awaiting significant upcoming events, including:

A U.S. jobs report which could impact Federal Reserve rate projections.

A U.S. Supreme Court decision regarding the legal status of certain tariff powers, which could either alleviate or exacerbate market anxieties.

Currently, traders are incorporating both potential scenarios into their outlooks, contributing to heightened volatility.

In financial markets, uncertainty is a major selling trigger. Even if the tariff proposal never materializes, markets frequently decline in anticipation of unfavorable news. This phenomenon is termed the anticipation effect, where traders opt to sell first and assess later for confirmation.

In this case, the uncertainty amplifies because:

Tariffs could be enacted through various legal means.

They may target nations with significant trade relations.

There is no definitive timeline for their potential implementation.

These ambiguities contribute to trader anxiety.

Let’s explore how various market segments are responding:

Sectors such as:

Textiles

Chemicals

Agricultural goods

Seafood

are facing significant selling pressure. The rationale? Tariffs on exported goods to core markets may escalate, leading to a decrease in international orders, thereby harming revenue streams.

Even blue-chip firms—especially in sectors like metals, energy, and finance—are experiencing declines. Normally, these companies contribute to market stability; however, today they are also suffering from the prevailing bearish trend.

As risk aversion intensifies, the U.S. dollar and bond yields often strengthen as money reallocates from equities into safer assets. Although a robust dollar makes imports less costly for the U.S., it simultaneously diminishes global equity performance. This accounts for the downturn in commodity prices and the weakness in emerging market currencies, including the Indian rupee.

Analysts characterize the current slump as a risk-off scenario primarily spurred by political and trade uncertainties rather than a collapse in company earnings or foundational demand.

Some analysts predict that the markets may overshoot on the downhill before stabilizing, especially if tariff news remains adverse. Others contend that positive economic data or clarifications regarding tariffs could lead to a swift market recovery—a classic case of “sell the rumor, buy the fact.”

However, the prevailing anxiety ensures that traders maintain a cautious approach, concentrating on risk management.

For investors seeking to comprehend today’s market shifts, here are vital insights:

Anticipate more significant price fluctuations as traders react to developments concerning politics and trade.

Although short-term fluctuations may feel intense, investment strategies should be based on cash flow, earnings, and economic fundamentals, rather than headlines.

Maintaining a diverse portfolio across sectors and asset classes (stocks, bonds, commodities) can cushion against sudden market shifts.

The direction of tariff developments—whether they tighten, loosen, or postpone—will directly influence market confidence.

The current drop in stock markets is primarily fueled by rising concerns over a potential tariff initiative linked to Donald Trump. While this proposed bill is still pending, its anticipated effects on global trade, corporate earnings, and investor confidence have induced substantial selling activity across markets. Declines in export-driven companies, fluctuations in foreign investor participation, and global uncertainty contribute to the current market weakness.

Increasing tariffs signal a move toward trade protectionism, often resulting in higher costs, diminished trade volumes, and investor trepidation. Until a clearer understanding of tariff developments and global economic data materializes, stock markets may continue to experience volatility.

Disclaimer:

This article aims to provide information only and does not serve as financial, investment, or trading guidance. The market can change rapidly, and investors should consult qualified financial professionals prior to making investment choices.

Kazakhstan Boosts Oil Supply as US Winter Storm Disrupts Production

Oil prices inch down as Kazakhstan's oilfield ramps up production, countered by severe disruptions f

Return of Officer's Remains in Gaza May Open Rafah Crossing

Israel confirms Ran Gvili's remains identification, paving the way for the Rafah border crossing's p

Border 2 Achieves ₹250 Crore Globally in Just 4 Days: Sunny Deol Shines

Sunny Deol's Border 2 crosses ₹250 crore in 4 days, marking a significant breakthrough in global box

Delay in Jana Nayagan Release as Madras HC Bars Censorship Clearance

The Madras High Court halts the approval of Jana Nayagan's censor certificate, postponing its releas

Tragedy Strikes as MV Trisha Kerstin 3 Accident Leaves 316 Rescued

The MV Trisha Kerstin 3 met an unfortunate fate near Jolo, with 316 passengers rescued. The governme

Aryna Sabalenka Advances to Semi-Finals, Targeting Another Grand Slam Title

Top seed Aryna Sabalenka triumphed over Jovic and now faces Gauff or Svitolina in the semi-finals as