Post by : Naveen Mittal

Global financial markets entered the week on stable footing as investors await critical decisions from central banks and digest a mixed bag of economic data. The dollar and stocks are holding firm amid anticipation over potential policy shifts, particularly the Federal Reserve’s upcoming rate decision. While volatility is expected around the announcement, market participants are eyeing dovish signals from the Fed, alongside global developments such as trade negotiations and shifts in commodity prices.

With a packed week ahead, analysts and traders alike are bracing for significant market moves driven by uncertainty over monetary policy, geopolitical tensions, and uneven economic indicators.

Major equity indices opened the week near recent highs. MSCI’s all-country index hovered close to record levels seen last week, while Europe’s STOXX 600 index climbed 0.3%. In the U.S., S&P 500 futures and Nasdaq futures remained steady, reflecting cautious optimism rather than exuberant buying.

The dollar maintained its strength against major currencies despite the uncertainties swirling around the Fed’s forthcoming decision. The euro, in particular, showed only a mild reaction to Fitch’s downgrade of France’s credit rating, edging up 0.1% to $1.1738.

This muted response suggests that markets are well prepared for near-term disruptions, with investor attention squarely focused on the Fed’s monetary policy outlook.

The central point of market focus this week is the Federal Reserve’s September 2025 policy meeting, where a 25 basis point cut is fully priced in by investors. Futures data show a negligible chance—just 4%—of a larger 50 basis point cut.

What’s driving the market's expectations? Analysts highlight the softening labor market and slowing inflation as key reasons for easing. However, the most significant focus is on the Fed’s “dot plot” projections and guidance from Chair Jerome Powell. Investors are desperate to understand whether this cut will be the first in a series or a one-off gesture.

David Mericle, Chief U.S. Economist at Goldman Sachs, remarked, “The key question for the September FOMC meeting is whether the Committee will signal that this is likely the first in a series of consecutive cuts.”

Markets are already pricing in 125 basis points of rate cuts by late 2026. If the Fed’s statement is not dovish enough, it could disappoint investors and trigger short-term volatility.

Traders are preparing for sharp swings around the Fed’s decision. Kathleen Brooks, Director at XTB Research, pointed out, “Uncertainty surrounding the future path for Fed policy means that some traders are now bracing for volatility around Wednesday’s Fed decision, with options markets pricing in a 1% swing in either direction.”

The implications for stocks, bonds, and commodities could be profound if the Fed deviates from expectations, particularly if Powell’s remarks suggest hesitation or indecision.

Meanwhile, political commentary adds further complexity. U.S. President Donald Trump renewed his criticisms of Powell, labeling him “incompetent” and blaming him for hurting the housing market. Such statements have fueled fears of political interference influencing monetary policy.

While the dollar remains central, the euro’s performance is noteworthy. After Fitch’s downgrade of France’s sovereign credit, the euro responded only marginally, gaining 0.1% to $1.1738. It edged down slightly against the sterling, trading at 86.42 pence.

The European Central Bank’s (ECB) signals have played a role in steadying the currency. Last week, ECB President Christine Lagarde indicated that policy is in a “good place,” bolstering investor confidence. Several ECB officials are scheduled to speak this week, and their remarks could further influence market sentiment.

The euro’s resilience underscores how monetary policy expectations can outweigh negative news when investors believe the ECB will maintain rates in the near term.

In Asia, markets showed mixed reactions to slowing economic growth in China. The CSI 300 index rose 0.2%, while Hong Kong’s Hang Seng also posted modest gains as investors placed renewed bets on Chinese tech stocks amid ongoing U.S.-China trade talks.

However, economic indicators released on Monday painted a sobering picture. August data showed weaker-than-expected industrial output, retail sales, and investment in property. Home prices declined 0.3%, continuing a downward trend that started earlier this year.

Lynn Song, Chief Economist at ING for Greater China, commented, “Given the slowdown of the past few months, we expect that there's a strong case for additional short-term stimulus efforts.”

Markets are now pricing in the possibility of further stimulus, including a 10 basis point rate cut and a 50 basis point reserve-requirement-ratio cut, to prop up growth.

Oil prices extended their gains as concerns about global supply disruptions intensified. Brent crude rose 0.2% to $67.14 a barrel, with drone attacks on Russian refineries potentially curbing crude exports.

Meanwhile, gold remained steady near its record high, trading at $3,640 an ounce. Investors are closely watching how safe-haven assets like gold respond to both market volatility and geopolitical uncertainty.

The ongoing Russia-Ukraine conflict continues to influence energy markets, while trade disputes between the U.S. and China create ripple effects across commodities and emerging market currencies.

For investors, the week promises to be action-packed, with key takeaways including:

Watch the Fed’s signals closely. Even subtle changes in guidance could trigger major moves.

Monitor ECB communications. Their stance on rates will impact European equities and currency flows.

Be prepared for volatility. Markets are pricing in swings as traders react to uncertainty.

Focus on China’s economy. Weak data could prompt stimulus measures, influencing global demand.

Track geopolitical developments, especially in oil markets and trade negotiations.

Investors should balance risk with opportunity by diversifying portfolios and staying informed through economic reports and central bank announcements.

The week ahead presents both challenges and opportunities. The dollar’s steady performance, buoyed by expectations of a Fed rate cut, masks underlying uncertainties that could drive short-term swings. Meanwhile, Europe’s euro remains relatively resilient, supported by stable ECB signals.

Asian markets are cautiously optimistic despite weak data from China, while commodities like oil and gold continue to reflect geopolitical anxieties.

With central banks, trade talks, and economic data shaping the narrative, investors must stay alert and agile. By closely tracking market signals and preparing for volatility, traders and portfolio managers can navigate the complexities of this pivotal week.

Kazakhstan Boosts Oil Supply as US Winter Storm Disrupts Production

Oil prices inch down as Kazakhstan's oilfield ramps up production, countered by severe disruptions f

Return of Officer's Remains in Gaza May Open Rafah Crossing

Israel confirms Ran Gvili's remains identification, paving the way for the Rafah border crossing's p

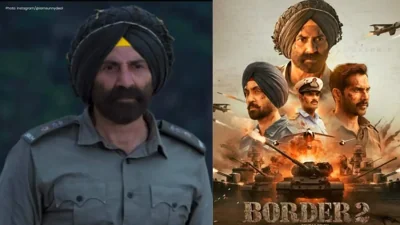

Border 2 Achieves ₹250 Crore Globally in Just 4 Days: Sunny Deol Shines

Sunny Deol's Border 2 crosses ₹250 crore in 4 days, marking a significant breakthrough in global box

Delay in Jana Nayagan Release as Madras HC Bars Censorship Clearance

The Madras High Court halts the approval of Jana Nayagan's censor certificate, postponing its releas

Tragedy Strikes as MV Trisha Kerstin 3 Accident Leaves 316 Rescued

The MV Trisha Kerstin 3 met an unfortunate fate near Jolo, with 316 passengers rescued. The governme

Aryna Sabalenka Advances to Semi-Finals, Targeting Another Grand Slam Title

Top seed Aryna Sabalenka triumphed over Jovic and now faces Gauff or Svitolina in the semi-finals as