Post by : Saif Nasser

Core consumer inflation in Tokyo remained well above the Bank of Japan’s (BOJ) 2% target in November, signaling a possible interest rate increase in the near future. Rising food prices and steady inflation excluding fresh food and energy have strengthened the case for a policy tightening by the central bank.

Data showed Tokyo's core consumer price index (CPI), excluding fresh food, rose 2.8% year-on-year in November, steady from October and slightly above market expectations of 2.7%. Another key measure that removes both fresh food and fuel costs also rose 2.8%, matching the previous month’s pace.

The increase in core prices was driven largely by higher food costs. Rice prices surged 38.5%, coffee beans rose 63.4%, and chocolate increased 32.5% compared to last year. Service-sector inflation remained modest at 1.5%, while goods prices climbed 4.0%, indicating stronger inflation pressures in physical goods.

Other economic indicators suggest Japan is navigating the impact of rising U.S. tariffs. Retail sales and factory output rose in October, while the unemployment rate held steady at 2.6%. Factory output grew unexpectedly by 1.4%, boosted by strong automobile production. However, manufacturers expect industrial production to decline in the coming months, signaling potential challenges ahead.

Analysts say that the BOJ is likely to resume its tightening cycle soon. Marcel Thieliant, head of Asia-Pacific at Capital Economics, noted, “With the labor market still tight and inflation excluding fresh food and energy set to remain above 3% for now, the Bank of Japan will resume its tightening cycle over the next couple of months.”

The recent weakening of the yen to 10-month lows also adds pressure on the BOJ. A weaker yen pushes up import costs, especially food, increasing the risk of persistent inflation. Some policymakers have warned that delaying rate hikes could further burden households with higher living costs.

Japan exited its decade-long ultra-loose stimulus last year and raised interest rates to 0.5% in January. Since then, the BOJ has held rates steady to assess economic impacts. But the current inflation data, combined with a falling yen and tight labor market, suggest that board members are increasingly in favor of a rate increase.

Reflationist advisers of Prime Minister Sanae Takaichi have cautioned against an early hike, citing weaker consumption and a contraction in GDP in the third quarter. However, analysts argue that raising rates soon could stabilize the yen and help control rising import prices.

In summary, Tokyo’s persistently high core inflation and rising food costs are bringing the BOJ closer to a rate hike, with the central bank weighing both domestic pressures and global trade challenges in its December policy meeting.

Duke Triumphs Thanks to Cameron Boozer's 35-Point Showcase Against Arkansas

Duke secures an 80-71 victory over Arkansas as Cameron Boozer scores 35 points, celebrating Thanksgi

Palash Muchhal's Health Update Following Wedding Stress Incident

Palash Muchhal has been discharged after being hospitalized due to a stress-related issue from his w

Ajay Devgn Reflects on 28 Years Since Ishq’s Release

Ajay Devgn marks 28 years of Ishq with heartfelt memories and celebrates the impact the film had on

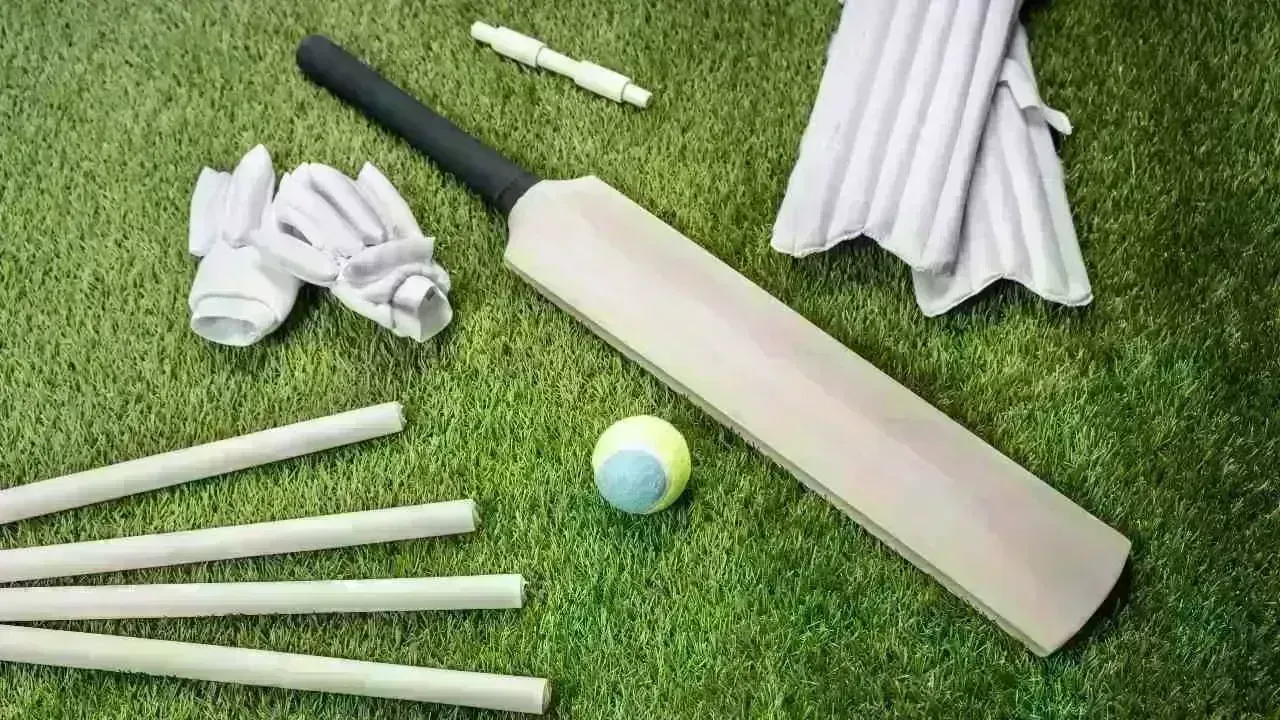

Saudi Arabia Set to Launch Women's World T20 Challenge in 2026

Starting in 2026, Saudi Arabia will host its first women's professional cricket tournament, featurin

Ayush Mhatre Appointed Captain of India for Under-19 Asia Cup in Dubai

The BCCI announces Ayush Mhatre as captain for the Under-19 Asia Cup starting December 12, highlight

Virat Kohli Visits MS Dhoni's Home in Ranchi Ahead of ODI

Kohli's visit to Dhoni's home sparks excitement among fans in Ranchi before the India–South Africa O