Post by : Monika

Photo: Reuters

In August 2025, house prices in the United Kingdom fell unexpectedly by 0.1% compared to July. This data comes from the Nationwide Building Society, one of the country’s largest mortgage lenders and property analysts.

The decline marks the third consecutive month of falling house prices since April, when a tax break for lower-value homebuyers ended. Year-on-year growth also slowed to 2.1%, which is the weakest pace since June 2024. Economists had expected prices to grow by 2.8%, so this result was below expectations.

This decline in house prices reflects the ongoing difficulties that homebuyers face in the UK, including high mortgage costs, limited affordability, and concerns about potential tax changes. It also shows that despite measures by the Bank of England to help buyers, the housing market is still under pressure.

Key Factors Affecting UK House Prices

Nationwide’s Chief Economist, Robert Gardner, highlighted that one of the main reasons for slower house price growth is affordability. For many first-time buyers, getting a home has become increasingly difficult. With a 20% deposit, the average monthly mortgage payment now consumes around 35% of a person’s take-home pay. This is significantly higher than the long-term average of 30%.

High monthly mortgage payments make it harder for buyers to afford homes, reducing demand in the housing market. When fewer people are able to buy, prices tend to stabilize or fall. For first-time buyers, this challenge is especially serious because they often have smaller savings for deposits and may have existing student loans or other debts.

Even though the Bank of England lowered interest rates to 4% in early August, many potential buyers remain cautious. Low interest rates generally make borrowing cheaper, helping more people buy homes. However, worries about inflation—the rise in the cost of goods and services—could prevent further rate cuts. If inflation remains high, banks may keep interest rates higher to control it. This uncertainty discourages buyers and slows down housing activity.

Impact of Possible Tax Changes

Another important factor affecting buyer confidence is speculation about potential tax increases in the upcoming autumn budget. Reports suggest that the government may consider introducing new taxes, such as a mansion tax on high-value properties.

Economist Ashley Webb warned that uncertainty over property taxes could make buyers hesitate. When buyers are unsure about how much tax they might need to pay in the future, they may delay purchasing a house. This delay can reduce demand in the short term, keeping house prices from rising.

Property taxes can also affect investors and landlords. If taxes on property ownership increase, landlords might raise rents to cover costs, affecting rental markets. Additionally, potential buyers may avoid purchasing new homes, fearing that higher taxes will reduce their financial security.

Housing Market Trends in Different Regions

The fall in house prices does not affect all regions equally. Some areas of the UK are seeing stronger housing demand than others.

London and the South East – House prices in London and nearby areas have slowed due to high costs. London homes remain expensive, and many first-time buyers cannot afford deposits. The slowdown in this region is more pronounced because it is the most expensive housing market in the UK.

Northern England and the Midlands – Some northern cities and midlands areas are still seeing modest price growth. Homes in these regions are more affordable, attracting first-time buyers and investors looking for value.

Scotland and Wales – In these areas, price changes are smaller. Housing markets in smaller cities and rural towns tend to be steadier, but affordability is still a concern.

Overall, the uneven nature of housing demand means that national statistics, like the 0.1% drop, represent an average across the country. Some regions may see rising prices, while others experience sharper falls.

Mortgage Costs and Affordability

Mortgage affordability is a critical factor in the current housing market. High monthly payments limit the number of people who can afford to buy a home. For example, first-time buyers with limited savings may be forced to rent for longer periods.

The situation is even more challenging for young professionals. With student loans, credit card debts, and rising living costs, many potential buyers find it difficult to save for a deposit and manage mortgage repayments at the same time.

Some households may also face rising utility bills and transportation costs, which further limits the amount they can spend on housing. Affordability challenges are therefore a key reason for the slowdown in house price growth.

Effect of Bank of England Interest Rate Decisions

The Bank of England’s decision to lower interest rates to 4% in August was intended to make borrowing cheaper and encourage people to buy homes. Lower interest rates reduce monthly mortgage payments, making homes more affordable for first-time buyers.

However, concerns about inflation and economic uncertainty mean that further rate cuts may not happen immediately. If interest rates remain high, monthly mortgage payments will continue to take a large portion of take-home pay, discouraging buyers. This is a major factor in the slow growth or decline of house prices in the UK.

Potential Consequences of Ongoing Price Decline

If house prices continue to fall or remain flat, several consequences may emerge:

First-Time Buyers – Falling prices can make homes more affordable for first-time buyers in some areas. However, if mortgage costs remain high, the benefits may be limited.

Homeowners and Equity – Existing homeowners may see the value of their property decrease. This can affect their home equity, reducing their ability to borrow against their property for other investments or personal needs.

Housing Market Activity – A lack of demand could slow down the number of property sales, reducing activity for estate agents, mortgage lenders, and construction companies.

Investors and Landlords – Property investors may face lower returns if house prices stagnate or fall. Rental income may become more critical, but potential taxes could affect profitability.

Economic Implications

Housing is an important part of the UK economy. Falling house prices can have broader economic effects:

Consumer Spending – Homeowners who see their property value decline may spend less on goods and services due to reduced wealth and confidence.

Construction Industry – Builders may delay new projects if they expect lower returns, affecting employment and investment in construction.

Banking and Mortgage Lending – Banks may face reduced profits if mortgage demand slows, affecting the financial sector.

Government Revenue – Stamp duty and property taxes may generate less revenue if fewer homes are sold or values decline.

Short-Term Outlook

In the near term, UK house prices are likely to remain flat or grow slowly. Affordability challenges, potential tax changes, and uncertainty about interest rates are all influencing the market.

Some experts believe that price declines could stabilize the market, giving buyers a chance to enter without paying high premiums. Others worry that prolonged stagnation could hurt economic growth and reduce confidence in the housing sector.

Long-Term Outlook

Over the long term, housing demand in the UK is expected to continue growing due to population growth and urbanization. However, affordability will remain a challenge unless wages increase and mortgage costs fall.

Government policies will also play a role. If policies provide support to first-time buyers or promote affordable housing, house prices may recover more quickly. Conversely, higher taxes or stricter regulations could keep prices low for longer.

Government and Policy Measures

The unexpected 0.1% drop in UK house prices in August 2025 highlights key challenges in the housing market. High mortgage costs, affordability issues, and uncertainty about potential taxes are slowing price growth. Despite a recent interest rate cut by the Bank of England, buyers remain cautious.

In the coming months, the housing market is likely to stay subdued. Affordability challenges and potential tax changes will continue to influence buyer behavior, while government policy and interest rate decisions will play a critical role in shaping the market.

For first-time buyers, falling prices may offer some opportunities, but high mortgage payments and economic uncertainty remain significant obstacles. Existing homeowners, investors, and the wider economy are also affected by these trends.

The UK housing market is at a delicate point, balancing affordability challenges with the need for economic stability. Careful monitoring of policies, interest rates, and market trends will be essential to ensure that the housing sector supports both buyers and the overall economy in the coming years.

Kazakhstan Boosts Oil Supply as US Winter Storm Disrupts Production

Oil prices inch down as Kazakhstan's oilfield ramps up production, countered by severe disruptions f

Return of Officer's Remains in Gaza May Open Rafah Crossing

Israel confirms Ran Gvili's remains identification, paving the way for the Rafah border crossing's p

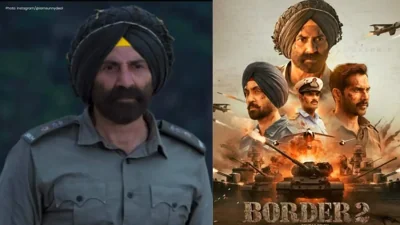

Border 2 Achieves ₹250 Crore Globally in Just 4 Days: Sunny Deol Shines

Sunny Deol's Border 2 crosses ₹250 crore in 4 days, marking a significant breakthrough in global box

Delay in Jana Nayagan Release as Madras HC Bars Censorship Clearance

The Madras High Court halts the approval of Jana Nayagan's censor certificate, postponing its releas

Tragedy Strikes as MV Trisha Kerstin 3 Accident Leaves 316 Rescued

The MV Trisha Kerstin 3 met an unfortunate fate near Jolo, with 316 passengers rescued. The governme

Aryna Sabalenka Advances to Semi-Finals, Targeting Another Grand Slam Title

Top seed Aryna Sabalenka triumphed over Jovic and now faces Gauff or Svitolina in the semi-finals as