Post by : Naveen Mittal

Emirates Global Aluminium (EGA), one of the largest aluminium producers in the UAE, is reportedly exploring a takeover of Companhia Brasileira de Alumínio (CBA), according to market sources. CBA is an integrated Brazilian aluminium firm that operates across the full value chain—from bauxite mining and refining to smelting and product manufacturing. EGA is working with Morgan Stanley as its adviser in assessing the potential deal. CBA is controlled by Brazilian conglomerate Votorantim, which owns a 69% stake.

CBA’s all-inclusive operations make it a coveted asset. Its control over upstream mining rights, refining capacity, and downstream plants gives it flexibility that many aluminium producers lack. For EGA, acquiring CBA would bolster its vertical integration, secure raw material supplies, and expand its footprint across Latin America—diversifying supply risks and enhancing competitiveness in a volatile commodity environment.

CBA’s shares jumped around 6% in early trading after news of EGA’s interest surfaced, highlighting investor optimism about a possible acquisition. The Brazilian firm is valued at roughly $487 million on the markets, making it a mid-sized target in the global metals M&A landscape.

There are several hurdles ahead. First, regulatory approvals in Brazil are likely to be demanding given CBA’s strategic resources and national interest in aluminium and mining sectors. Second, EGA will need to manage integration risks—merging corporate culture, environmental compliance standards, and supply chain logistics across regions. Third, global aluminium prices remain volatile, influenced by trade tensions, energy costs, and carbon regulations. EGA itself recently forecast continued price fluctuations due to trade friction and tariff pressures.

This potential acquisition aligns with EGA’s broader strategy of expanding globally. The company has already laid out plans for a $4 billion aluminium smelter in Oklahoma, its first new primary aluminium plant in the U.S. since the 1980s. For that project, EGA has been negotiating power supply and incentives with local authorities. The CBA deal would further deepen EGA’s global supply chain presence and help it hedge against regional disruptions.

• Whether EGA files a formal offer and the terms of any bid

• Regulatory and antitrust scrutiny in Brazil

• How EGA plans financing and debt structure for the acquisition

• Reaction from existing shareholders such as Votorantim

• The impact on aluminium markets: pricing, capacity, and industry consolidation

This article is based on publicly available reporting and credible sources as of October 2025. It is intended for informational purposes and does not constitute financial or investment advice. Readers should refer to official statements and financial filings for confirmation of developments.

EGA, CBA, aluminium acquisition, mining M&A, UAE industry, metals & mining, vertical integration, global expansion, commodity markets, strategic investment

Taylor Swift's 'The Life of a Showgirl' Breaks Sales Records

Taylor Swift's new album, 'The Life of a Showgirl,' sold 2.7 million copies on its first day, breaki

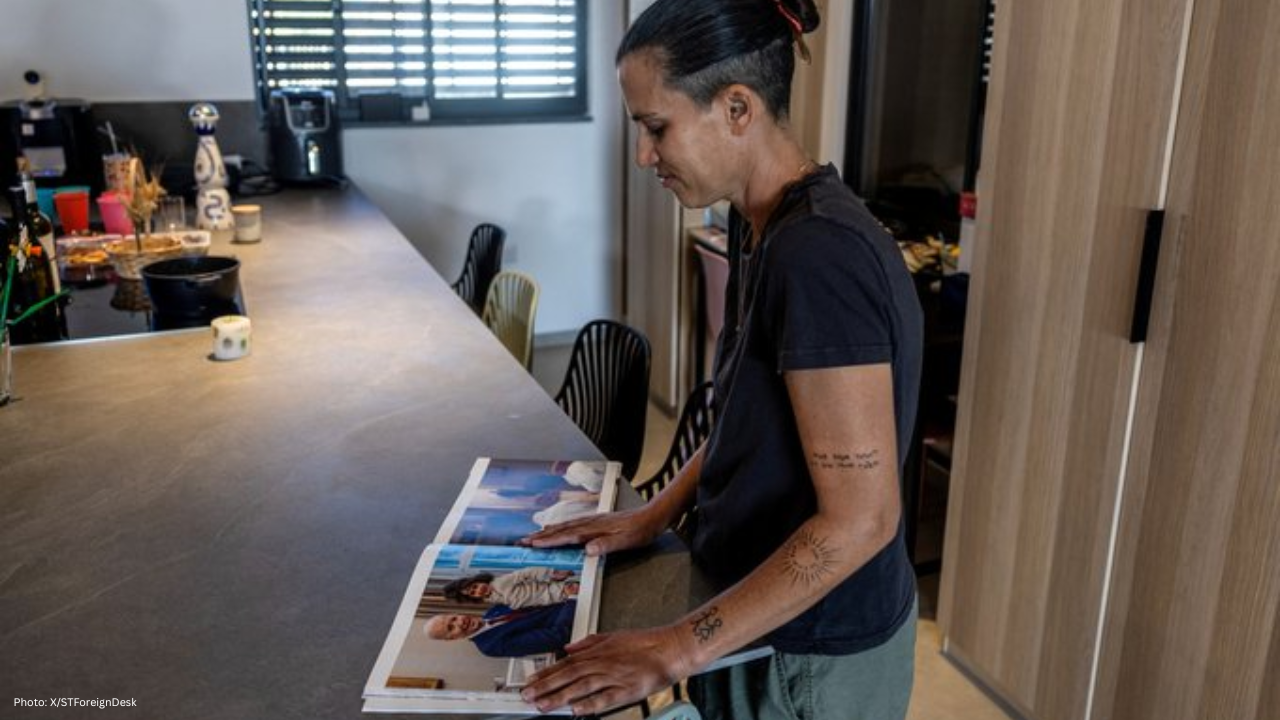

Israel Marks 2 Years Since Hamas Attack Amid Ongoing War

Israel commemorates two years since Hamas's deadly attack; war continues with hostages still held, a

Yen Falls to Two-Month Low After Japan Election

The Japanese yen drops to a two-month low against the dollar and hits a record low against the euro

Global Markets Pause After AI Surge; Fed Speeches Awaited

Global stocks hit record highs due to AI deals and mergers; markets await Federal Reserve signals am

UEFA Approves Milan and Barcelona Matches Abroad

UEFA allows AC Milan and Barcelona to play league matches abroad, but says it is an unusual exceptio

Amateurs Get Shot at Big Win in Aussie Open One-Point Contest

In 2025, 10 amateur tennis players will face top pros in a one-point “Million Dollar” contest at the