Post by : Sami Jeet

Impulse spending can silently devastate your finances. A minor purchase here and an impulsive online buy there may seem inconsequential at first, yet these small decisions accumulate, leading to significant financial drain over time. To cultivate a better savings habit and fully eliminate buyer's remorse, it is essential to adopt a structured approach that minimizes impulse buys and promotes considered actions. The straightforward 30-24 Rule stands out as a potent strategy to empower you to pause, reflect, and make informed buying choices.

Impulse purchases primarily arise from emotional stimuli rather than rational thought. Factors like attractive discounts, feelings of stress or boredom, social influences, and targeted marketing often sway your decision-making without you realizing. The ease of click-button shopping further exacerbates this issue.

Time-sensitive offers prompt hasty choices, while emotional moments like jubilation or sadness might push you to indulge. Social media advertisements often create unrealistic wants, and the simplicity of digital transactions diminishes the perceived burden of spending.

Awareness of these triggers is crucial for regaining financial insight.

The 30-24 Rule operates on two levels of decision-making, designed to decelerate impulse purchases and encourage deliberate spending.

If an item costs less than $30, delay the purchase by 24 hours. For items over $30, extend that waiting period to 72 hours.

This guideline compels you to pause, fostering a gap between desire and action, allowing your mind to transition from impulse to logical evaluation.

With time, the excitement fueling impulsive buying diminishes, reducing the emotional drive that leads to dissatisfaction stemming from unnecessary purchases.

Time encourages thoughtful reflection. By postponing purchases, you activate the logical regions of your brain. Emotional impulses tend to lighten within hours, lessening the urge. When the thrill of instant gratification fades, it becomes clearer whether the item genuinely adds value.

Surprisingly, most individuals discover they have little interest in the item after the waiting period.

The 30-24 Rule is applicable whether you're shopping in person, browsing online, or scrolling through social media.

Place the item in your shopping cart but refrain from checking out. You can bookmark the product or save it for later. Set reminders for 24 or 72 hours afterward. Ask if you can truly live without it.

More often than not, the desire wanes, leading to savings and alleviating financial guilt.

Creating a Want Later list can help you maintain control without the distress of outright denial.

Instead of saying “no” to yourself, reframe it as “not right now.” This perception allows you to sidestep purchases while genuinely feeling in control.

Over time, many items on this list may lose their initial allure.

For enhanced effectiveness, pair the 30-24 Rule with a weekly review process.

Reflect on temptations you faced, what you delayed purchasing, and how much you saved that week.

Observing your progress fosters discipline and provides motivation to persist.

If impulsive purchases are problematic, consider limiting payment methods that facilitate rapid spending.

Remove saved cards from shopping apps. Retain only one card for essential expenses, and withdraw cash for personal spending while sticking to that limit.

Ensuring multiple steps are involved in any purchase can decrease the likelihood of impulse buying.

Certain environments can almost guarantee impulse buys.

Malls, festival sales, online flash discounts, and targeted social media promotions.

Employing the 30-24 Rule in these contexts can spare you from unnecessary pitfalls.

Achieving financial discipline isn't about perpetual restriction—it's about aligning decisions with your long-term objectives.

Remind yourself of your financial goals, visualize the rewards of long-term stability, keep track of your advancements weekly, and recognize emotional triggers to swap them for non-spending activities like journaling or taking a walk.

A robust mindset reinforces your adherence to the rule, making it increasingly instinctive over time.

The 30-24 Rule is easy to implement but can yield substantial dividends. It slows emotional decision-making, mitigates regret, and empowers considered purchases. When combined with conscious spending practices, weekly reflections, and mindful triggers, it can transform your financial management. With consistent adherence, you will find yourself reducing expenditures, increasing savings, and embracing a sense of financial control.

This article is for general financial knowledge and should not substitute for professional advice. Financial situations vary for everyone, and techniques discussed may not apply universally. Consult a certified financial advisor for personalized recommendations before making significant financial decisions.

Duke Triumphs Thanks to Cameron Boozer's 35-Point Showcase Against Arkansas

Duke secures an 80-71 victory over Arkansas as Cameron Boozer scores 35 points, celebrating Thanksgi

Palash Muchhal's Health Update Following Wedding Stress Incident

Palash Muchhal has been discharged after being hospitalized due to a stress-related issue from his w

Ajay Devgn Reflects on 28 Years Since Ishq’s Release

Ajay Devgn marks 28 years of Ishq with heartfelt memories and celebrates the impact the film had on

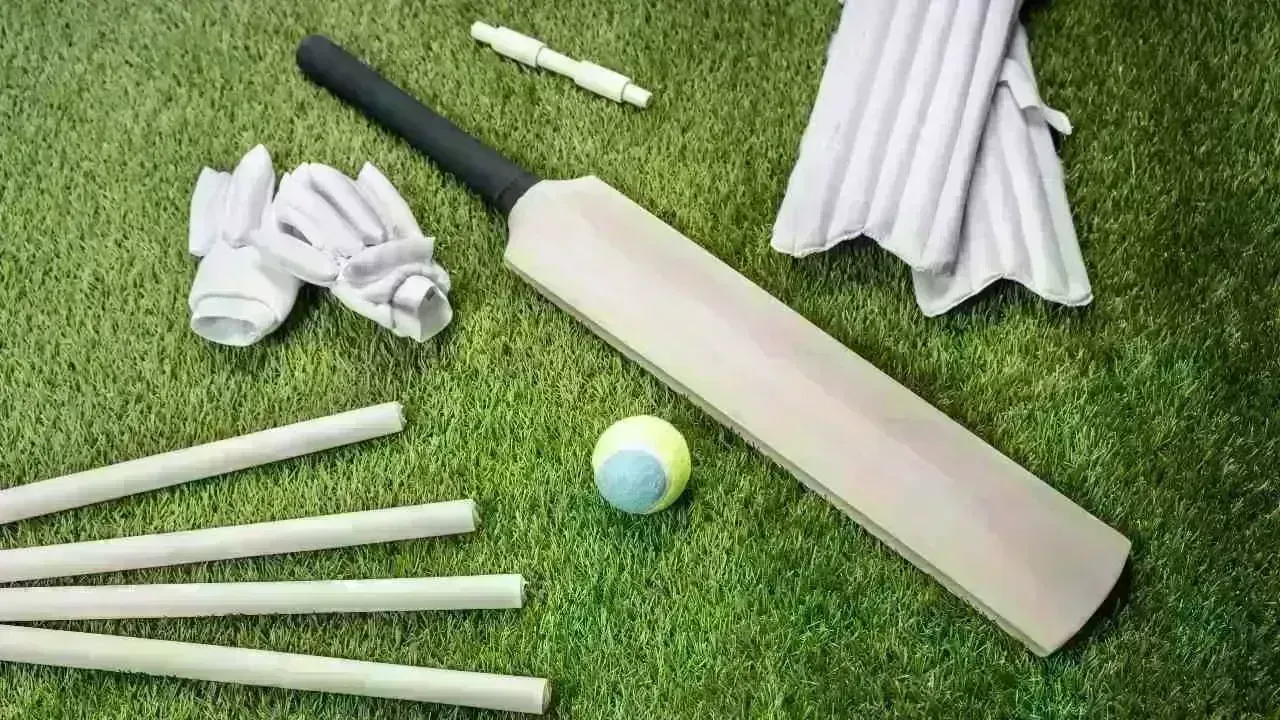

Saudi Arabia Set to Launch Women's World T20 Challenge in 2026

Starting in 2026, Saudi Arabia will host its first women's professional cricket tournament, featurin

Ayush Mhatre Appointed Captain of India for Under-19 Asia Cup in Dubai

The BCCI announces Ayush Mhatre as captain for the Under-19 Asia Cup starting December 12, highlight

Virat Kohli Visits MS Dhoni's Home in Ranchi Ahead of ODI

Kohli's visit to Dhoni's home sparks excitement among fans in Ranchi before the India–South Africa O