Post by : Monika

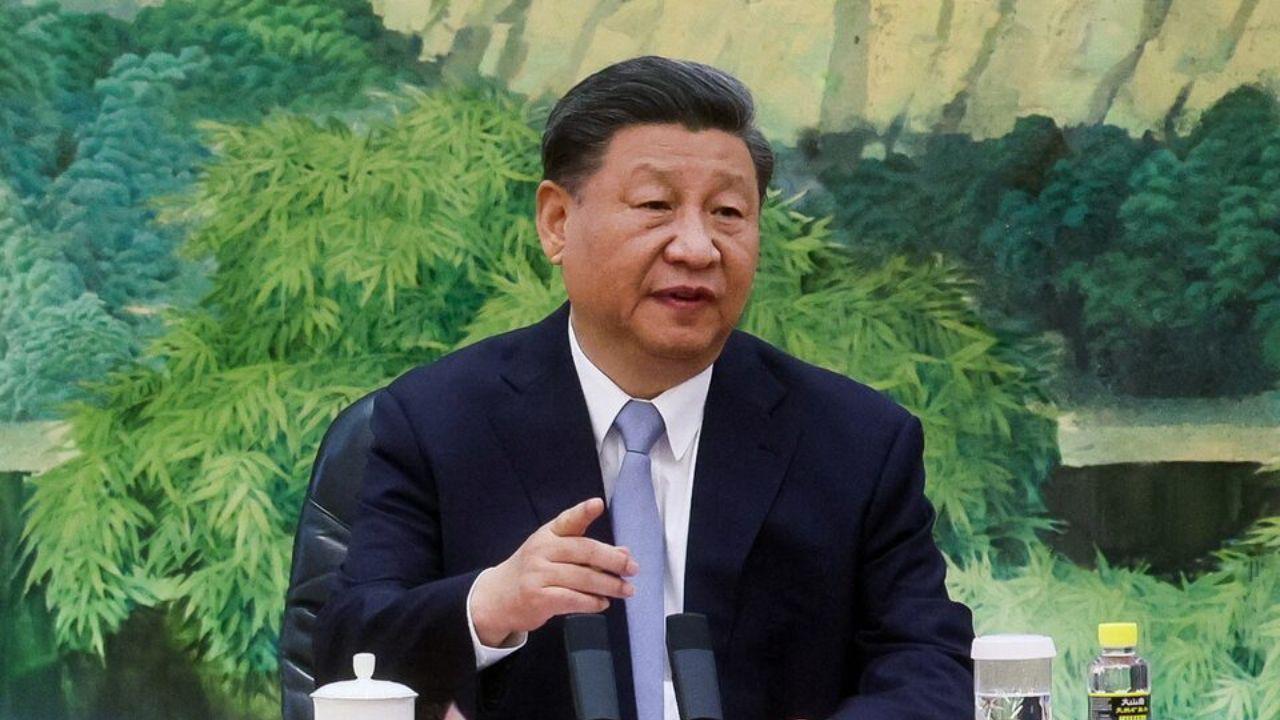

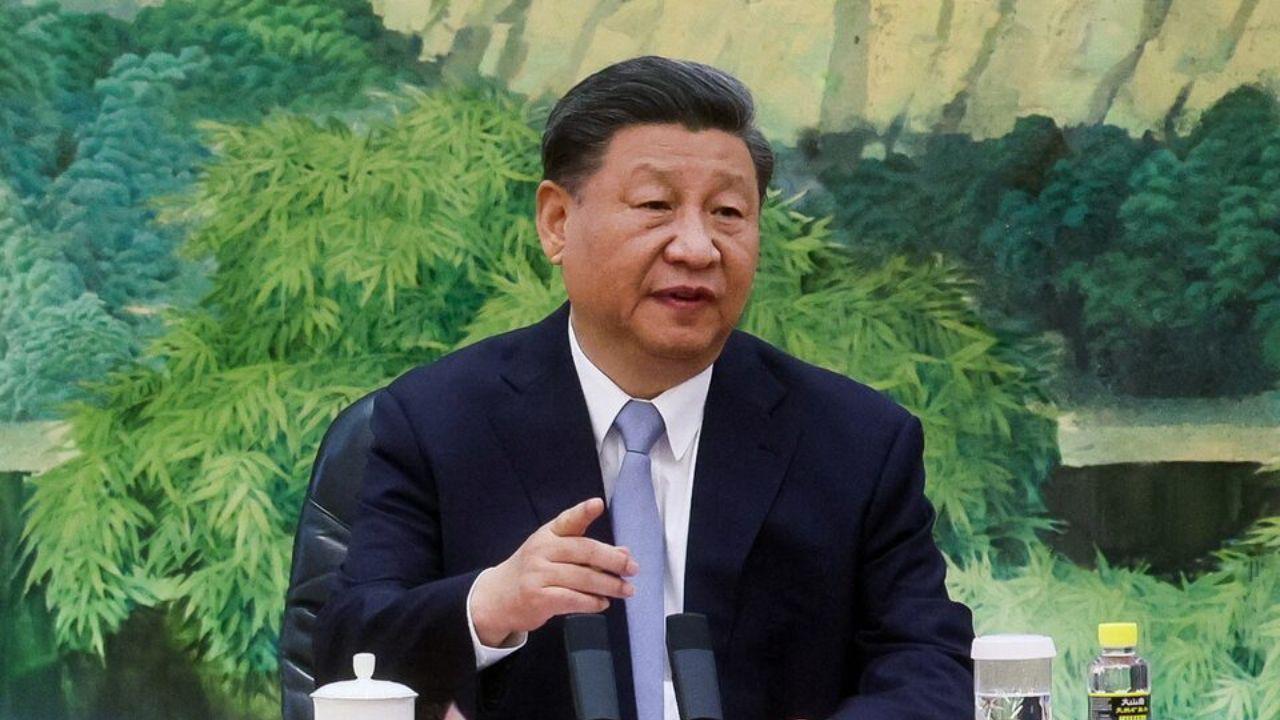

Photo: Reuters

On September 1, 2025, Christine Lagarde, the President of the European Central Bank (ECB), issued a serious warning about potential risks to both the U.S. and the global economy. She highlighted that political actions targeting the independence of the U.S. Federal Reserve could have long-lasting consequences.

Lagarde specifically pointed to President Donald Trump’s attempts to remove key Federal Reserve officials, including Chairman Jerome Powell and Governor Lisa Cook.

She said that undermining the Federal Reserve’s independence could destabilize the American economy and, because of the U.S. dollar’s central role in global trade, could also affect countries around the world.

Central bank independence is a cornerstone of economic stability. It allows experts to make difficult decisions, like controlling inflation or adjusting interest rates, without political pressure. Lagarde emphasized that any threat to this independence could shake investor confidence, disrupt markets, and make economic planning more difficult.

The Role of Central Banks

Central banks, such as the U.S. Federal Reserve or the ECB in Europe, have a special role in the economy. They control monetary policy, which includes setting interest rates, managing inflation, and ensuring financial stability. Their decisions influence everyday aspects of the economy, such as loan rates, mortgage costs, and the value of the national currency.

The independence of central banks means that they can make these decisions based on economic data rather than political goals. For example, lowering interest rates might help stimulate growth,

but it may not always align with a politician’s agenda. Lagarde stressed that when central banks lose independence, policies may become inconsistent or unpredictable, which can cause economic instability both domestically and internationally.

Trump’s Interference and Its Implications

President Trump has been publicly critical of Federal Reserve Chairman Jerome Powell, particularly for not lowering interest rates quickly enough. He believes that lower rates would boost economic growth and help American workers. Trump has also attempted to remove Governor Lisa Cook from her position at the Federal Reserve.

Lagarde warned that these actions could be extremely risky. If politicians interfere with central bank decisions, it may lead to sudden changes in economic policy, which can confuse markets and create uncertainty. Investors may lose confidence in the U.S. economy, leading to lower investment, rising borrowing costs, and more volatile financial markets.

She further explained that the U.S. Federal Reserve is considered a global benchmark for central bank policy. Any disruption to its independence could encourage similar political interventions in other countries, spreading economic instability worldwide.

Legal Challenges and Economic Uncertainty

Adding to the uncertainty, a U.S. appeals court recently ruled that most of President Trump’s tariffs were illegal. Tariffs are taxes imposed on imported goods, and Trump had used them to try to reduce trade deficits. While intended to protect U.S. industries, these tariffs had far-reaching effects on international trade.

The court ruling invalidated many of these tariffs, creating uncertainty for businesses and investors. Traders, manufacturers, and exporters now face unpredictable costs and changing rules for importing and exporting goods. Lagarde noted that this legal uncertainty adds another layer of risk to the already fragile economic situation.

Global Market Reactions

Lagarde’s warnings were echoed by other international leaders. Olli Rehn, a senior ECB official, also expressed concern about political interference in central banks. Rehn said that undermining central bank independence could lead to higher inflation and slow economic growth.

Financial markets reacted to these warnings. When investors lose confidence in central banks’ ability to act independently, they may move funds away from affected currencies or countries.

In this case, concerns about the U.S. Federal Reserve led to fluctuations in the value of the U.S. dollar. Investors also began paying closer attention to European and Asian currencies, seeking stability in uncertain times.

Central bank independence is closely linked to interest rates, currency values, and global trade. Any disruption in the U.S. Federal Reserve’s decision-making could ripple through international markets, affecting companies, governments, and consumers around the world.

Impact on Inflation and Economic Growth

Lagarde highlighted the connection between political interference, inflation, and economic growth. Inflation occurs when prices rise over time, reducing the purchasing power of money. Central banks use interest rates to control inflation.

If politicians force central banks to make decisions for short-term political gains, inflation may rise uncontrollably. This could make goods and services more expensive for everyday citizens. On the other hand, inconsistent policies may slow economic growth because businesses cannot plan confidently for the future.

For the global economy, any disruption in U.S. monetary policy could affect trade, investment, and financial stability. Since the U.S. dollar is widely used in international trade and reserves, changes in its value can have far-reaching effects. Lagarde stressed that these risks are not just domestic; they are global.

Importance of Stability for Investors and Businesses

Investors and businesses rely on predictable policies to make long-term decisions. When central banks operate independently, they provide a sense of security. Companies can plan investments, hire workers, and expand operations knowing that monetary policy is based on economic realities rather than political pressure.

Lagarde warned that when political interference threatens this stability, markets may become volatile. Stock prices can fluctuate rapidly, borrowing costs may rise, and investment may slow down. Businesses may delay expansion plans, and global supply chains could face disruptions.

Trade Relations and International Impact

The potential disruption to U.S. Federal Reserve independence also affects international trade. A weaker or unstable U.S. economy can reduce demand for imports from other countries, affecting global trade balances. Businesses around the world that rely on U.S. consumers may face decreased sales.

Moreover, countries that peg their currency to the U.S. dollar or hold large reserves in dollars could face economic shocks if the dollar becomes unstable. This makes the independence of the Federal Reserve not just an American issue, but a matter of international concern.

Lagarde’s Recommendations

Christine Lagarde urged that central bank independence must be protected at all costs. She called on governments and political leaders to respect the boundaries between political authority and monetary policy.

She also emphasized the need for international cooperation. Global economic stability requires that central banks around the world act responsibly and independently. By maintaining clear boundaries between politics and economics, policymakers can ensure long-term growth and avoid sudden shocks in financial markets.

Looking Ahead

The situation in the United States remains closely watched by economists, investors, and policymakers worldwide. Any further attempts to influence Federal Reserve decisions could heighten global economic risks. Lagarde’s warning serves as a reminder of the delicate balance needed to maintain stability in both domestic and international economies.

Traders, investors, and business leaders will be monitoring U.S. political developments and Fed actions carefully. Decisions made in Washington D.C. will continue to have ripple effects across global financial markets. Maintaining central bank independence is seen as a key factor in minimizing risks and promoting sustainable economic growth.

ECB President Christine Lagarde’s warning highlights a critical issue for both the U.S. and the global economy: the importance of central bank independence. Political interference in the U.S. Federal Reserve could destabilize the economy, increase inflation, and create uncertainty in global financial markets.

Lagarde emphasized that protecting the autonomy of central banks is essential for investor confidence, stable trade relations, and long-term economic growth. The recent court ruling on tariffs and ongoing political actions in the U.S. only add to the uncertainty, making her warning particularly timely.

Global economies are interconnected, and actions taken in the United States can have far-reaching effects. Investors, businesses, and governments worldwide need to be aware of these risks and plan accordingly. Lagarde’s message is clear: safeguarding central bank independence is not just a national concern, it is a global necessity.

By ensuring that central banks operate free from political pressure, countries can promote economic stability, protect investor confidence, and maintain sustainable growth. The world is watching closely as developments in the U.S. continue to unfold, and the consequences will be felt far beyond American borders.

ECB President Christine Lagarde

Alibaba Cloud Leads China’s AI Market with 36% Share

Alibaba Cloud captured over one-third of China’s AI cloud market beating rivals and investing billio

Cambodia Defends China’s Belt and Road as Economic Lifeline

Cambodia praises China’s Belt and Road projects, calling them vital for growth rejecting claims of d

Portugal Norway England shine in UEFA World Cup qualifiers

Portugal beats Hungary 3-2 Ronaldo scores Haaland shines for Norway, Kane leads England in dominant

PV Sindhu exits Hong Kong Open HS Prannoy Lakshya Sen win

PV Sindhu loses early at Hong Kong Open HS Prannoy and Lakshya Sen advance in tough battles India's

Iran Signs New Cooperation Deal with UN Nuclear Watchdog in Cairo

Iran agrees to a new framework with UN nuclear agency resuming controlled inspections after June’s c

Syrian man found guilty for deadly festival stabbing in Germany

A Syrian man inspired by IS was convicted for stabbing people at a German festival, killing three an