Post by : Priya

Photo:Reuters

In recent weeks, global financial markets have appeared unusually stable. Stock prices are holding steady, major indexes are showing modest gains, and panic selling has disappeared—for now. At first glance, this looks like a welcome return to calm after years of high inflation, rising interest rates, and geopolitical tension. But beneath this calm surface, many economists and investors are asking a difficult question: Is this quiet period a sign of strength—or a trap waiting to snap?

A Market That Feels Peaceful—On the Surface

After years of pandemic-related disruption, supply chain troubles, inflation shocks, and aggressive rate hikes by central banks, the world’s financial markets finally seem to have taken a breather. Major stock indexes like the S&P 500, NASDAQ, FTSE 100, and Nifty 50 have shown relatively stable performance since the beginning of 2025.

For investors who endured wild swings in previous years, this period of calm feels almost like a reward. Some have even started calling it the "new normal"—a return to stable growth, where inflation is slowing, interest rates are peaking, and companies are showing consistent earnings. But is this really the start of a lasting recovery?

Why the Calm? A Closer Look at the Drivers

1. Interest Rate Pauses

The biggest factor behind today’s calm markets is the decision by central banks to pause interest rate hikes. After nearly two years of raising borrowing costs to fight inflation, banks like the U.S. Federal Reserve, European Central Bank, and Reserve Bank of India are now holding rates steady.

This pause has provided relief to investors. Higher interest rates usually make borrowing more expensive and hurt business profits. With rate hikes on hold, companies are breathing easier, and consumers may start spending more again.

2. Cooling Inflation

Inflation, which was the biggest economic threat of 2022 and 2023, has been gradually easing in many parts of the world. Prices for food, fuel, and raw materials are stabilizing, and central banks say they are beginning to see results from their earlier rate increases.

Lower inflation helps restore consumer confidence and gives governments more room to support growth. It also makes fixed-income investments like bonds more attractive, which helps balance out stock market pressure.

3. Strong Tech Sector Performance

Big technology companies have delivered better-than-expected profits in the first half of 2025. Firms like Apple, Microsoft, Google’s parent Alphabet, and newer players in the AI and chip industries have posted strong earnings. Their strong balance sheets and global demand for technology products have helped lift market sentiment.

The Hidden Risks Beneath the Calm

While the surface may look calm, several warning signs suggest that markets may not be as safe as they seem.

1. Low Market Volatility Can Be Deceptive

The Volatility Index (VIX), often called the "fear gauge," is at its lowest level in two years. On the one hand, this means that investors feel confident. But on the other hand, it can also mean that the market is being too relaxed—and not pricing in enough risk.

In history, very low volatility has sometimes come before major corrections. When investors become too comfortable, they may overlook hidden dangers, and a single negative event can cause a sharp market reaction.

2. Debt Levels Are Rising

Around the world, both governments and companies are borrowing more money than ever before. In the U.S., public debt has crossed $35 trillion, while in developing countries like Brazil and India, corporate borrowing has hit record highs.

If interest rates rise again—or if economic growth slows—many borrowers may struggle to repay their loans. This could lead to defaults, bankruptcies, and a loss of investor trust.

3. Geopolitical Tensions Remain

Calm markets can be shaken overnight by international events. Rising tensions in the South China Sea, the ongoing conflict between Russia and Ukraine, and political instability in several African nations all pose serious risks. Even a small escalation in these areas can send markets tumbling.

In addition, the 2024 U.S. Presidential elections showed how deeply divided some countries remain. Political uncertainty always carries economic consequences, especially if it affects trade, regulation, or global cooperation.

4. Corporate Earnings May Be Overstated

While some large tech companies are doing well, many smaller firms are struggling. Retail, manufacturing, real estate, and travel industries still show signs of weakness. Some companies are using financial tricks—like stock buybacks or accounting adjustments—to make earnings appear better than they really are.

This creates a risk of disappointment in future quarters, especially if consumer demand slows or costs increase again.

Historical Patterns: Calm Before the Storm?

History offers important lessons. Financial markets have often appeared calm before major downturns:

In 2007, before the global financial crisis, stock markets were setting record highs. Just months later, Lehman Brothers collapsed, and the world entered a deep recession.

In 1999, before the dot-com bubble burst, tech stocks soared and market volatility was low. Within months, billions in market value disappeared.

In 2019, before the COVID-19 pandemic, markets were reaching peak levels. The shock of the virus sent stocks crashing by over 30% in just a few weeks.

Each of these moments began with calm confidence—followed by a fast and brutal correction.

What Are Experts Saying Today?

Mohammed Ameen, Chief Economist at Gulf Capital Markets:

“The lack of market movement is not necessarily a good thing. It often shows that investors don’t know what to expect next. This kind of silence can be dangerous.”

Laura Cheng, Global Investment Strategist:

“We’re in a classic wait-and-see moment. The problem is, when everyone is waiting, the first sign of trouble can cause everyone to run for the exit at the same time.”

Dr. Sanjay Mehra, Financial Historian:

“Periods of calm are sometimes caused not by confidence—but by confusion. When no one is sure what to do, they stop moving. But sooner or later, something breaks that silence.”

The Role of Investor Psychology

Investor behavior plays a huge role in how markets perform. During times of fear, people rush to sell. In good times, they often buy too much. Right now, the mood is somewhere in between: cautious, but not fearful.

This can be a dangerous place. Investors may be ignoring risks while still hoping for rewards. They may be following others instead of doing their own research. And they may not be prepared for how quickly things can change.

How to Navigate the Calm Market Carefully

Calm stock market

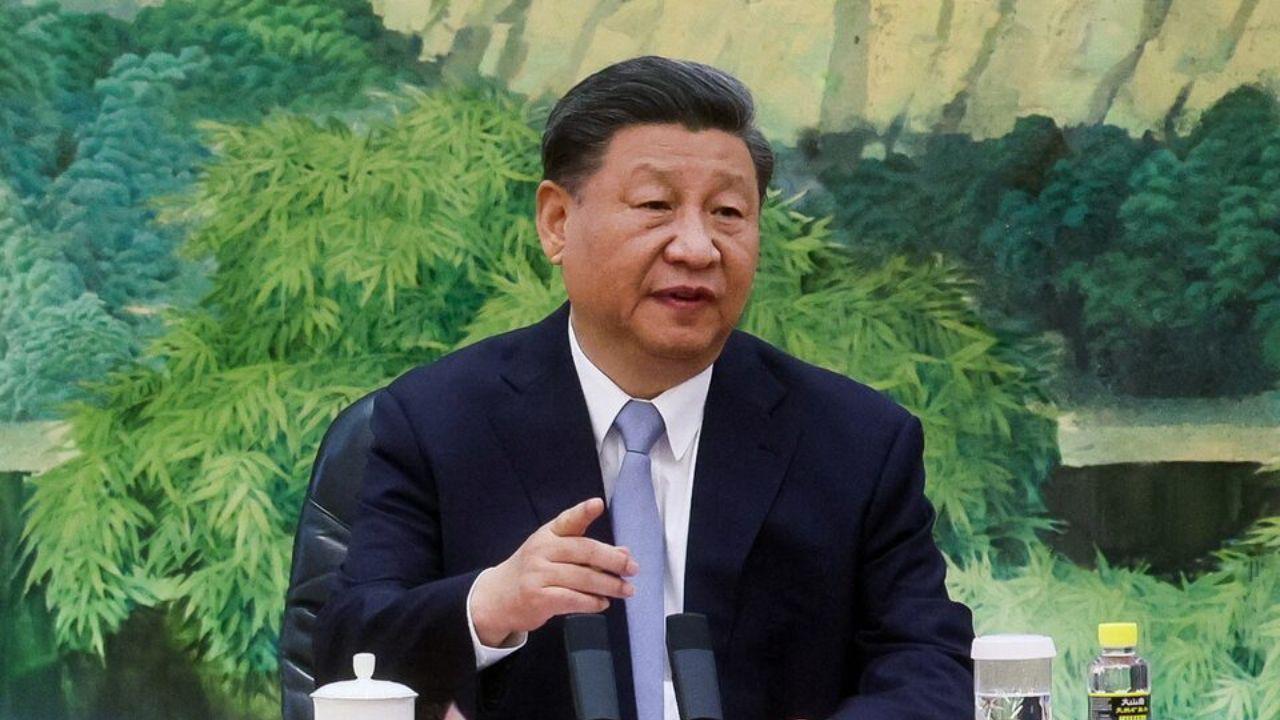

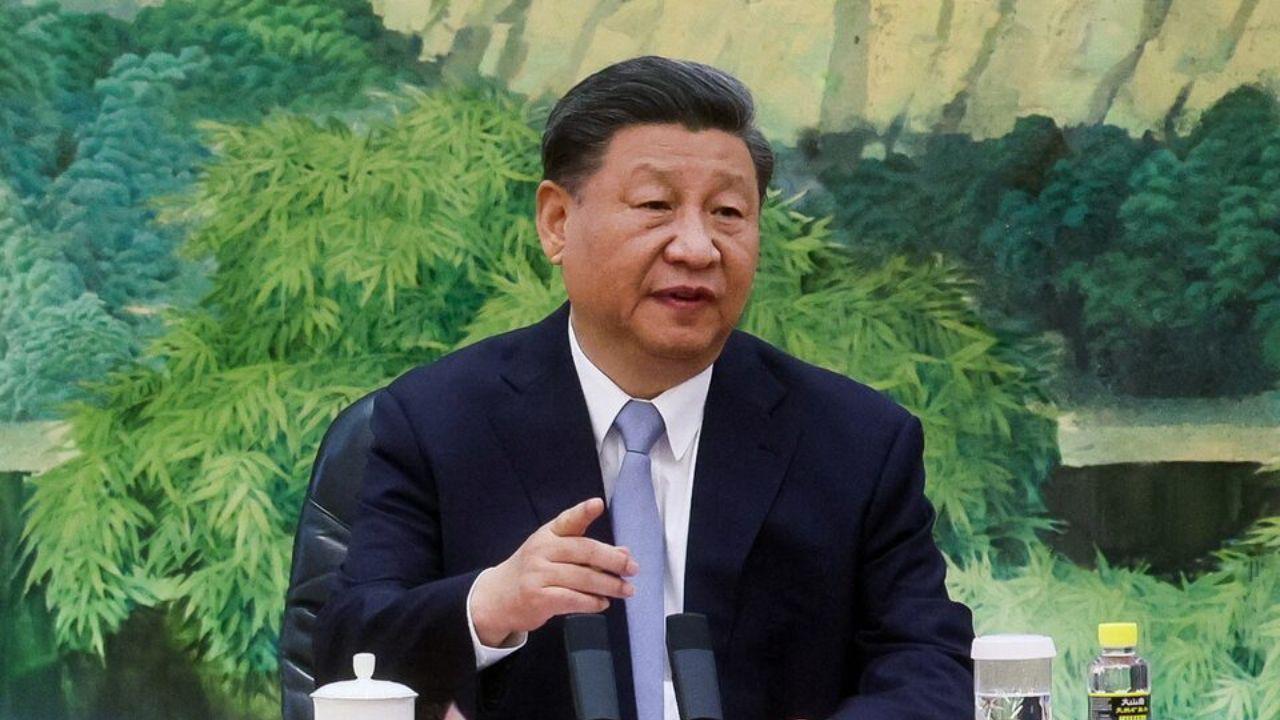

Alibaba Cloud Leads China’s AI Market with 36% Share

Alibaba Cloud captured over one-third of China’s AI cloud market beating rivals and investing billio

Cambodia Defends China’s Belt and Road as Economic Lifeline

Cambodia praises China’s Belt and Road projects, calling them vital for growth rejecting claims of d

Portugal Norway England shine in UEFA World Cup qualifiers

Portugal beats Hungary 3-2 Ronaldo scores Haaland shines for Norway, Kane leads England in dominant

PV Sindhu exits Hong Kong Open HS Prannoy Lakshya Sen win

PV Sindhu loses early at Hong Kong Open HS Prannoy and Lakshya Sen advance in tough battles India's

Iran Signs New Cooperation Deal with UN Nuclear Watchdog in Cairo

Iran agrees to a new framework with UN nuclear agency resuming controlled inspections after June’s c

Syrian man found guilty for deadly festival stabbing in Germany

A Syrian man inspired by IS was convicted for stabbing people at a German festival, killing three an