Post by : Sami Jeet

Embarking on your investment journey can seem daunting, especially with the abundance of online advice and overwhelming choices. However, entering the investment world doesn't necessitate intricate strategies or expert knowledge. What beginners need is a structured approach that safeguards their funds, minimizes risk, and promotes gradual, long-term growth. This guide outlines the most secure and user-friendly method for novice investors to start investing with confidence and clarity.

As newcomers, it's tempting to be lured by high-return claims, trending stocks, and quick-fix shortcuts. Yet, errors like investing excessively at the outset, pursuing quick gains, or relying on unverifiable tips can lead to early setbacks, impeding long-term investment goals. A safe investment framework fosters steady growth, enhances market understanding, and nurtures confidence prior to taking more substantial financial risks.

Before diving into investing, novices should first ensure their financial stability.

Aim to save between three to six months' worth of expenses to shield yourself from premature withdrawals during market fluctuations.

High-interest debts, like credit card dues, can quickly siphon off potential investment gains. Addressing these debts first enhances your overall financial safety.

This simple, structured, low-risk method is well-suited for those completely new to investing.

Index funds are ideal for beginners as they disperse investments across numerous companies, lowering risk while ensuring consistent growth.

They offer benefits such as low costs, automatic diversification, reliable long-term performance, and minimal maintenance.

Beginning with a broad-market index fund is typically the safest option for novice investors.

Not all of your funds should be exposed to the market. Secure investments safeguard your principal while delivering a dependable return.

This segment serves as your financial cushion, particularly valuable in volatile market conditions.

This portion is your optional exploration budget. It provides practical experience on market functioning without jeopardizing your complete savings.

You could experiment with blue-chip stocks, minor SIPs, or straightforward ETFs.

The aim is to learn through involvement while maintaining manageable risks.

New investors frequently face challenges in selecting individual stocks, timing the market, and analyzing companies. Index funds simplify these complexities.

They reflect the market's long-term growth trajectory. They require almost no extensive research. They help avoid stock-picking errors. They recover efficiently following economic downturns.

Consequently, they stand out as the safest, simplest, and most dependable instrument for first-time investors.

Rather than investing a lump sum upfront, beginners should adopt a systematic investment plan.

SIPs mitigate risk through rupee-cost averaging. They cultivate investment discipline automatically and facilitate steady wealth accumulation over time.

When using SIPs, market volatility becomes less daunting as your investments proceed consistently.

Many novices mistakenly venture into too many investment products at once. Safe investing thrives on simplicity.

Start with one index fund, one secure savings vehicle, and one exploratory investment.

You may expand your portfolio only after gaining insight into how each tool functions.

Short-term trading tends to incite anxiety, while long-term strategies lay the groundwork for wealth accumulation.

Markets naturally appreciate over time. Compounding enhances returns. Emotional decisions diminish.

Holding investments over a span of five to ten years greatly amplifies both safety and potential profits.

Safe investing entails evading pitfalls that lead to initial losses.

Jumping into trending stocks, investing without an emergency fund, overreacting to market fluctuations, heeding unverified financial advice, and expecting immediate returns.

Maintaining discipline ultimately shields both your money and mental outlook.

A straightforward, low-pressure, low-risk portfolio structure is most beneficial at the outset:

45% index fund SIP, 30% high-interest savings or fixed deposits, 15% in gold or government bonds, and 10% for small exploratory investments.

This strategy not only secures your funds but also fosters consistent growth and learning opportunities.

Safe investing doesn't equate to minimal returns; it signifies smart wealth-building practices. By adhering to a structured methodology, leveraging reliable financial instruments like index funds, and nurturing a long-term focus, beginners can steadily grow their wealth with assurance and clarity. Safe investing emphasizes consistency, discipline, and shielding your financial future from undue risks.

This content is intended for general educational use only and should not be construed as professional financial or investment counsel. Individual financial situations vary, and the strategies presented may not suit every reader. Seek advice from a licensed financial advisor or conduct thorough personal research before making investment decisions. The author is not liable for any financial losses or actions arising from this information.

Duke Triumphs Thanks to Cameron Boozer's 35-Point Showcase Against Arkansas

Duke secures an 80-71 victory over Arkansas as Cameron Boozer scores 35 points, celebrating Thanksgi

Palash Muchhal's Health Update Following Wedding Stress Incident

Palash Muchhal has been discharged after being hospitalized due to a stress-related issue from his w

Ajay Devgn Reflects on 28 Years Since Ishq’s Release

Ajay Devgn marks 28 years of Ishq with heartfelt memories and celebrates the impact the film had on

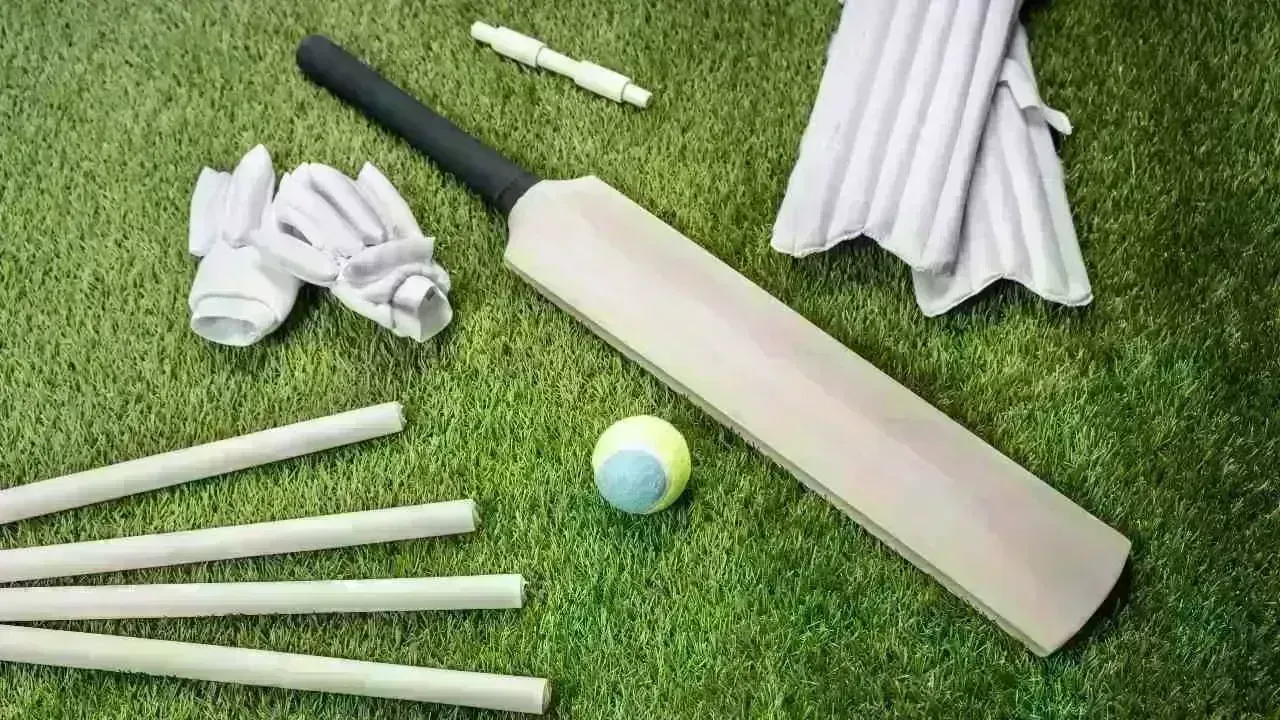

Saudi Arabia Set to Launch Women's World T20 Challenge in 2026

Starting in 2026, Saudi Arabia will host its first women's professional cricket tournament, featurin

Ayush Mhatre Appointed Captain of India for Under-19 Asia Cup in Dubai

The BCCI announces Ayush Mhatre as captain for the Under-19 Asia Cup starting December 12, highlight

Virat Kohli Visits MS Dhoni's Home in Ranchi Ahead of ODI

Kohli's visit to Dhoni's home sparks excitement among fans in Ranchi before the India–South Africa O