Post by : Sami Jeet

Making informed financial choices today is crucial for ensuring long-term security. Whether you're embarking on your financial journey or looking to improve after previous missteps, even minor adjustments can significantly enhance your financial standing. Consistency, discipline, and strategic actions yielding compounding benefits are key. This guide outlines immediate steps for maximizing your savings, minimizing risks, and establishing a solid financial future.

Prior to diving into advanced financial strategies, it is vital to assess your current financial situation.

Examine your income alongside fixed expenses, outstanding debts with their interest rates, savings, and discretionary spending.

This comprehensive view enables you to pinpoint leaks and opportunities for improvement. Skipping this step may result in repeating old financial habits.

Establishing an automation process takes willpower out of the equation. By consistently transferring a portion of your income into savings, you ensure discipline with minimal effort.

You prioritize savings before expenditures. This system ensures you won’t skip saving during tight periods. Your funds accumulate steadily over time.

Set aside specific accounts for savings, emergencies, and investments, automating transfers immediately upon receiving your salary.

Unexpected expenses can wreak havoc on financially unprepared individuals.

Three to six months’ worth of essential expenses, or nine to twelve months for fluctuating incomes.

Consider high-yield savings accounts or liquid mutual funds. A well-maintained emergency fund safeguards you from resorting to high-interest loans or tapping into investments.

Debt accruing at high-interest rates can outpace investment returns. Settling this debt early guarantees returns by eliminating further interest payments.

Focus on credit card debt, personal loans, and buy-now-pay-later obligations.

Pay more than the minimums. Consider shifting balances to lower-interest accounts. Utilize bonuses or additional income to pay down principal amounts.

This straightforward budgeting framework organizes your after-tax income into three actionable categories.

50% for necessary expenses like rent and utilities.

30% for discretionary spending including entertainment and hobbies.

20% for savings, investments, and debt repayment.

This strategy establishes balance while preventing lifestyle inflation.

You don’t need a large initial investment to begin; timing is crucial.

Consider index funds, SIPs, ETFs, and diversified mutual funds.

Compounding benefits maximize with time. Even modest investments can blossom into significant wealth.

Concentrating all your assets in one area can increase vulnerability. Diversifying reduces overall risk across various asset classes.

Maintain a savings account for liquidity, fixed deposits or bonds for stability, and investments for growth through SIPs. Including gold can offer protection in times of crisis.

Monthly assessments can obscure overspending trends. Weekly reviews enhance control.

Utilize an app or spreadsheet to categorize expenditures into food, transport, entertainment, and other areas. Set aside time each Sunday to evaluate totals.

This habit can significantly boost savings by curtailing mindless spending.

A solid credit score enhances access to loans, rental approvals, and job opportunities.

Ensure timely bill payments, keep utilization below 30%, and refrain from multiple loan applications.

Maintaining a good credit score opens doors to better financial opportunities and lower interest rates.

Consider insurance a protective measure rather than just an expense.

Health insurance for medical expenses, term insurance for family protection, and comprehensive coverage for vehicles and homes are essential.

Insurance acts as a safeguard in emergencies.

Though saving is beneficial, income potential is limitless.

Focus on digital marketing, data analysis, AI technologies, proficient communication, and specialized technical abilities.

Increased income accelerates your ability to save, repay debt, and invest successfully.

Clear goals make financial growth more manageable.

Goals may include purchasing a home, building retirement savings, launching a business, or generating passive income.

Decomposing these into yearly and monthly milestones creates achievable pathways for progress.

Economic conditions, income, and personal priorities shift over time. Regular assessments allow necessary adjustments.

Examine your budget, investments, debts, emergency reserves, and insurance coverage.

Periodic reviews help keep your financial strategies aligned with your evolving goals.

Enhancing your financial outlook does not require drastic measures. It’s about a series of small, intelligent decisions—automating savings, managing debts, diversifying investments, improving income, and staying committed. The earlier you start, the sooner your finances will flourish in your favor. Prioritize daily habits over one-off actions for sustainable security. Begin today, remain steadfast, and your future self will appreciate it.

This article provides general financial guidance and does not substitute for personal financial advice. Individual situations vary, and readers are encouraged to consult certified financial professionals before making investment, savings, or debt-related decisions. The author assumes no responsibility for any financial outcomes stemming from this information.

Duke Triumphs Thanks to Cameron Boozer's 35-Point Showcase Against Arkansas

Duke secures an 80-71 victory over Arkansas as Cameron Boozer scores 35 points, celebrating Thanksgi

Palash Muchhal's Health Update Following Wedding Stress Incident

Palash Muchhal has been discharged after being hospitalized due to a stress-related issue from his w

Ajay Devgn Reflects on 28 Years Since Ishq’s Release

Ajay Devgn marks 28 years of Ishq with heartfelt memories and celebrates the impact the film had on

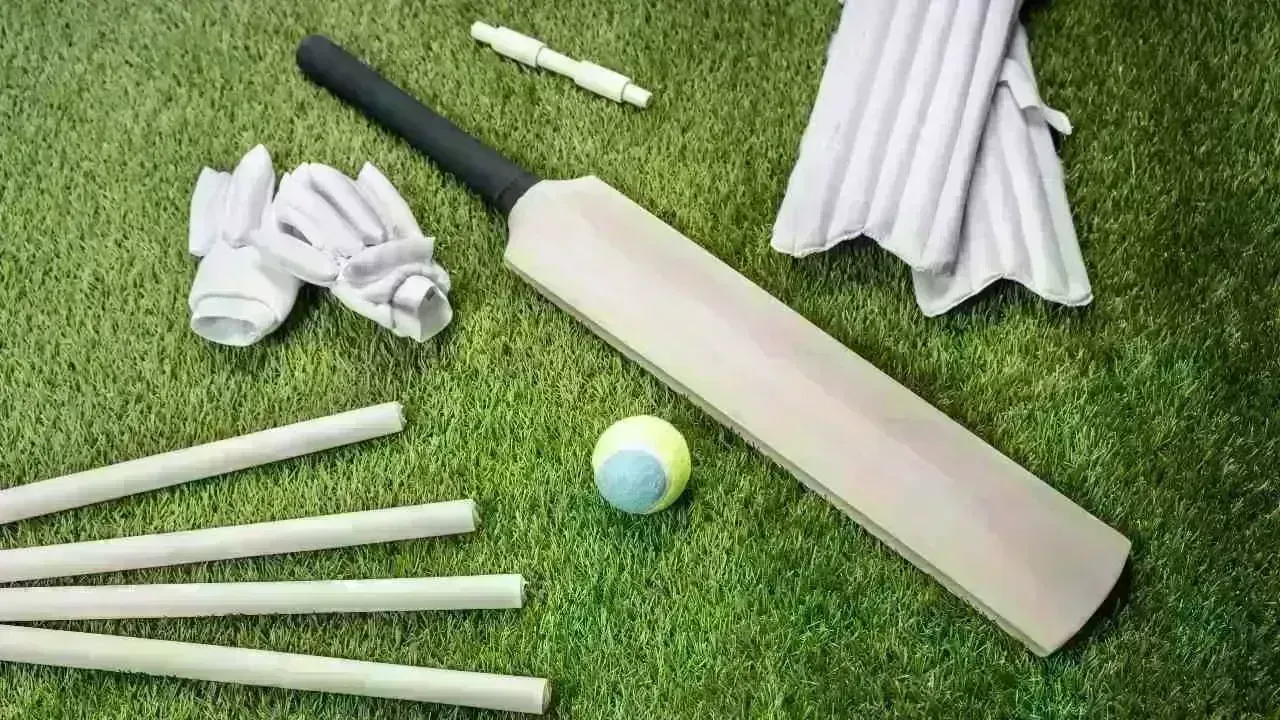

Saudi Arabia Set to Launch Women's World T20 Challenge in 2026

Starting in 2026, Saudi Arabia will host its first women's professional cricket tournament, featurin

Ayush Mhatre Appointed Captain of India for Under-19 Asia Cup in Dubai

The BCCI announces Ayush Mhatre as captain for the Under-19 Asia Cup starting December 12, highlight

Virat Kohli Visits MS Dhoni's Home in Ranchi Ahead of ODI

Kohli's visit to Dhoni's home sparks excitement among fans in Ranchi before the India–South Africa O