Post by : Bianca Suleiman

Sharjah-based developer Arada is making bold international moves, committing up to £325 million ($427.7 million) to acquire an 80% stake in the Thameside West waterfront project in London’s Royal Docks. The acquisition, sourced from private developer Keystone, marks Arada’s second UK entry in under two months, signaling a fast-paced global expansion strategy.

The 47-acre riverside site is set for development starting in 2027, with plans to deliver at least 5,000 homes in multiple phases. The first phase alone is expected to see 1,000 homes completed. The development blueprint includes schools, retail spaces, creative hubs, and two new riverside parks, aiming to blend residential comfort with community-focused amenities.

Funding for the project will come from a mix of Arada’s equity and local or international bank financing. The land itself cost around £225 million, primarily covered by the company’s equity, with additional funds expected from UAE sources. CEO Ahmed Alkhoshaibi emphasized flexibility in financing options, stating the company would adopt the strategy most suitable at the time of development.

This move follows Arada’s 75% acquisition of UK-based developer Regal in September, backed by a Dh2.5 billion ($680 million) initial commitment to London real estate. Industry observers note that UAE developers are increasingly targeting the UK market: Aldar Properties, for instance, purchased London Square in 2023 for Dh1.07 billion, while Dubai’s JA Resorts & Hotels recently acquired two Scottish heritage hotels.

Arada’s international ambitions extend beyond the UK. The developer plans a 30,000-home pipeline in London, with additional projects in Sydney set to launch in early and mid-2026. CEO Alkhoshaibi expects property transactions and valuations in both cities to surge over the next two years, justifying the early acquisition of strategic locations.

Back home, Arada aims to add 10,000 homes to its UAE pipeline, while also exploring opportunities in Saudi Arabia, potentially in collaboration with the kingdom’s Public Investment Fund. Overall, the company expects its 2026 portfolio to include 25,000 homes, reflecting confidence in robust demand across multiple markets.

As part of its growth strategy, Arada has engaged JPMorgan for advice on sukuks and convertible bonds, viewed as preparatory steps toward a potential IPO in 2028. Alkhoshaibi remains deliberate about timing, focusing on readiness over market trends, despite strong investor interest in early listings.

With ambitious international acquisitions and a strong pipeline across UAE, London, and Sydney, Arada is positioning itself as a rising global player in real estate development, blending large-scale residential projects with strategic urban regeneration initiatives.

Kazakhstan Boosts Oil Supply as US Winter Storm Disrupts Production

Oil prices inch down as Kazakhstan's oilfield ramps up production, countered by severe disruptions f

Return of Officer's Remains in Gaza May Open Rafah Crossing

Israel confirms Ran Gvili's remains identification, paving the way for the Rafah border crossing's p

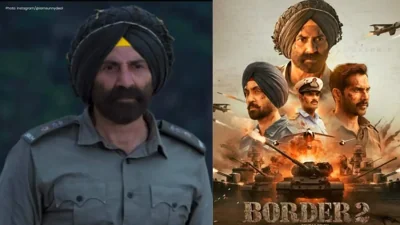

Border 2 Achieves ₹250 Crore Globally in Just 4 Days: Sunny Deol Shines

Sunny Deol's Border 2 crosses ₹250 crore in 4 days, marking a significant breakthrough in global box

Delay in Jana Nayagan Release as Madras HC Bars Censorship Clearance

The Madras High Court halts the approval of Jana Nayagan's censor certificate, postponing its releas

Tragedy Strikes as MV Trisha Kerstin 3 Accident Leaves 316 Rescued

The MV Trisha Kerstin 3 met an unfortunate fate near Jolo, with 316 passengers rescued. The governme

Aryna Sabalenka Advances to Semi-Finals, Targeting Another Grand Slam Title

Top seed Aryna Sabalenka triumphed over Jovic and now faces Gauff or Svitolina in the semi-finals as